El Banco de Chiapas

In 1901, the Díaz regime granted a concession to the Pan-American Railway Company (a Nebraska company incorporated in New Jersey) organized by J.M. Neeland (a Los Angeles contractor) and the Everett family (Franklin, Walter, E.B. and Fremont) of Omaha, Nebraska, to build a railway from San Geronimo, Chiapas to Tonolá on the Guatemalan border. Neeland, the force behind the project, had just completed a 175 mile spur connecting the Chihuahua and Pacific Railroad to mines owned by Enrique Creel in partnership with a group of Americans. Neeland's relationship with Creel proved invaluable because he gained for the Pan-American Company one of the bank concessions granted by the Díaz regime. No other American-owned bank was chartered as a state bank or as a bank of issue, and no other railway company was permitted to establish a bank as a condition of its concession.

The way the Everett family tell ithttps://ourfamilyhistoryblog.com/ is that Neeland, a Los Angeles promoter, got in touch with Walter Everett about the possibilities in developing a railway in southern Mexico. A European firm had gone bankrupt in such an attempt in the 1880s, but had left some completed track, and a great deal of machinery. The idea was to buy the concession from the Mexican government and complete the line. Included in the deal was the privilege of establishing this bank of issue in Chiapas. Although Walter was convinced that the deal was a very attractive one, the father, Franklin, though then nearly seventy, insisted on a first-hand look, so he made a most difficult journey through Mexico and returned to participate in the venture. Next, in 1901, Fremont Everett and his brother-in-law Herbert Shumway made a similar trip and came home similarly impressed.

With many difficulties, the Nebraska farmers, as they were referred to by workmen and other employees, managed to build a considerable amount of track in the jungles within the prescribed time limits. As the non-resident president of the company Walter Everett frequently had to make arduous trips from the United States to settle disputes; Fremont, whose role was that of banker and paymaster, admitted that he was not very successful at the management level.

Fremont Everett left Lyons, Nebraska, on 24 December 1901 to California with its wife Mary Evelyn Shumway and daughter Clara, accompanied by Delbert Lyon, who would serve as cashier. In San Diego they boarded a ship which took them to Mazatlán, Sinaloa, where they got $50,000 in silver pesos, part of the initial capital for the opening of the bank. Lyon took the money by boat to Tonalá while Fremont went to Mexico City to raise more funds, then travelled on 10 February 1902 via Oaxaca, Salina Cruz and Tonalá to Tuxtla Gutiérrez, a journey that took two weeks.

Three years were enough for the Nebraska farmers, and when they were able to sell out to a Kansas City firm, and the Mexican government paid them bonuses in cash and bonds for the work already completed, they were glad to return home.

There is no doubt that, to put it mildly, Neeland was a crook and heavily involved in defrauding Mexican and U.S. investors through dubious tropical plantation schemessee William Schell, jr, “Banco de Chiapas: a license to print money - collaborators, swindlers, and the Porfirian banking system” in SECOLAS annals, vol 24, pp 58-68, 1993 but the Franklins appear to have been industrious and their involvement in the Banco de Chiapas (and any possible loans or the use of its notes to meet the construction crew’s payroll) was limited to a short period of time.

Thus, the Banco de Chiapas was founded by a concession of 25 September 1901 in the recently designated capital of Tuxtla Gutiérrez with a capital of 500,000 pesos and opened on 25 February 1902The Mexican Herald, vol. XIII, no. 209, 21 March 1902; informe of interventor Castillo, 1 July 1902 in Memoria de las Instituciones del Crédito, 1902.

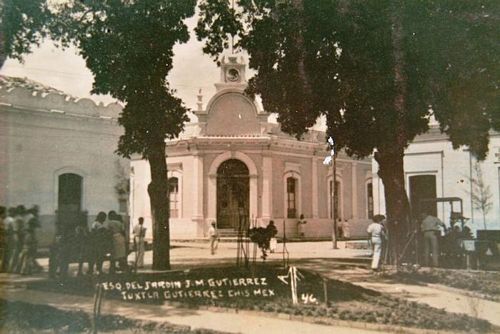

The bank’s offices were in a building of neocolonial style on the corner of calle del Estado y avenida México (now calle Central and Primera Sur). Its president was Walter Everett; general manager (gerente general) Fremont Everett, treasurer Edward B. Everett and its cashier (cajero) Alfred B. Lyon, all originally from Nebraska, United States.

