El Banco Nacional Mexicano

The restoration of diplomatic and trade relations between Mexico, France and Britain in 1880 - interrupted in 1862 during the French Intervention - and the resumption of the payment of external debt to European creditors, allowed Mexico to attract a mayor influx of direct foreign investment, particularly of French origin, into its banking sector.

This bank was founded by Edward NoetzlinNoetzlin was the most important foreign financier during the Porfiriato and involved in virtually all the key financial events in Mexico. The fact that Noetzlin was a foreign financier, involved in numerous “national” financial arrangements both helped him advance, and limited his successes. Perhaps most illustrative of the weakness that his foreign status conveyed was the infamous 1884 foreign debt negotiations between Noetzlin (and his European banking syndicate) and the Mexican government. While this debt arrangement was being scrutinized and debated in the Mexican Congress, street protests erupted in Mexico City denouncing the deal with shouts of “Muera a Noetzlin.” The arrangement was scuttled. Despite this and several other private incidents where Noetzlin’s status as a foreigner was used to discredit his role in Mexico’s national finances, Noetzlin traded gainfully in Mexico and in Europe on his social capital, on the value and worth of his social networks. In Mexico Noetzlin represented himself and his bank as part of a broad European capital network, a network he argued was necessary for Mexican entrepreneurs to gain access to lucrative foreign credit markets. Moreover he used similar arguments when he negotiated with a credit-strapped Mexican government or when it sought to diversify its financial exposure in Europe. Similarly, in Europe, Noetzlin represented himself as the consummate Mexican insider with a wealth of experience, contacts and intimates, and thus he was the necessary linchpin between European capital and the expanding Mexican market (Thomas Passananti, Banking on Mexico: Edouard Noetzlin and the Role of Financial Networks in Porfirian Mexico) and its shareholders were mainly identified with the Franco-Egyptian Bank. It was granted a federal concession on 16 August 1881 and began operations on 23 February 1882El Diario del Hogar, Tomo I, Núm. 122, 22 February 1882, with its main office in Mexico City and branches in Guanajuato, San Luis Potosí, Puebla, Veracruz and Mérida. It had a number of privileges, among which was the important one that its notes were accepted as unlimited legal tender in all offices of the federal government (a privilege soon restricted as far as branch issues were concerned).

By 23 February the bank had ready signed 23,000 notes of various denominations, representing $2,128,000El Foro, Tomo XVIII, Año X, Núm. 47, 11 March 1882.

The bank was governed in Mexico City by a Consejo de Administración, headed by Antonio de Mier y Celis and composed of Ramón Guzmán, Félix Cuevas, José María Bermejillo, Sebastián RobertJoseph Ollivier and Co held a small percentage of the Banco Nacional Mexicano stock, so it was able to place Sébastien Robert, then manager of La Ciudad de Londres. on the bank's first board and to bring about the appointment of Sylvain Balp to the board of the Veracruz branch. and Gustavo Struck. In Paris a Junta de Paris, composed of members of some important European banks, oversaw the general direction of the bank.

Because Veracruz was at that time the most important customs port in the Mexican Republic, the provisions agreed for its management largely determined the way other branches were administered. For the President of the Republic, the issue of the collection, commissions and ways to get cash to the Government bodies were a priority issue to be resolved once the bank was installed.

The Board of Directors complained to the Minister of Finance that the government had authorized the formation of a national bank in order to encourage trade and support the government, but also authorized the issue of banknotes by other institution that exceeded the needs of circulation among the public. Moreover, these other institutions had dedicated themselves to collecting the largest possible amount of Banco Nacional Mexicano banknotes to exchange for their own banknotes which decreased circulation even more. To aggravate the situation, the government owed the bank more than half of its share capital which caused a retraction in supply of credit to other interested parties. In these and other ways the preferential conditions indicated in the concession were completely fictitiousAHBanamex, Correspondencia, 3 January 1883.

