El Banco de Durango

The bank was founded on 6 September 1890 by Carlos Bracho and Juan González Asunsolo with a capitalisation of $500,000 and began operating on 1 June 1891. The original shareholders and their holdings were as follows:

| General Juan M. Flores General Juan Manuel Flores was governor of Durango during the Porfiriato. He married the rich Ángela Flores y Quijar, daughter of the powerful latifundista Juan Nepomuceno Flores Alcalde | $73,800 |

| Bracho Hermanos | $73,800 |

| Juan González Asúnsulo | $63,800 |

| De Juambelz Hermano | $63,800 |

| Rafael Bracho | $63,800 |

| Gregorio de la Parra Moreno Gregorio de la Parra Moreno belonged to a family of latifundistas in Poanas and together with his brothers Leonardo, Rafael, Julio and Manuel, practiced cropgrowing and cattle rearing | $30,000 |

| Juan Lozoya | $30,000 |

| Fernando Pimentel y Fagoaga Fernando Pimentel y Fagoaga married María Bracho Zuloaga from Durango and so had large investments in the state. Pimentel bought the Cía Carbonífera del Norte owned by the company American Monterrey Iron and Steel Company. By 1909 he was performing, with Eduardo Hartman, as a representative of the Cía Maderera de la Sierra de Durango S.A. and in a deed of 1919, appears as president of that company completing the board of directors with Jesús Salcido and Avilés and Angel López Negrete. In La Laguna he was a partner of the Company of Rastros de Torreón y Parral S.A. together with Luis and Alberto Terrazas, Jesús Salcido y Avilés and Juan Brittingham. in 1889 he joined a company to exploit the Hotel Guardiola, which he intended be done "according to current needs". To do this, he partnered with his recurring cronies. Jesús Salcido y Avilés and Angel López Negrete, as well as Ricardo Padilla and Salcido, Jacinto Pimentel y Fagoaga and Luis M. Meade. (La Evolución, 21 June 1889) | $25,000 |

| Hugo Doorman | $15,000 |

| J. Ignacio Zubiría | $15,000 |

| Maximiliano Damm | $10,000 |

| Juana Campa Vda. de Grimaldo | $10,000 |

| Lowerde Hermanos, Sucesores | $10,000 |

| Juan F. Paura | $ 5,000 |

| Manuel Durán | $ 3,000 |

| Ladislado López Negrete The brothers Ladislao and Ángel López Negrete belonged to a family with extensive landholdings in various parts of Durango. Ladislao (hijo) was jefe político of the city of Durango, a deputy to the local congress and president of the board of the Compañía Minera de Peñoles | $ 2,000 |

| Rafael Pescador | $ 2,000 |

| Juan Santa Marina | $ 2,000 |

| Jesús Vargas | $ 1,000 |

| Maximiliano Delius | $ 1,000 |

Following the Ley General de Instituciones de Crédito on 18 September 1897 the bank modified its concession and was given five years in which to withdraw all its $1 notes.

In 1899 the bank’s officials were presidente: Carlos Bracho Zuloaga; gerente: Francisco Asúnsolo; secretario: Antonio de Juambelz y Redo; suplente: Julio Crez; vocal: J. Maximiliano Damm; suplente: Guillermo Drunkert; cajero: Egberto Rapp; contador: Hugo McManus; and Jesús Asúnsolo, contador.

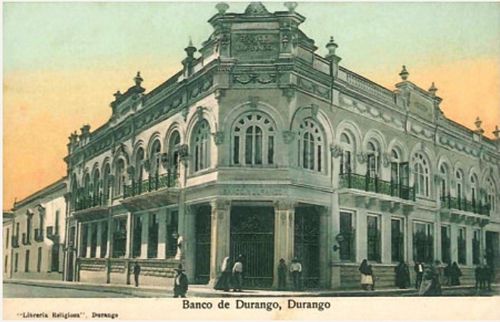

The bank’s first premises were at 2ª calle de Teresas (today calle Juárez) 14, a property owned by Toribio Bracho de la Bárcena, one of the main shareholders. This proved insufficient so on 1 January 1904 the bank moved into new premises on the corner of calle Constitución and calle Mayor (now calle 20 de Noviembre). "The building which is being erected at Durango for the Banco de Durango, is said to be one which, when finished, will not be excelled by any other bank building of the republic. The building will be two stories, the lower one being entirely devoted to the bank’s offices, arrange in the most commodious and convenient way. There is a large burglar and fire proof vault. The outside is of Renaissance architecture, with pretty railings for the windows and balconies. The upper storey is to be the residence of Manager Francisco Asunsolo, who is also a stockholder. This building, which will cost about $200,000 will contribute largely to the beauty of Durango. It will be entirely finished within six months"The Mexican Herald, Vol. XVI, No. 14, 14 March 1903.