The bank failed completely in its first two months. It had no deposits and the new notes were not accepted. The public distrusted the bank because commerce in Tuxtla was based on the Guatemalan currency known as “cachuco” and the businesses run by the well-known families such as the Casa Farrera, Gout or Cueto, already functioned as traditional banking institutions.

In May 1902 the North Americans handed the bank over to Ramón Rabasa Estebanell who was Tesorero General in the government of Rafael Pimentel. Rabasa was the perfect person to restore the fortunes of the bank, given his financial knowledge and experience and his political connections.

Rabasa gave up his government office and reconstructed the bank with a group of local investors, which continued to include Enrique C. Creel and José Mora. He promoted Ciro Farrera, drew in the wealthy Carlos Meyer and appointed Rafael Selvas as cashier; Clemente Castillo continued as interventor. Rabasa also appointed bank agents authorized to receive banknotes, money orders and loans Mariano S. Trujillo in San Cristóbal, Manuel E. Guzmán in Cintalapa, Enrique Rau in El Triunfo (Palenque) and Chilón, Messrs. Schauenburg and Meyer in Comitán, R. Corzo in Chiapa de Corzo and M. Forteza in Pichucalco (See informe of interventor Castillo, 5 January 1905 in Memoria de las Instituciones del Crédito, 1905. It also mentions agencies in Tonalá and Simojovel ).. On 29 December 1905 the bank proposed setting up branches in Tapachula and Tonaláinforme of interventor Castillo, in Memoria de las Instituciones del Crédito, 1905. Tapachula opened in February 1906 with R. O. Stevenson, a local hacendado and later British vice-consulEl Heraldo de Chiapas, Año 1, Núm. 31, 3 February 1907, as manager. Tonalá was not in fact opened because of the financial crisis facing the bank and local producers.

Henceforth the bank began to report good results.

For 1906 Ramón Rabasa was designated State Governor and left the bank in the hands of four board members (consejeros propietarios): Rómulo Farrera, Juan B. Brenchley, Enoch Paniagua and Carlos Tiedemann with Antonio Rancé, Leopoldo Gout, Noé Vázquez, José Manuel Velasco and Federico C. Serrano as consejeros suplentes. For their part Ciro Farrera and Carlos Meyer stood down from the offices of consejero propietario and suplente, respectively.

However, in 1907 the bank suffered from the economic crisis in the United States, which led to a withdrawal of deposits and the exchange of bank notes for hard currency, as well as affecting the state’s exports.

The end came when President Diaz suddenly issued, on 19 June 1908, a reform to the Banking Law because all local banks had abused their short and long-term lending operations. The Banco Oriental de México, based in Puebla, announced that it would absorb the Banco de Chiapas and the Banco de Oaxaca, as it had already acquired almost all of their shares. The Banco de Chiapas did not make a formal announcement in Tuxtla. Only Rómulo Farrera gave a statement to the Mexican Herald, hinting at the Banco de Chiapas' plans, saying that "the way out for small banks is to join the big banks"The Mexican Herald, Vol. XXVII, No. 36, 6 October 1908. In January 1909, the Banco Oriental started the absorption proceedings with the Secretaría de Hacienda, stating that the object was “to create a large regional bank with powerful elements that could serve the interests of industry and commerce”.

By the end of March, the Government of Chiapas liquidated the $9,501 owed to the declining bank. On 7 June the merger was formalized. Few people noticed the change in Tuxtla. The bank continued operating in the same small facilities near the park, but now as a little used and almost abandoned branchbased on J. Manuel Salinas Sánchez, “El banco de emisión de Chiapas, 1902-1908. Una experiencia singular a finales del porfiriato” in Pueblos y fronteras digital, vol.7, num.14, December 2012 – May 2013 and on Valente Molina, El Banco de Chiapas, pionero en Tuxtla (1902-1915), Tuxtla Gutiérrez, 2011.