Due to this, the Nacional Monte de Piedad suspended the exchange of their banknotes and the alarm produced among the public quickly restricted the circulation of notes. To this was added the fact that the lack of reserves in the national treasury prevented these institutions to "take a single peso out of their boxes either to help the government, or to help the government, or to attend to the orders of the trade, or to be able to attend to their own obligations". AHBanamex, Banco Nacional Mexicano, Actas del Consejo de administración, 23 de mayo, 1883. Even more serious was the suspension in payment of duties that were consigned to cover the advances that the banks had made to the Supreme Government. The General Board of Directors assumed a series of measures to solve the situation but as these measures were insufficient to deal with the crisis, the government promoted the merger of the Banco Nacional Mexicano with the Banco Mercantil Mexicano to keep them "afloat".

So, on 15 May 1884, the bank merged with the Banco Mercantil Mexicano to form the Banco Nacional de México. Both banks agreed to retire their notes within two years and replace them with notes of the new bank. As a consequence surviving notes are extremely rare.

American Bank Note Company print runs

The American Bank Note Company produced the following notes.

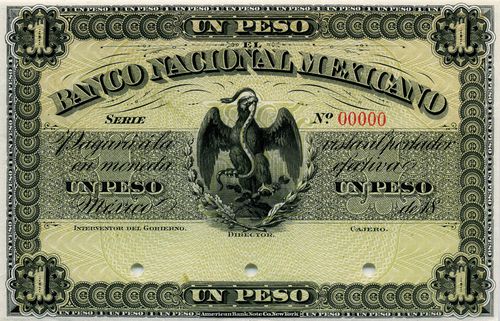

M307s $1 Banco Nacional Mexicano specimen

M307s $1 Banco Nacional Mexicano specimen

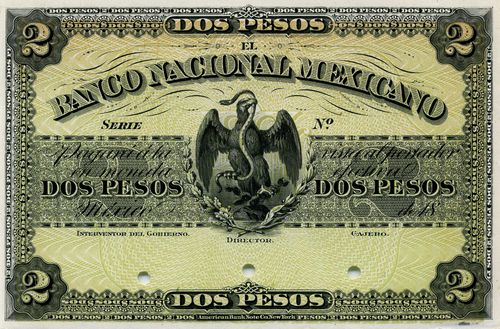

M308s $2 Banco Nacional Mexicano specimen

M308s $2 Banco Nacional Mexicano specimen

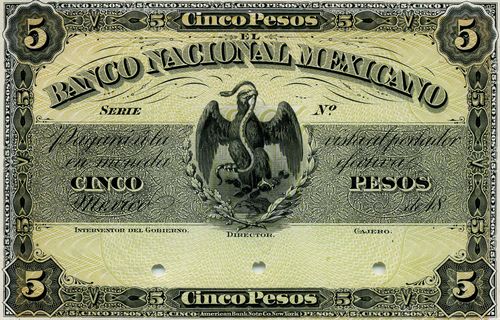

M309s $5 Banco Nacional Mexicano specimen

