El Banco del Estado de México

Early attempts

On 29 April 1882 the state Congress, in decree núm. 60[text needed], authorised the Executive to establish in Toluca a ‘banco de circulación, depósitos, hipotecas, cuentas corrientes con interés y descuento’ with a share capital of $500,000. For this the government had to name 'un inspector e interventor que tome parte, baja su firma, en todas las operaciones del banco y le dé cuenta de las faltas que note por contravención a esta Ley o a sus reglamentos'La Ley. Periódico Oficial del Gobierno del Estado Libre y Soberano de México, 5 May 1882{/footote}.

On 4 December 1891 Finance Secretary José Limantour granted Antonio Pliego Pérez a concession[text needed] to establish a a bank of issue (banco de emisión, depósito, descuento y circulación) in Toluca. However, Pliego Pérez failed to fulfil one of the conditions in the contract, probably the lodging of a $30,000 guarantee, and the contract was declared void in the bonfire of unfulfilled contracts that Limantour made in March 1897 to prepare the way for his Ley General de Instituciones de Crédito. Pliego Pérez was one of the founding shareholders of the bank that was subsequently established in 1897.

El Banco del Estado de México

Luis de la Barra, director of the Sindicato de Ingenieros de México, suggested founding a bank to Barón Carl de Merck, of Merck, Weisser y Cía. Merck visited Mexico together with the German banker Otto Frommer to study the possibilities, and after the passing of the Ley general, on 22 March 1897 de Merck, Frommer and Donato Chapeaurouge applied for a concession for a bank in the state of México. The contract was signed on 2 April 1897.

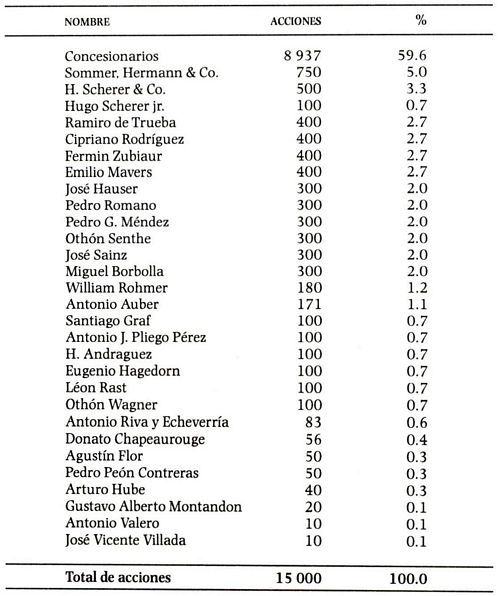

list of the founding shareholders, 1897

Among the founding shareholders were prominent impresarios, who were both hacendados and businessmen, such as Santiago Graf, Alberto Henkel, Antonio Pliego Pérez and Antonio Riba y Echeverría.

According to the original plans the baron de Merck would be the Director General, with Donato de Chapeaurouge, of the Casa Bancaria de Esteban Benecke y Sucesores, in charge of the Mexico City branch. However, in July 1897, disagreements between the concessionaires and shareholders led to the former leaving the enterprise. The Mexican shareholders took over the direction of the bank from the foreign promoters and a new board was established, composed of José Vicente Villada, the governor of the state, Ramiro Trueba, T. Hauser, Hugo Scherer, Donato de Chapeaurouge, F. Zubiaur and Santiago Graf. Villada gave up the presidency on 3 August 1897, at the first annual general meeting, and was replaced by Juan Henkel.