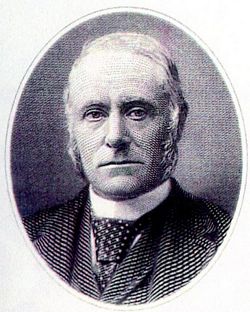

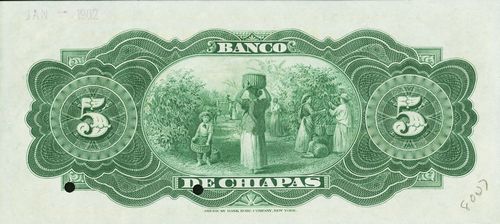

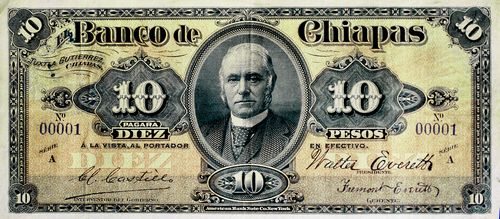

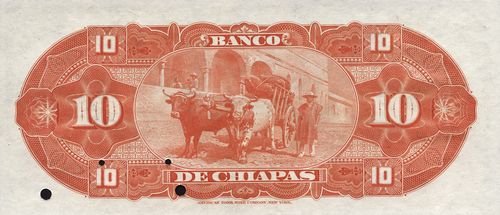

American Bank Note Company print run

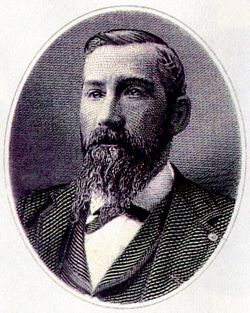

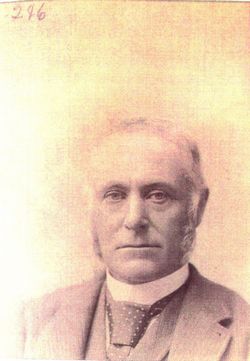

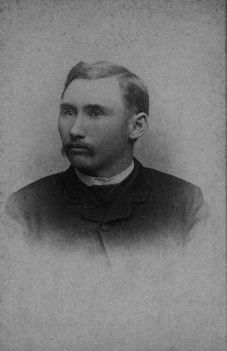

J.O. Milligan, a businessman of Wakefield, Nebraska, arranged the printing of the bank's notes. The American Bank Note Company printed one set of notes in October 1901. It engraved special vignette portraits of Franklin Everett (C 245) for the $5 note and of J. O. Milligan (C 246) for the $10 note.

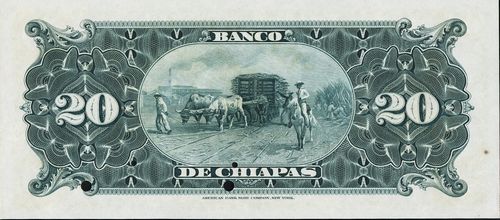

Other stock vignettes used were C 781 for the $10 reverse, and C 777 for the face and C 787 for the reverse of the $20 note. The signature of bank president Walter Everett was typographed onto all notes.

M65s $5 Banco de Chiapas specimen

M65s $5 Banco de Chiapas specimen

M66s $10 Banco de Chiapas specimen

M66s $10 Banco de Chiapas specimen

M67s $20 Banco de Chiapas specimen

M67s $20 Banco de Chiapas specimen

| Date | Value | Number | Series | from | to |

| October 1901 | $5 | 50,000 | A | 00001 | 50000 |

| $10 | 25,000 | A | 00001 | 25000 | |

| $20 | 12,500 | A | 00001 | 12500 |

The plates for these notes were cancelled on 25 September 1931 (on order F 9459)The plates were:

1 – 6 $5 Face plate

2 – 1 $5 Lithographed Tint plates Nos. 1 and 2

1 – 6 $5 Back plate

1 – 4 $10 Face plate

2 – 1 $10 Lithographed Tint plates Nos. 1 and 2

1 – 4 $10 Back plate

1 – 4 $20 Face plate

2 – 1 $20 Lithographed Tint plates Nos. 1 and 2

1 – 4 $20 Back plate (ANBC, folder 1513, Banco de Chiapas (1931-1932)).