M309s $5 Banco Nacional Mexicano specimen

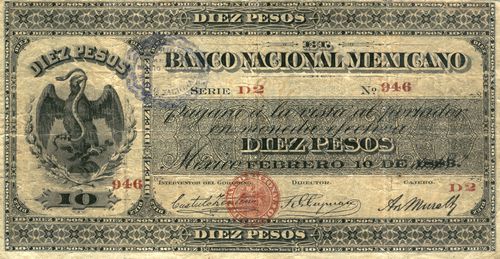

M310a $10 Banco Nacional Mexicano specimen

M310a $10 Banco Nacional Mexicano specimen

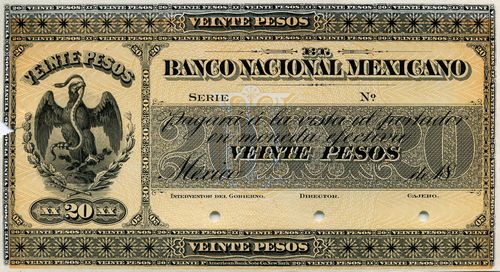

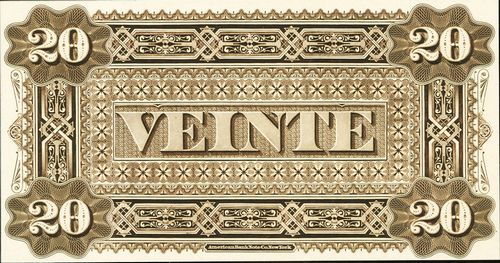

M311s $20 Banco Nacional Mexicano specimen

M311s $20 Banco Nacional Mexicano specimen

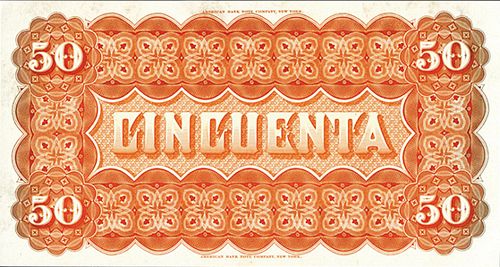

M312s $50 Banco Nacional Mexicano specimen

M312s $50 Banco Nacional Mexicano specimen

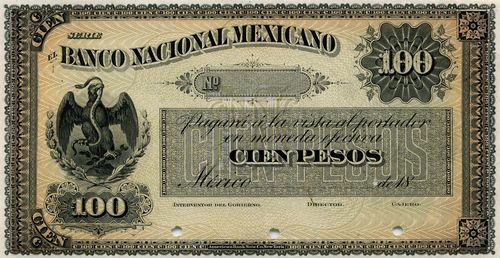

M313s $100 Banco Nacional Mexicano specimen

M313s $100 Banco Nacional Mexicano specimen

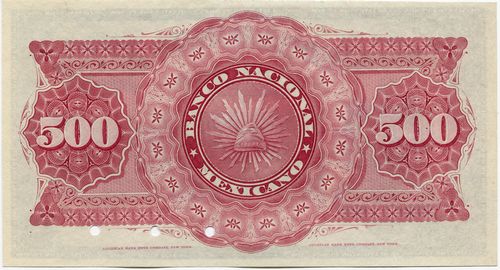

M314s $500 Banco Nacional Mexicano specimen

M314s $500 Banco Nacional Mexicano specimen

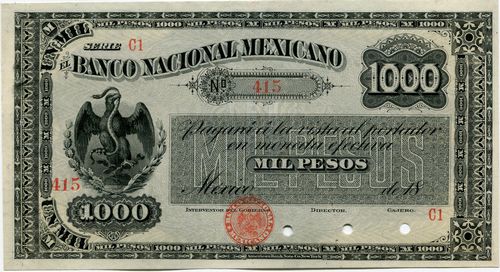

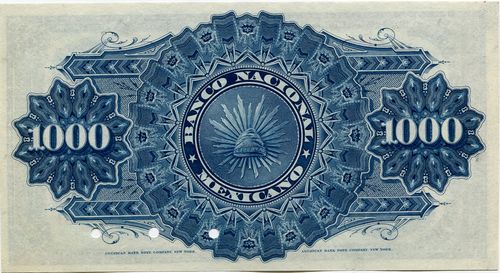

M315s $1,000 Banco Nacional Mexicano specimen

M315s $1,000 Banco Nacional Mexicano specimen

| Date | Value | Number | Series | from | to | Comment |

| October 1881 | $1 | 50,000 | A1-Z2 | 000 | 999 | 50 series from A1 to Z2 with 1,000 notes each (I1 and I2 were not used) |

| $2 | 100,000 | A1-Z4 | 000 | 999 | 100 series from A1 to Z4 with 1,000 notes each (I1. I2, I3 and I4 were not used) | |

| $5 | 350,000 | A1-Z14 | 000 | 999 | 350 series from A1 to Z14 with 1,000 notes each (I1-I14 were not used) | |

| $10 | 250,000 | A1-Z10 | 000 | 999 | 250 series from A1 to Z10 with 1,000 notes each (I1-I10 were not used) | |

| $20 | 100,000 | A1-Z4 | 000 | 999 | 100 series from A1 to Z4 with 1,000 notes each (I1. I2, I3 and I4 were not used) | |

| $50 | 20,000 | A1-U1 | 000 | 999 | 20 series with 1,000 notes each (I1 was not used) | |

