The crisis of 1935

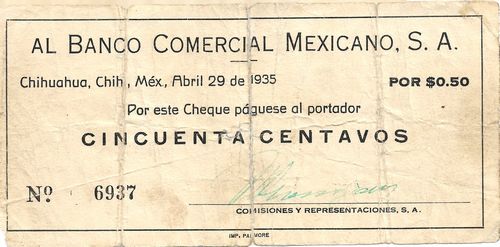

The United States passed its American Silver Purchase Act on 19 June 1934 and as a result of the increase in the price of silverThe price of silver was as low as 28c (US) in 1932 but rose to 35c in 1933, 48c in 1934 and 64c in 1935, silver coins began to be hoarded to be remelted at a profit. On 26 April 1935 the Mexican government reacted by withdrawing silver coins from circulation and arranging for them to be replaced with Banco de México notes. However, the sudden shortage led many banks and other commercial organisations, particularly Chambers of Commerce, to issue scrip in the form of bearer cheques during the spring of 1935.

Chihuahua

In Chihuahua, the new one peso notes of the Banco de México were not expected to arrive before the second half of May and in the meantime two banks made emergency issues. Both were issued on 30 AprilEl Heraldo, 30 April 1935: El Heraldo, 1 May 1935 and soon found acceptance by government offices, the local banks, businesses and cinemas.

Banco Mercantil de Chihuahua

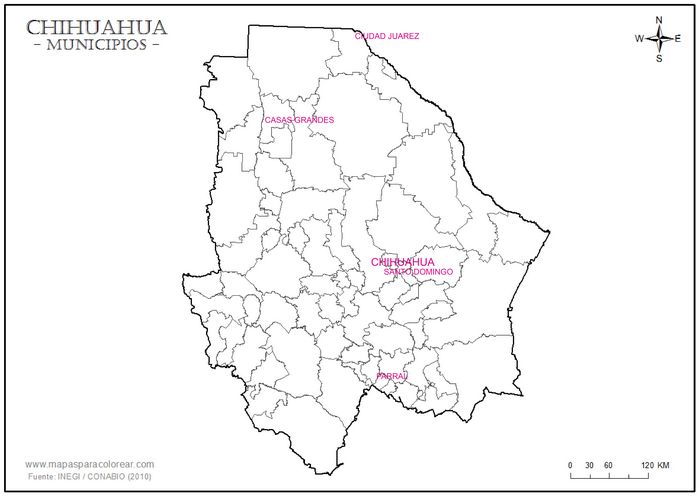

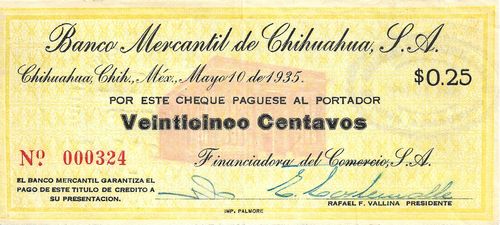

M4248 25c Banco Mercantil de Chihuahua

M4248 25c Banco Mercantil de Chihuahua

One emergency issue, a total of 10,000 pesos in up to six denominations (25c, 50c, $1, $2, $3 and $4[images needed]In an interview on 29 April 1935 Rafael F. Vallina, manager of the Banco Mercantil de Chihuahua, and Eloy Vallina, of the Banco Comercial Mexicano, said that their banks would each issue cashiers' notes (vales de caja al portador) for fifty centavos and one peso (El Correo de Chihuahua, 29 April 1935). On 30 April the Banco Mercantil said it was issuing all five values (La Voz de Chihuahua, 30 April 1935) whilst later on the banks were said to be redeeming notes for 50c, $1, $2 and $3 (El Heraldo, 3 May 1935). The $4 value is mentioned in El Heraldo, 30 April 1915 and 1 May 1915), was drawn on the Banco MercantilThe Banco Mercantil de Chihuahua, S. A. opened its doors for business on 24 August 1925. The principal stockholders were the Blanco brothers, Spaniards and owners of flour mills in Chihuahua. José F. Blanco was the President and Chairman of the Board, Benito Martínez, a Spaniard, one of the owners of the Compañía Cervecera de Chihuahua, S. A., a brewery, Vice President, and Rafael F. Vallina, the Manager. The bank’s capital was to be $250,000. The institution was to do a general banking business and would pay 4% interest per annum on saving deposits, whereas no other banking institution in the city paid any interest whatever on deposits (SD papers 812.516/373, report of consul to Department of State, 26 August 1925). Rafael F. Vallina invited his brothers, including Eloy, to work with him. by the Financiadora de Comercio, S.A. This included one thousand notes in the $2 value printed on white paperEl Correo de Chihuahua, 18 May 1935.