The bank began operations on 2 August 1897Memorias de las Instituciones de Crédito correspondientes a los años 1897-1898-1899, tomo I. El Xinantecatl, Toluca, Tomo I, Núm. 81, 1 August 1897 reports 1 August. Its notes began ito circulate in Mexico City on 8 August (El Xinantecatl, Toluca, 8 August 1897). The bank acquired its offices on 1 August 1898, and on 6 September 1898 set up an agency in Tenancingo under the management of Miguel Izquierdoinforme of interventor in Memoria de las Instituciones de Crédito, 1898.

head office in Toluca

Contador and Caja of the bank (from El Porvenir de México, 1907)

The bank’s initial capital was $1,500,000. In December 1905 the board decided to double its share capital to $3,000,000, and as a result reconstructed its board in Toluca, composed of early shareholders (Eduardo Henkel, Alfredo Ferrat and Alejandro Pliego) and estabished a Comité Directivo in Mexico City, on which sat old shareholders (Fermin Zubiaur), representative of powerful German casas comerciales (Juan Hatfiel or Ernesto Shroeder), financiers connected to the Banco Central Mexicano, allies of the Científicos (Manuel Araos, Ramón Alcázar) and a guarantor of French interests (Fernando Pimentel y Fagoaga).

The bank opened a branch in Morelia, in the neighbouring state of Michoacán, on 27 September 1899Memorias de las Instituciones de Crédito correspondientes a los años 1897-1898-1899, tomo I. By 1905 the bank had established branches in Tenancingo, Coatepec Harinas, Zacualpan, Temascaltepec, Sultepec, Ixtlahuaca, and Morelia, Michoacán, and agencies in Pátzcuaro, Uruapan and Ario, Michoacán, and Acámbaro, Guanajuato.

On 3 September 1900 the Congress authorised the Executive to allow the Ayuntamiento of Toluca to contract with the Banco del Estado de México a loan of $20,000Gaceta del Gobierno, 5 September 1900.

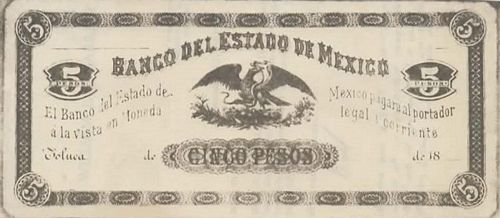

Perkins Bacon

M395 $5 Banco del Estado de México pattern

M395 $5 Banco del Estado de México pattern

This is apparently a part manuscript, part printed "paste up" prepared by Perkins Bacon, so the bank appears to have sought quotes from other suppliers before deciding on the American Bank Note Company.

American Bank Note Company print runs

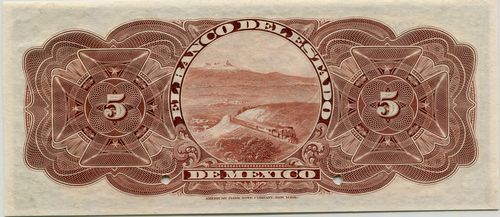

The American Bank Note Company made three print runs. It engraved a special vignette of the valley of Toluca (C 642) for the backs.

M400s $100 Banco del Estado de México specimen

M400s $100 Banco del Estado de México specimen

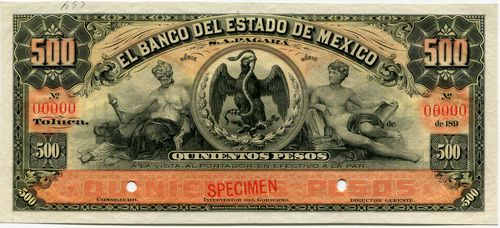

M401s $500 Banco del Estado de México specimen

M401s $500 Banco del Estado de México specimen

M402s $1,000 Banco del Estado de México specimen

M402s $1,000 Banco del Estado de México specimen

| Date | Value | Number | Series | from | to |

| August 1897 | $5 | 60,000 | 1 | 60000 | |

| $10 | 30,000 | 1 | 30000 | ||

| $20 | 20,000 | 1 | 20000 | ||

| $50 | 10,000 | 1 | 10000 | ||

| $100 | 5,000 | 1 | 5000 | ||

| $500 | 1,000 | 1 | 1000 | ||

| $1000 | 500 | 1 | 500 |

For the 1906 printing the ABNC erased the dateline and changed 'DIRECTOR GERENTE' to 'CAJERO'.