Signatures

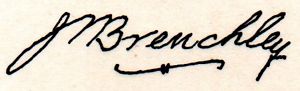

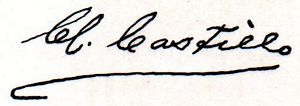

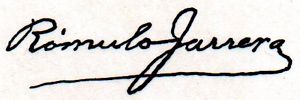

The notes carry the signatures of Walter Everett or J. Brenchley as Presidente, Clemente Castillo as Interventor and Fremont Everett or Rómulo Farrera as Gerente.

Presidente

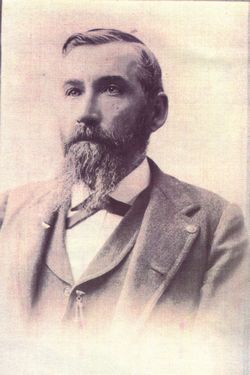

Walter Everett was the son of Franklin Everett, had a long experience of banking in the States and was president of the Pan-American Railroad Company as well as of the bank. In 1904 he returned to Nebraska, then moved to Los Angeles where he died in 1945. |

|

|

Juan B. Brenchley was appointed a member of the board at the annual general meeting of 19 March 1906. He signed some $10 notes dated 5 May 1906. |

|

Interventor

| Clemente Castillo was the brother of Victor Manuel CastilloVictor Manuel Castillo was an eminent professor of law and sometime President of the Mexican Bar, the grandson of General Angel Albino Corzo (who had many times been the governor of Chiapas), and held countless political offices, including president of the Chiapas legislature, federal deputy from 1894 until 1908, senator for Campeche (1910-1914) and senator for Chiapas (1914-1916), who asked Secretario Limantour to offer the post of interventor to his brotherCEHM, Fondo CDLIV Colección José Y. Limantour, 2a. 1902, carpeta 14, legajo 42 letter Victor Manuel Castillo to Limantour 16 January 1902. |  |

Gerente

|

In Lyons, Fremont was employed as a lawyer. He also had land holdings in Eastern Nebraska and was financially connected with many business ventures. He moved to Mexico in 1901 and had charge of the construction of the Pan American railway through the southern part of Mexico. He also served for a short time as the first manager of the Banco de Chipas. After arranging the sale of the bank Fremont Everett returned to Nebraska in 1904 and in 1916 published Some of the Everetts with details of his stay in Chiapas. Fremont later moved to Portland, Oregon, where he bought up thousands of acres of timber land and was engaged in the lumber business for many years. However, this business failed in the mid 1920s. “The causes for the failure were no doubt complex – he may have again been “cheated” by his partner, there may have been mismanagement, or the lumber business may have undergone a serious slump at that time. But Frank Edwards once said to me that around the lumber camps and mills Fremont Everett was known to be an “easy mark,” and it is the family consensus that he was never a business man, in spite of early successes; he was basically idealistic and trusting by nature. Fremont lost nearly everything. In the spring of 1926,he was operating the retail lumber yard in Sheridan, living on the premises during the week, and spending the weekends in Portland. He was then 70"https://ourfamilyhistoryblog.com/fremont-and-mary-evelyn-eva-shumway-everett/. He died in Denver, Colorado on 16 October 1936. |

|

|

The Farrera family were owners of the most important companies in the state, with branches in the principal cities of Tuxtla Gutiérrez, Tonalá, San Cristóbal and Comitán. In Tuxtla and Mezcalapa they produced coffee, cacao and cattle. With the support of families such as the Farrera governor Rabasa pushed forward the industrialisation and comercialisation of the state. Rómulo Farrera was appointed a deputy to the state Congress in 1900, joined the board of the Banco de Chiapas in 1905 and was appointed manager on 23 June 1906El Tiempo, Año XXIV, Núm. 7714, 7 July 1906; The Mexican Herald, vol. XXIII, No. 132, 11 July 1906. He was a federal deputy for Chiapas to the XXVI Legislature (1912-1914). He signed some $10 notes dated 5 May 1906. |

|

Fremont Everett was born, on 16 December 1855, in Iowa, where his father Franklin was a successful farmer and investor. Franklin moved his family to Lyons, Nebraska about 1868.

Fremont Everett was born, on 16 December 1855, in Iowa, where his father Franklin was a successful farmer and investor. Franklin moved his family to Lyons, Nebraska about 1868.