| from | to | total number |

total value |

signature | ||

| 25c | includes number 000324 | |||||

| 50c | ||||||

| $1 | ||||||

| $2 | 1 | 300 | 300 | 600 | Rafael Vallina | |

| 301 | 500 | 200 | 400 | Cipriano Ortega hijo | ||

| 501 | 700 | 200 | 400 | Nestor Colomo | ||

| 701 | 1000 | 300 | 600 | Jesús Campos hijo | ||

| $3 | ||||||

| $4 | ||||||

| $10,000 |

The signatories included:

|

Rafael F. Vallina García, with his brother Eloy, was part of a family that came to dominate finance in Chihuahua. The Vallinas arrived in Mexico in the Porfiriato with their father, a mining superintendent. They went to the United States in 1914 to avoid the Revolution and Eloy and Rafael settled in El Paso in 1919. They studied banking at a local business college and then went to work in local banks. Rafael Eloy rose to head the Mexican department of the First National Bank in El Paso, whilst Eloy oversaw the loan department. Rafael married Delfina Fernández Campo, the daughter of another Spanish immigrant, an industrialist in Chihuahua, Tomás Fernández Blanco. The three Fernández brothers operated a flour-milling business and leased the Compañía Cervecera de Chihuahua, formerly operated by the Terrazas. With their in-laws’ financial backing, the Vallina brothers started the Banco Mercantil in 1925. After a series of bankruptcies of rival financial institutions and their takeover of the Ciudad Juárez and Chihuahua branches of the Banco Nacional de México in 1932, their bank enjoyed a virtual monopoly of banking in Chihuahua. In 1929 Rafael started the Compañía Mercantil de Inversiones, which operated an ice factory and refrigeration plant for fruits and vegetables. The Vallinas’ most successful enterprise was established in 1934, when Eloy united the Chihuahuan elite in the Banco Comercial Mexicano. Using the bank as a base after 1940 the Vallinas, in conjunction with their long-standing partners, branched out into industry. Rafael's companies included the Compañía Mercantil de Inversiones, S.A., Financiadora del Comercio, S. A.., and Servicios Técnicos y de Administración, S. A. Rafael headed the Cervecería de Chihuahua and was also president of the Compañía Distilladora del Norte, S. A. |

|

| Cipriano Ortega Domínguez was born on 12 October 1901 in Chihuahua. His father was jefe de almacén of the great Ketelsen y Degetau store, situated in calle Libertad, between Independencia and Segunda. After studying banking he joined the Banco Russek and rose to be manager. In 1935 he was appointed manager of the Ciudad Juárez branch of the Banco Mercantil, a post he held until 1940. In 1940 Eloy Vallina appointed him manager of the Banco Comercial Mexicano, and he was the national manager from 1970 till 1982. He was president of the Cámara Nacional de Comercio de Chihuahua in 1941. | |

| Nestor Colomo | |

| Jesús Campos, hijo | |

| [identification needed] |  |

Counterfeits

By 9 May counterfeits of the $2 Banco Mercantil note had appeared. Curiously, the authentic notes had the name of the manager, Vallina, wrongly spelt with a 'B' whilst in the forgeries this error had been correctedAlso the serial numbers were greater than 1000. (El Heraldo, 16 May 1935; La Voz de Chihuahua, 16 May 1935). The bank asked people to bring in their notes to be restamped and on 11 May issued new notes that would be impossible to forgeEl Heraldo, 9 May 1935: La Voz de Chihuahua, 9 May 1935: El Heraldo, 11 May 1935. On 30 May Juan Ortiz was arrested in Gómez Palacio whilst trying to pay with forged banknotes (billetes falsificados de un banco de esta población (i.e. Chihuahua)) (El Heraldo, 1 June 1935). By 13 May the Banco Mercantil was asking people to redeem the notes (titulos de crédito) at its offices and not put them back into circulationEl Correo de Chihuahua, 13 May 1935.