| $100 | 20,000 | A1-U1 | 000 | 999 | 20 series with 1,000 notes each (I1 was not used) | |

| $500 | 3,000 | A1 | 000 | 999 | ||

| B1 | 000 | 999 | ||||

| C1 | 000 | 999 | ||||

| $1000 | 1000 | A1 | 000 | 999 |

| Date | Value | Number | Series | from | to | Comment |

| August 1882 | $500 | 2,000 | D1 | 000 | 999 | |

| E1 | 000 | 999 | ||||

| $1000 | 12,000 | B1 | 000 | 999 | ||

| C1 | 000 | 999 |

The bank’s notes state that they will be paid in legal tender (moneda efectiva) but the day after it opened the bank issued a notice that in the capital they would always be redeemed in silver (pesos fuertes)El Foro, 25 February 1882.

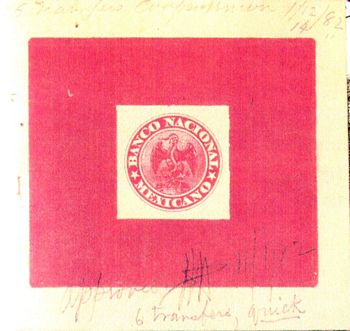

The ABNC also produced a seal for the bank.

The platesThe plates were:

1-6 on $1 face plate

1-6 on $1 back plate

1-6 on $2 face plate

1-6 on $2 back plate

4-6 on $5 face plates Nos. 1 to 4

6-6 on $5 back plates Nos 1 to 6

3-6 on $10 face plates Nos. 1 to 3

4-6 on $10 back plates Nos 1 to 4

1-6 on $20 face plate

1-6 on $20 back plate

1-6 on $50 face plate

1-6 on $50 back plate

1-3 on $100 face plate

1-3 on $100 back plate

1-1 on $500 face plate

1-1 on $500 back plate

1-1 on $1,000 face plate

1-1 on $1,000 back plate used in printing these notes remained in the ABNC plate vault until 11 May 1932 when, with the approval of its successor, the Banco Nacional de México, they were destroyedABNC, folder 158, Banco Nacional de México (1920-1933).

Signatures

The (identifiable) signatures are Cástulo Zenteno and Manuel Romero Rubio as Interventor, Ramón G. Guzmán and José María Bermejillo as Director, and Alberto de Muralt as Cajero.

Interventor

Cástulo Zenteno was born in Matamoros, Tamaulipas on 22 May 1837. He owned the El Cristo coal mine in Tempoal, Veracruz, served as a special messenger for Porfirio Díaz in 1876 and attained the rank of colonel in 1878. As well as political offices (deputy for Yucatan (1876-1878), senator for Yucatán (1884-1888) and deputy from Yucatán (1896-1900)), he represented the Mexican government on the Oriental, International and Interoceanic Railroads (1881), and was chief tax collector for the Federal District (1884). Cástulo Zenteno was born in Matamoros, Tamaulipas on 22 May 1837. He owned the El Cristo coal mine in Tempoal, Veracruz, served as a special messenger for Porfirio Díaz in 1876 and attained the rank of colonel in 1878. As well as political offices (deputy for Yucatan (1876-1878), senator for Yucatán (1884-1888) and deputy from Yucatán (1896-1900)), he represented the Mexican government on the Oriental, International and Interoceanic Railroads (1881), and was chief tax collector for the Federal District (1884). |