M396s $5 Banco del Estado de México specimen

M396s $5 Banco del Estado de México specimen

M399s $50 Banco del Estado de México specimen

M399s $50 Banco del Estado de México specimen

| Date | Value | Number | Series | from | to |

| March 1906 | $5 | 100,000 | 60001 | 160000 | |

| $10 | 50,000 | 30001 | 80000 | ||

| $20 | 6,250 | 20001 | 26250 | ||

| $50 | 4,000 | 10001 | 14000 | ||

| $100 | 2,000 | 5001 | 7000 |

In February 1910 the bank asked for a price for 200,000 $5 notes, and also how much it would cost to engrave a new plate the same size as the Banco Nacional de Mexico $5 noteABNC, folder 6, Banco del Estado de México, 1910-1931). On 26 February it placed an order for the 200,000 notes, the same size as before.

| Date | Value | Number | Series | from | to |

| March 1910 | $5 | 200,000 | 160001 | 360000 |

The bank asked for around 20,000 notes as soon as possible, as it was in short supply. On 3 May the ABNC forwarded one box containing 15,000 $5 notes (E 160001-175000) and thereafter 50,000 (E 175001-225000) on 27 May, 30,000 (E 225001-255000) on 14 June and finally, 105,000 (E 255001-360000) on 1 July, completing the order.

On 16 December 1915 the Comisión Reguladora reported that the bank was within the requirements of the Ley General and so could continue operating.

Under Obregón's decree of 31 January 1921 the bank was placed into Class A (for banks whose assets were greater than their liabilities) and allowed to resume all customary operations except the issue of bank notes. The bank was finally liquidated in 1930.

The platesThe plates were:

2 – 6 on – $5 face plates Nos. 2 & 3 - made on order F 2419

2 – 1 on – $5 tints – Nos, 1 & 2

2 – 6 on – $5 back plates Nos. 2 & 3 - made on order F 2419

1 – 4 on – $10 face plates - made on order of 20 August 1897

2 – 1 on – $10 tints – Nos, 1 & 2

2 – 4 on – $10 back plates, #1 made on order of 20 August 1897

#2 on F 821

1 – 4 on – $20 face plate made on order of 20 August 1897

2 – 1 on – $20 tints – Nos, 1 & 2

1 – 4 on – $20 back plate made on order of 20 August 1897

1 – 2 on – $50 face plate made on order of 20 August 1897

2 – 1 on – $50 tints – Nos, 1 & 2

1 – 2 on – $50 back plate made on order of 20 August 1897

1 – 1 on – $100 face plate made on order of 20 August 1897

2 – 1 on – $100 tints – Nos, 1 & 2

1 – 1 on – $100 back plate made on order of 20 August 1897

1 – 1 on – $500 face plate made on order of 20 August 1897

2 – 1 on – $500 tints – Nos, 1 & 2

1 – 1 on – $500 back plate made on order of 20 August 1897

1 – 1 on – $1,000 face plate made on order of 20 August 1897

2 – 1 on – $1,000 tints – Nos, 1 & 2

1 – 1 on – $1,000 back plate made on order of 20 August 1897

(ABNC, folder 6, Banco del Estado de México, 1910-1931) used by the ABNC in printing the bank’s notes were cancelled on 17 July 1931.

Branches

Oaxaca

Morelia

The branch in Morelia, situated at Portal de Matamoros núm. 1, opened on 27 September 1899 with Othón G. Neumann as managerEl Comercio de Morelia, Tomo VII, Núm. 178, 30 September 1899: La Patria, 7 October 1899. The agreement with the state government was dated 22 September 1899[text needed]. The cajero was Félix V. Alba, the contador Guillermo Carmona, and the consejeros for the branch were Manuel Anciola, Felipe Iturbe, F. Javier Gil and José Vélez..

.