The forgers were led by Ordorico García. García was a tax collector (recaudador de rentas) in Villa Aldama and then a businessman in Ciudad Delicias. When he saw the vales of the Banco Mercantil, he realised that they would be easy to copy and contacted his friend, Salvador Rubalcaba, who worked in the El Norte press. Rubalcaba made the plate and rubber seal, which García took to Edmundo Espinosa at the Gutenberg Press who made a thousand copies of the $2 note and a thousand of the $1 notes. However, García refused to accept the latter as they were a different colour from the genuine notes. García used fourteen $2 notes (numbered 2737 to 2751) to settle an account at a furniture store and when the shopkeeper tried to deposit them at the Banco Mercantil and found they were false, he put the police on to the trail of García and the othersLa Voz de Chihuahua, 15 May 1935.

Meanwhile the false $2 notes continued to circulate and people were told to hand them in to the Procuraduría or bank, so that they could be destroyedLa Voz de Chihuahua, 23 May 1935.

At the end of May Juan Ortiz, driven by poverty, tried to pass some counterfeit notes of the Banco de Chihuahua (sic) in Gómez Palacio and was caughtEl Siglo de Torreón, 30 May 1935.

In October 1935 the Procurador General found Salvador Ruvalcaba not guilty and set him freeAMC, Fondo Cardenismo, Sección Justicia, Año 1935, caja 1, exp. 5.

Banco Comercial Mexicano

The Banco Comercial Mexicano, S. A., was established on 30 January 1934 with a capital of $300,000 and opened on 23 April 1934. It was based in the former premises of the Banco Minero at the corner of avenida Independencia and calle VictoriaAmong the founders were Eloy S. Vallina García, Vicente F. Vallina, Simón L. Gil, Arturo Wisbrum, José Vallina, Miguel Márquez T., Edwin P. Rayan, Antonio Guerrero, Pedro Terrazas, Rodrigo Quevedo, Ramón Gómez Salas, Luis Laguette T., Leopoldo Mares, Enrique Seyffert, Gustavo Vargas, Ernesto Costemalle, Adolfo Krakauer, Juan Creel, Juan Muñoz, Oscar and Raúl Flores S., and Donato Terrazas. Its first consejo de administración were Simón L. Gil, presidente; Edwin P. Rayan, vicepresidente; and Miguel Márquez T., Ramón Gómez Salas, Arturo Wisbrum, Eloy S. Vallina García, Ricardo Hernández, Walter Wibbe, Jacobo Castro, Carlos Sisniega, Enrique Seyffert and José Costemalle as vocales. The comisario was Manuel Rivero Mier and Gerente General Eloy S. Vallina García. The first officials included Dustano Ruiz, Alfonso Corona, Jesús F. Vallina, Cipriano Ortega Domínguez, Manuel O’Reilly, Antonio Torres Orija and Fernando Schwartz.

The bank started operations in Hidalgo del Parral in June 1934, with Jesús F. Vallina as the first branch manager..

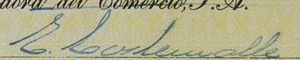

M4247 50c Banco Comercial Mexicano

M4247 50c Banco Comercial Mexicano

This bank’s issue, totalling 12,000 pesos, in three demominations (25c[image needed], 50c and $1[image needed]), was drawn on the Banco Comercial Mexicano by Comisiones y Representaciones, S. A.

| from | to | total number |

total value |

||

| 25c | |||||

| 50c | includes number 6937 | ||||

| $1 | |||||

| $12,000 |

The known example is signed by [ ][identification needed] but, depending on the relationship between the nominal drawer, Comisiones y Representaciones, S. A., and the Banco Comercial Mexicano some of these may have had the signature of Eloy S. Vallina García.

Similar notes, ranging in value from fifty centavos to four pesos, were also issued in other towns in the stateEl Heraldo, 11 May 1935.

Casas Grandes

For example, in Casas Grandes in the north west of the state all coins in values up to one peso disappeared and were replaced by cartones of fifty centavos and one peso, issued by the Banco Mercantil, and cheques of certain well-established businessmen drawn on commercial housesEl Correo de Chihuahua, 21 May 1935.

