El Banco Internacional é Hipotecario de México

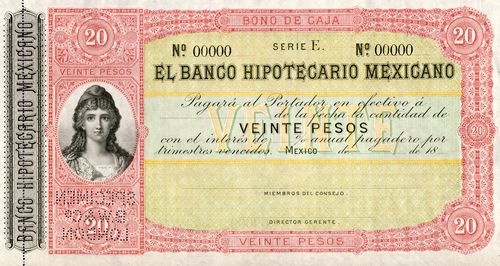

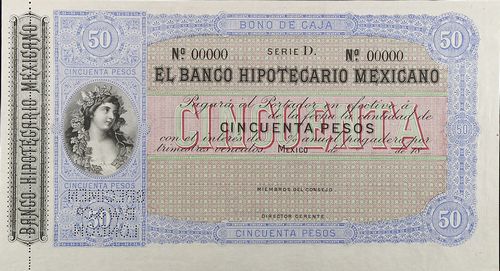

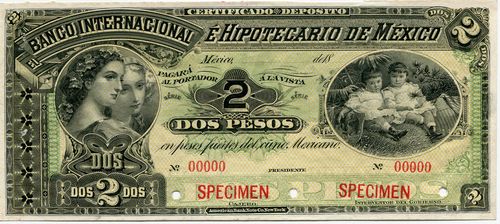

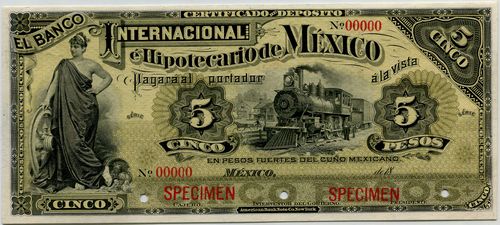

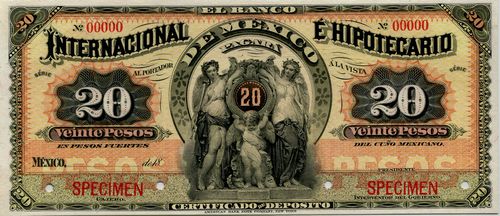

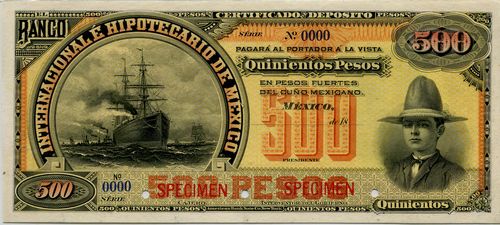

This institution was originally authorised on 24 March 1882 under the name of El Banco Hipotecario Mexicano and the corporation was formed on 24 April 1882 by Eduardo Garay and Francisco de Tavera. It was authorised to make mortgage loans in the Federal District and Baja California and was to issue cashier bonds and certificates of deposit but not banknotes. The following specimens, produced by Bradbury Wilkinson & Company of London, England are therefore illustrated here simply because they appear in most catalogues.

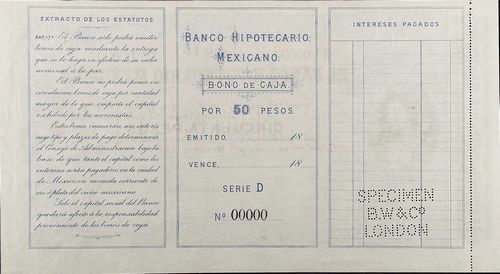

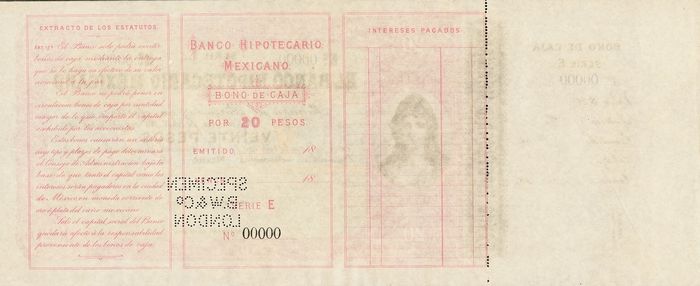

The specimens were printed with a counterfoil.

The notes had article 17 of the bank’s statutes printed on their reverse. This stated that the bank could only issue bonos de caja for their nominal value at par in cash, could not put into circulation more bonos than the share capital raised, and that the capital and any interest would be paid in Mexico CityEl Banco solo podrá emitir bonos de caja mediante la entrega que se le haga en efectivo de su valor nominal á la par.