|

Manuel Romero Rubio was born on 7 March 1828 in Atzcapotzalco, Mexico City. He was a lawyer and politician holding various offices including deputy from Puebla (1856-1857, 1867-1868) and governor of Mexico City (1857). He joined Juárez’ Liberals during the revolution of Ayutla (1855-1856), was captured by the French and exiled to Europe in 1863. As a supporter of Lerdo and his secretary of foreign relations he opposed Díaz’ Plan of Tuxtepec in 1876 and was exiled to New York from 1877 until 1880. He returned to establish an opposition newspaper and became a senator from the state of Tabasco from 1880 to 1895. He eventually collaborated with his former political opponent by serving as Díaz’ Secretario de Gobernación for eleven years until his death (1 December 1884-3 October 1895). He was the father of Carmen Romero Rubio, the second wife of Porfirio Díaz, as well as the father-in-law of the prominent banker José de Teresa. He died on 3 October 1895. Manuel Romero Rubio was born on 7 March 1828 in Atzcapotzalco, Mexico City. He was a lawyer and politician holding various offices including deputy from Puebla (1856-1857, 1867-1868) and governor of Mexico City (1857). He joined Juárez’ Liberals during the revolution of Ayutla (1855-1856), was captured by the French and exiled to Europe in 1863. As a supporter of Lerdo and his secretary of foreign relations he opposed Díaz’ Plan of Tuxtepec in 1876 and was exiled to New York from 1877 until 1880. He returned to establish an opposition newspaper and became a senator from the state of Tabasco from 1880 to 1895. He eventually collaborated with his former political opponent by serving as Díaz’ Secretario de Gobernación for eleven years until his death (1 December 1884-3 October 1895). He was the father of Carmen Romero Rubio, the second wife of Porfirio Díaz, as well as the father-in-law of the prominent banker José de Teresa. He died on 3 October 1895. |

|

Director

|

On his death a magazine wrote: “Ramón G. Guzmán was born in Jalapa in 1836 and died in Mexico on February 24th of this year [1884]. Who does not know Ramon Guzmán's name? The name Ramón Guzmán is one of the most popular in all the Americas. This friendly name has always been associated with any bold, useful and profitable company. Ramón Guzmán put his capital in the service of his country, employing it for the benefit of the public: Guzmán shines in politics and trade; his financial talent has been very extraordinary and his activity and success in the world of business very remarkable. His thoughts did not rest for a moment, eager for something new to invent, longing to contribute to the progress of his much-loved homeland. In the last moments of his life, he saw his pains softened by the tenderness of his beautiful and loving wife and by the trials of affection of his many friends. Ramón Guzmán has left three little girls, those who were always very well shielded, because Guzmán's widow is a lady endowed with very clear intelligence, a lot of character and a great heart. In the misfortune of which he has been a victim he has shown a great elevation of spirit and great temple of soul. We associate ourselves wholeheartedly with the just pain justly experienced by the charming Señora Rosa Zayas de Guzmán”El Album de la Mujer, Año 2o, Núm 11, 16 March 1884. |

|

|

From 1884 to 1904 he took over the management of the Bermejillo business from his brother Pío. His work was characterized by his marked interest in Mexican mining.: Casa Bermejillo granted various loans to different mining companies and Bermejillo’s participation in this sector made him one of its representatives in the Comisión Monertaria of 1903, which aimed to study the possible consequences of the adoption of the gold standard on the Mexican economy. José María Bermejillo can be considered an innovative entrepreneur, because he accessed a new market, that of the electrical industry of Guadalajara, thanks to the good use he made of the natural resources of his hacienda which he owned with his wife, Dolores Martínez Negrete Alba, who inherited 12,319 hectares of estates in El Salto, Jalisco. He was a member of different Spanish associations in Mexico, such as El Casino Español and the Spanish Chamber of Commerce. These were ideal spaces where one could access market information, establish new economic relationships and design new investment projects. In the Casino Español not only the most distinguished members of the Spanish colony congregated, but also the members of the economic elite of Mexico City. José María was a shareholder and board member of the Banco Nacional Mexicano, Banco Mercantil Mexicano and Banco Nacional de México. He died in Mexico City on 1 September 1904, leaving a large fortune of more than three million pesos to his wife, who survived him 25 years until 1929. |

|

Cajero

|

Alberto de Muralt De Muralt left his position when the two national banks merged in 1884El Nacional, 7 June 1884. |

|

Branches and overprints

The reason for the branch overprints was the rule for redeeming notes. On its opening the bank published a notice that notes issued by branches would have two stamps (one central and one local). The branch would reemburse its own notes but had no obligation to remburse the notes of Mexico City or of other branches. Branch notes could be reembursed in the head office, according to rules that the bank would issueEl Diario del Hogar, Tomo I, Núm. 122, 22 February 1882.