Ciudad Juárez

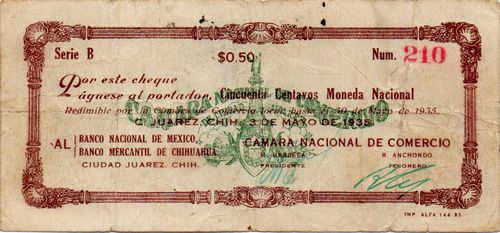

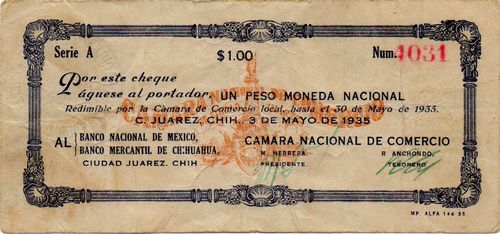

Cámara Nacional de Comercio

By 29 April the local banks and public offices in Ciudad Juárez were collecting in all the silver coinage. Because of the lack of small change, the manager of the branch of the Banco Mercantil, A. B. Carrillo, suggested to the president of the local Cámara Nacional de Comercio (Chamber of Commerce) that they ask the postmaster (administrador de correo) to issue postage stamps for use as currency (vales postales) for 25c, 50c and one peso. The suggestion was immediately forwarded to the director general (Director General de Correos)El Continental, 29 April 1935 but got bogged down in practicalitiesThe post office wanted to charge a premium (El Continental, 2 May 1935).

So the Cámara Nacional de Comercio issued its own cheques, for 25c, 50c and $1, drawn on the Banco Nacional de México and Banco Mercantil de Chihuahua.

M4252 25c Cámara Nacional de Comercio

M4252 25c Cámara Nacional de Comercio

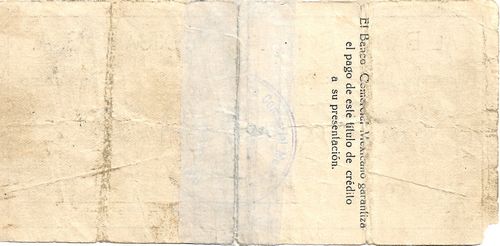

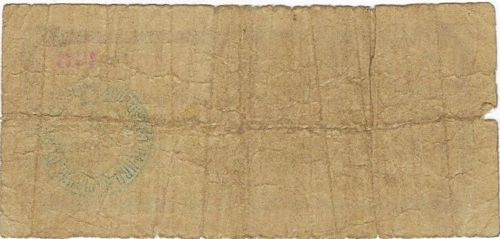

M4253 50c Cámara Nacional de Comercio

M4253 50c Cámara Nacional de Comercio

M4254 $1 Cámara Nacional de Comercio

M4254 $1 Cámara Nacional de Comercio

| series | from | to | total number |

total value |

||

| 25c | C | includes numbers 173 to 5227 | ||||

| 50c | B | includes numbers 210 to 7071 | ||||

| $1 | A | includes numbers 4031 to 11568 | ||||

| $16,000 |

These were initialled by Magarito Herrera as Presidente and R. Anchondo as Tesorero.

|

He was an alternate Presidente Municipal in 1952 and Presidente Municipal briefly in March 1953 and then again in 1956. He died in Ciudad Juárez on 30 May 1959. |

|

| R. Anchondo |  |

The vales were guaranteed by funds deposited in the Banco Nacional de México, had to be validated by the Banco Nacional de México branch, and were available from the Chamber of Commerce and local banksEl Continental, 2 May 1935. The notes had the seal of one of the banks on their reverse and were redeemable only until 30 May.

The validating was still taking place on 3 May but it was hoped that they would begin to circulate that day. In fact Herrera announced that $5,500 ($1,500 in 50c and $4,000 in $1 notes) had already been issued, and predicted that $3,000 would be in circulation by the next dayEl Paso Times, 3 May 1915. By 7 May $13,000 had been issued (2,000 25c, 4,000 50c and 10,000 $1)El Continental, 7 May 1935 and the total amount ultimately reached $16,000El Continental, 28 May 1935.

The new $1 notes of the Banco de México finally reached Ciudad Juárez on 16 May El Continental, 17 May 1935 but it was not until 28 May that the branches of the Banco Nacional de México and Banco Mercantil received enough to announce the withdrawal of the Chamber of Commerce vales, which they hoped to achieve by 30 JuneEl Continental, 28 May 1935.

Banco Mercantil

On 30 April the Banco Mercantil in Chihuahua sent its Ciudad Juárez branch vales in the denominations of 25c, 50c and one peso[mages needed]El Continental, 30 April 1935.