El Banco no podrá poner en circulación bonos de caja por cantidad mayor de lo que importe el capital exhibido por los accionistas.

Estos bonos causarán un interés cuyo tipo y plazas de pago determinará el Consejo de Administración bajo la base de que tanto el capital como los intereses serán pagaderos en la ciudad de México, en moneda corriente de oro ó plata del cuño mexicano.

Solo el capital social del Banco quedará afecto á la responsabilidad proveniente de los bonos de caja..

In August 1888 the bank's concession was modified and its name changed to El Banco Internacional é Hipotecario. In 1889 the bank was authorised to issue certificates of deposit (certificados del depósitos al portador). These certificados had to be denominated in pesos and 100 backed by gold or silver coins or bars in the bank’s vault. They were redeemable on demand and paid no interest.

The American Bank Note Company therefore produced the following set of notes. It engraved five special vignettes: Guatainotzin (C 376), Aztec stone (C 759), Children (The Two Republics) (C 384), Miguel Lerdo de TejadaMiguel Lerdo de Tejada was born in Veracruz in 1812. In 1849 he was counselor of the Municipal Government of Mexico City which he presided over until 1852. He was Secretary of State seven times during five different presidential periods. He also held posts as Secretary of Public Works, Secretary of Foreign Affairs and Secretary of the Treasury. He actively participated in the War of Reform and wrote a number of books. He died in 1861 in Mexico City. (C 156) and "Colgate's boy" (C 158).

| Date | Value | Series | from | to |

| November 1889 | $1 | 1 | 200000 | |

| $2 | 1 | 50000 | ||

| $5 | 1 | 200000 | ||

| $10 | 1 | 200000 | ||

| $20 | 1 | 50000 | ||

| $50 | 1 | 30000 | ||

| $100 | 1 | 50000 | ||

| $500 | 1 | 1200 | ||

| $1,000 | 1 | 600 |

The Banco Nacional de México protested to the Secretaría de Hacienda that these certificados were essentially banknotes. The 100 per cent reserve requirement meant that their issue would not be particularly profitable for the Banco Internacional é Hipotecario, but the Banco Nacional de México worried about any assault on its privileges. Secretario Dublán rejected the Banco Nacional de México’s protestsreferences needed from Noel Mauer, The Power and the Money: The Mexican Financial System, 1876-1932.

So, these were not used. Some, however, escaped because in early February 1985 someone appeared at a stall located in the Fuente de Santa Ana to make some purchases and paid with a $1 note. The ladies who ran the establishment took the note, but when their brother, Antonio Legorreta, arrived, they showed it to him, to his surprise. Legorreta took the note to the offices of the Banco Internacional é Hipotecario, where they told him that the note was good, but that it had not yet been put into circulation. The bank said that it must have belonged to some that had gone astray and, in order not to arouse suspicion in the public, begged Legorreta not to report the matter to the authorities. Legorreta kept the noteLa Voz de México, 10 February 1895.

In the ABNC records are the comments "These are not "Notes" although entered as such in Order Book - they are Ctfs of Deposit" and "Mr. Gibbs says bank was not allowed to put these in use a/c their similarity to Bank Notes 10/21/15. see letter 12/23/13"ABNC.

The American Bank Note Company also produced a certificate of deposit for 1,000 grams of gold.

Known numbers are unsigned and unissued.

| series | from | to | total number |

total value |

||

| 1,000 gm | A | includes numbers 0041 to 0221 |

Personnel

J. de Teresa Miranda was president of the bank on 31 October 1891.

Joaquín de Trueba resigned as manager in October 1903 to be replaced by Ricardo Honey and José V. BurgosEl Correo Español, 8 October 1903; El Tiempo, 10 October 1903.

The board elected in March 1906 consisted of Richard Honey, Sr. Lic. Emilio Velasco, Joaquin Eguia, Porfirio Diaz, Jr., Thomas P. Honey, Julio Limantour, Jacinto Pimental, Huberto E. Brooke and José V. BurgosThe Mexican Herald, 14 March 1906. In 1909 the board consisted of Richard Honey as President, Porfirio Diaz, Jr., Huberto E. Brooke, Andrés Aldasoro, Richard Honey, Jr., Emilio Pardo, José V. Burgos and Thomas P. Honey. Thomas P. Honey was still managing director, José V. Burgos sub-manger, A. Lozano R., accountant and Enrique Carral, cashierThe Mexican Year Book, 1909.