On 6 June 1882 the government agreed terms for accepting the branch notes which limited the federal offices' obligationsEl Siglo Diez y Nueve, 22 June 1882; La Voz de México, Tomo XIII, Núm. 141, 22 June 1882.

The banknotes of the Banco Nacional Mexicano circulated as voluntary tender and were also admitted in government offices to cover tax obligations. The reception of paper currency by the public was good and a few months after its opening, the branches reported to the head office that the exchange rate of money was "satisfactory" and that in general those of 50 pesos and below were mostly accepted AHBanamex, Banco Nacional Mexicano, Actas del Consejo de administración, 20 December 1882.

In December 1882, several branches applied to the main management council to receive banknotes from other banks, specifically of the Banco Mercantil Mexicano, to which the board agreed and determined that there should be at least two extraordinary collectors in each branchAHBanamex, Banco Nacional Mexicano, actas del Consejo de administración, 3 January 1883.

The discount amounted to 50 percent, as did the Banco Mercantil MexicanoAHBanamex, Banco Nacional Mexicano, actas del Consejo de administración, 31 January 1883.

Veracruz

Veracruz was the first branch and opened on 1 March 1882El Diario del Hogar, Tomo I, Núm. 130, 4 March 1882; El Siglo Diez y Nueve, 7 March 1882. The Junta de vigilancia was composed of Domingo A. Mirón, Manuel R. Alvarez, Guillermo Krahnstover and Juan F. Pasquel and the director was Teodoro Chavat. Its opening capital was $200,000 in cash and $1,812,500 in notes.

M307c $1 overprinted and needle-punched 'VERACRUZ'

M307c $1 overprinted and needle-punched 'VERACRUZ'

In April 1882 the federal government asked the Board of Directors to authorise the Veracruz branch to exchange banknotes presented by Customs without the special seal of the issuing branch. The board agreedAHBanamex, Banco Nacional Mexicano, actas del Consejo de administración, 19 April 1882, but this resolution lasted only one month, because in June the Board of Directors requested that all banknotes were stamped by the branches, which the representative of the Secretaría de Hacienda acceptedAHBanamex, Banco Nacional Mexicano, actas del Consejo de administración, 2 June 1882. The conditions for the exchange of banknotes in branches were: that all banknotes were overstamped, and that the branches could demand a premium for exchanging their banknotes against those of other banksAHBanamex, Banco Nacional Mexicano, actas del Consejo de administración, 14 June 1882.

By December 1882, after overcoming certain difficulties, the bank’s notes were being accepted as legal tender in the important Progreso customs houseLa Patria, 30 December 1882.

Guadalajara

San Luis Potosí

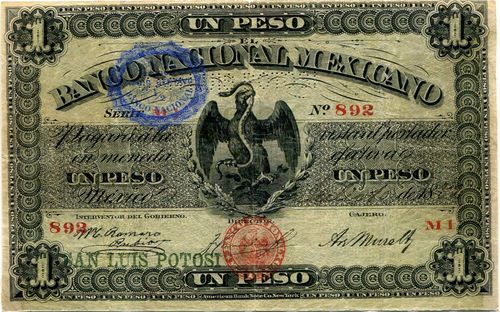

M307b $1 overprinted 'SAN LUIS POTOSI'

M307b $1 overprinted 'SAN LUIS POTOSI'

The issue of a branch in San Luis Potosí was discussed by the bank’s board on 24 December 1881 where it was reported that talks with the state government had been concluded and everything indicated a favorable environment. The next step was to address "three of the main people". of the capital" in the state, namely Matías Hernández Soberón, Felipe Muriedas and José Encarnación Ipiña, to get the support of “su ilustración e influencia (their illustration and influence)" to continue with the procedures for opening a branch. To do this, the board sent a telegram to these gentlemen to know if they would be willing to support the Banco Nacional Mexicano “con su concurso (with their support)”, to which they replied that they were willing. So, the board agreed to allocate fifty shares for each of them, of the thousand reserved for branchesAHBanamex, Banco Nacional Mexicano, actas del Consejo de administración, 24 December 1881. State governor Pedro Díez Gutiérrez proposed and received the approval of the state congress to celebrate a contract with the bankPeriódico Oficial, 16 November 1881: ASLP, Secretaría General de Gobierno, Colección Leyes y Decretos, 11 November 1881 and concluded a contract with Félix Cuevas and Ramón G. Guzmán, representing the bank, on 5 January 1882 AHBanamex, Banco Nacional Mexicano, contratos de concesión y estatutos, 21 june 1882.