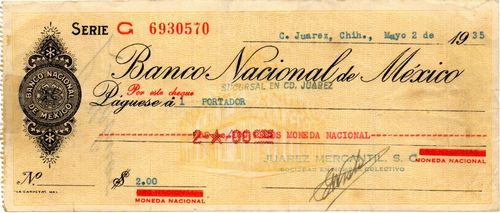

Banco Nacional de México

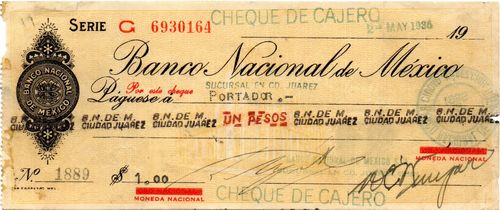

M4258 $1 Banco Nacional de México

M4258 $1 Banco Nacional de México

| series | from | to | total number |

total value |

||

| $1 | G | includes number 69030164 |

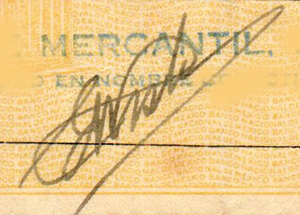

On 3 May a Ciudad Juárez newspaper reported that $1 bearer cheques (cheques al portador) issued by the branch of the Banco Nacional de México had begun to circulateEl Continental, 3 May 1935. A $1 cheque dated 2 May and signed by [ ][identification needed] and the manager, W. C. Winegar, is known.

|

|

| In 1902 W. C. Winegar was teller for the Banco de CananeaTucson Daily Citizen, 28 February 1902: The Cananea Herald, 28 September 1902 . In August 1906 he was appointed manager of the Chihuahua branch of the Banco de Sonora El Correo de Chihuahua, 17 August 1906 . During the revolution he left for El Paso and then Los Angeles. By 1914 he was working for the Sonora Bank and Trust Company, the Nogales-based company set up by the Banco de Sonora on the American side of the border, and had risen to manager and vice-president by the time it went into liquidation in November 1931Nogales Herald, 19 November 1931 . From there he went to the Banco Nacional de México in Ciudad Juárez. |  |

Also known from the same date is a $2 Banco Nacional bearer cheque drawn on Juarez Mercantil S. C. (sociedad en nombre colectivo).

M4258.5 $2 Banco Nacional de México

M4258.5 $2 Banco Nacional de México

| series | from | to | total number |

total value |

||

| $2 | G | includes number 6930570 |

|

On 10 February 1919 Wisburn formed Juárez Mercantil S. A. as a general store and comission agency (que girará en esta plaza en el comercio de abarrotes en general, representación de casas y fábricas nacionales y extranjeras, comisiones, operaciones bancarias, etc.) Periódico Oficial, 1 March 1919. Juárez Mercantil, S. A. merged with Juárez Mercantil, S. C. on 5 January 1927Periódico Oficial, 14 April 1934. |

|

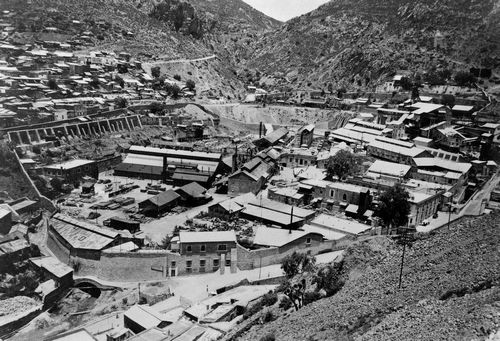

Santo Domingo

El Potosí Mining Company in 1956

The El Potosí Mining Company and its affiliate, the Compañía Industrial “El Potosí”, S.A.The records of El Potosí Mining Company are held by the Benson Latin American Collection at the University of Texas at Austin. They include annual reports covering both El Potosí Mining Company and Cía. Industrial "El Potosí", S.A. for the years 1931 to 1939., which was located at Santo Domingo, in the Santa Eulalia district, issued bearer cheques (cheques al portador y a la vista) for one and two pesos[images needed]La Voz de Chihuahua, 1 May 1935 drawn on the Banco Comercial to pay its workersEl Heraldo, 1 May 1935.

| from | to | total number |

total value |

||

| $1 | |||||

| $2 |

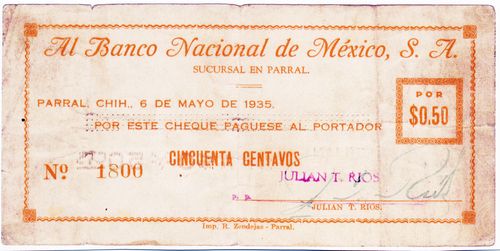

Hidalgo del Parral

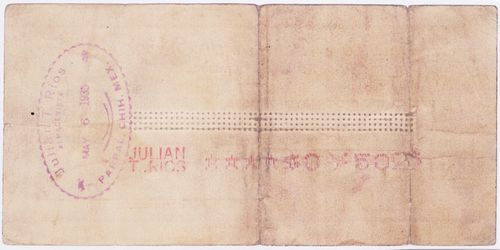

Julián T. Ríos

M4259 50c Banco Nacional de México

M4259 50c Banco Nacional de México

| from | to | total number |

total value |

||

| 50c | includes number 1800 |

In Parral, the business Julián T. Ríos issued 50c cheques, dated 6 May, drawn on the Banco Nacional de México. These were produced by the local printers, Imprenta R. Zendejas.

Julián T. Ríos ran the famous Dulcería Julián T. Ríosimage courtesy of Sandra Vázquez / El Sol de Parral. Julián T. Ríos ran the famous Dulcería Julián T. Ríosimage courtesy of Sandra Vázquez / El Sol de Parral. |

|

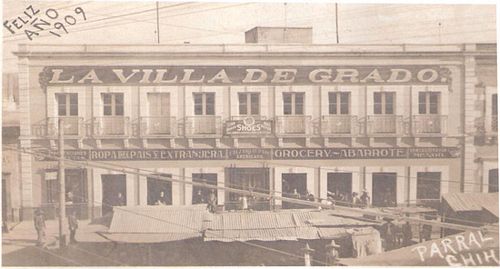

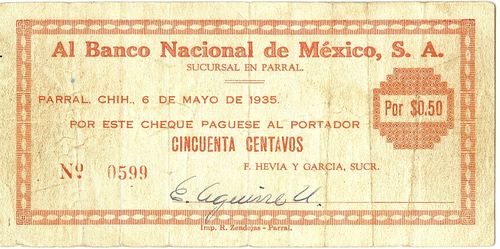

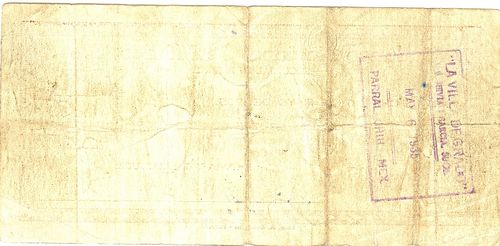

F. Hevia y García

La Villa de Grado department store, offering Mexican and foreign clothes, shoes and groceries (and also agricultural and mining machinery and explosives), was constructed in 1908 by the architect Federico Gabriel Amérigo Rouvier for Federico Stallforth, a German merchant who spent many years in Parral, acquiring a fortune and becoming a major benefactor. It was here that Francisco Villa bought goods to be resold on his hacienda at Canutillo for the same price.

F. Hevia y García, Sucr. of "La Villa de Grado" issued 50c cheques, dated 6 May, drawn on the Banco Nacional de México.

M4261 50c Banco Nacional de México

M4261 50c Banco Nacional de México

| from | to | total number |

total value |

||

| 50c | includes number 0599 |

These were also produced by the local printers, Imprenta R. Zendejas. They were signed by E. Aguirre U.

| E. Aguirre U. |  |

Magarito Herrera López was born in Tepehuanes, Durango on 8 March 1900. He was a successful businessman, founding the Casa Herrera with his brother, Leonardo, in 1919 and specialising in cigars.

Magarito Herrera López was born in Tepehuanes, Durango on 8 March 1900. He was a successful businessman, founding the Casa Herrera with his brother, Leonardo, in 1919 and specialising in cigars. Eduardo Wisbrun was a German, born in Westphalia on 8 April 1874, who emigrated to Ciudad Juárez on 5 June 1891.

Eduardo Wisbrun was a German, born in Westphalia on 8 April 1874, who emigrated to Ciudad Juárez on 5 June 1891.