The contract decreed the circulation of the bank’s banknotes in the offices of the state "to the exclusion of those of any other credit establishment established or to be established or any paper money, although the banknotes issued by the Nacional Monte de Piedad can be received by these offices". In compensation for the advantages granted by the San Luis Potosí government, the Banco Nacional Mexicano was bound to establish a branch in the state within a year and would not charge more interest or income on transactions than the norm in Mexico City. In addition, the bank’s branch was obliged to open a current account to the State TreasuryAHBanamex, Banco Nacional Mexicano, contratos de concesión y estatutos, 1881: ASLP, Secretaría General de Gobierno, Colección Decretos y Leyes, 5 January 1882.

On 12 July 1882 the bank appointed Santiago Wastall as director of the branch, the directors relying on the honour and prestige that he enjoyed as a settled merchant in San Luis Potosí. At that same meeting, the council authorized the branch to have a working capital of $500,000, including $200,000 in banknotes. Wastall was named in charge of personally transferring the cash from Mexico City, although the management assumed responsibility to take care that the trip took place as timely and as safely as possibleAHBanamex, Banco Nacional Mexicano, actas del Consejo de administración, 12 July and 27 July 1882.

The Consejo de Administración and the Junta de Vigilancia of the branch were Matías Hernández Soberón, Felipe Muriedas, José Encarnación Ipiña, with Wastall as manager (gerente) and Celestino Labarthe as cashier (cajero)Periódico Oficial, & November 1882. Three of the four members of the Junta de Viligancia were related by blood ties (Soberón and Ipiña) or by mutually supportive relationships (compadrazgo) (Soberón, Ipiña and Muriedas). And they had previous experience in privately granting credits.

On 30 October 1882, the branch was inaugurated and the local board gave notice to the Board of Directors in Mexico City the following dayAHBanamex, Banco Nacional Mexicano, actas del Consejo de administración, 31 October 1882. The bank was opened to the public on 1 November 1882El Siglo Diez y Nueve, 14 November 1882; La Patria, 18 November 1882; Periódico Oficial, 7 November 1882. By that time its capital was $150,000 in cash and $500,000 in notes.

Two years later, this branch became a branch of the Banco Nacional de MéxicoFor more information on the branch, see “La sucursal del Banco Nacional Mexicano en San Luis Potosí” in Adriana Corral Bustos, Estrategias de asociación para la inversión: el desarrollo del sistema financiero en San Luis Potosí entre 1850 y 1900, El Colegio de San Luis Potosí, 2017.

Guanajuato

The Guanajuato branch was established on 1 November 1882El Siglo Diez y Nueve, 14 November 1882; La Voz de México, 16 November 1882. The director was Francisco de Ibarrondo and the cajero Francisco de Ezcurdia. Its opening capital was $150,000 in cash and $323,000 in notes.

Puebla

The Puebla branch opened on 1 July 1882 under Mariano Pasquel, a member of an ancient and moneyed family with links to Veracruz and Mexico City(?). The manager was Enrique Pomier and its opening capital was $150,000 in cash and $547,500 in notes.

Mérida

On 17 October 1882 the governor of Yucatán, General Octavio Rosado, and J. Mammelsdorf and Santiago Kulp, for the bank, agreed a contract to open a branch in Yucatán. The contract allowed the bank to issue banknotes which would be accepted as legal tender in all payments to the state and municipalities with the bank obliged to redeem them in cash at the bank’s branch.

The branch opened on 15 November 1882Le Trait d’Union, 25 November 1882 with a capital of $150,000 in cash and $200,000 in notes and under the management of Carlos VaronaThe Junta de Viligancia was composed of Pedro de Regil y Peón, Manuel Dondé Cámara and Camilo Cámara. The cajero was Emilio Márquez.