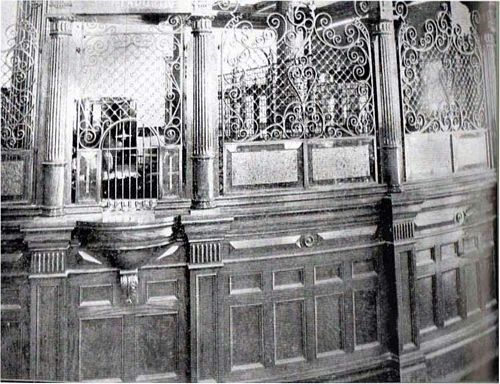

Interior of bank, 1906

The bank opened a branch in Gómez Palacio on 20 February 1904letter of Carlos Bracho, 17 February 1904 in Memorias de las Instituciones de Crédito correspondientes á los años de 1904-1906, tomo III. The Junta de Vigilancia was composed of Pedro Torres Saldaña, Sigfrido Buchanan and Pedro Alvarez, the manager was Luis Gurza Vergara and the Cajero-contador Antonio Rivas Castillo.

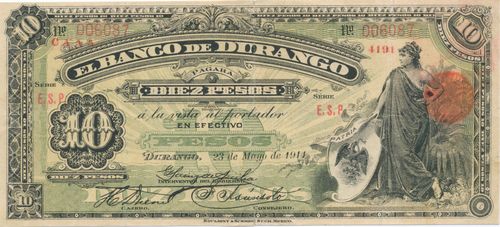

American Bank Note Company print runs

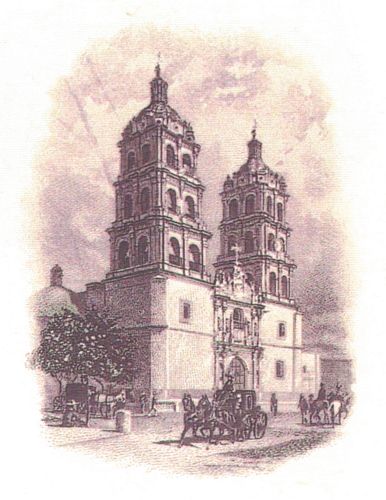

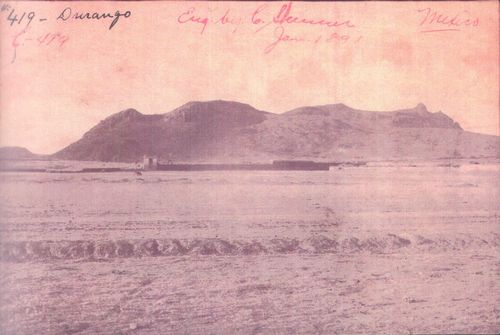

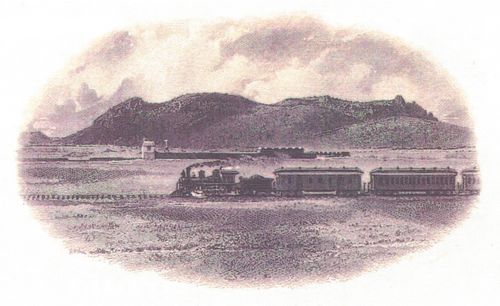

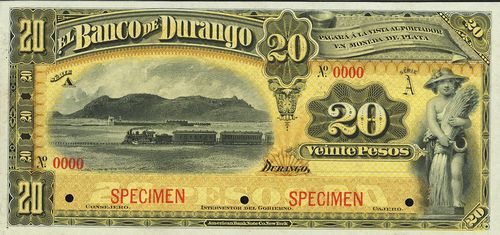

The American Bank Note Company produced the following notes. It engraved two special vignettes in December 1890: a view of the cathedral (C 420) for the $10 note and the Cerro de Mercado (C 419) for the $20 note, adding a train to the original view.

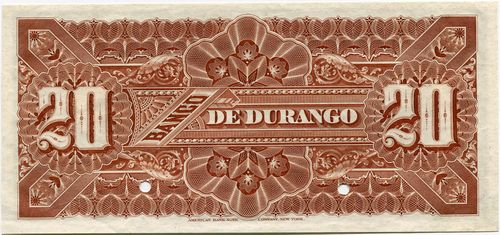

M331s $1 Banco de Durango specimen

M331s $1 Banco de Durango specimen

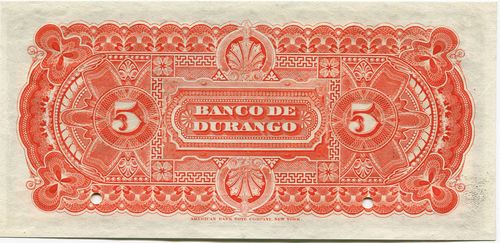

M332s $5 Banco de Durango specimen

M332s $5 Banco de Durango specimen

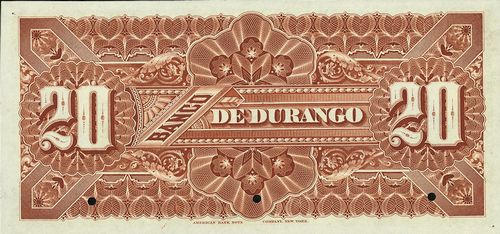

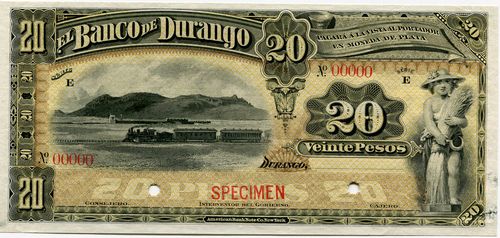

M334s $20 Banco de Durango specimen

M334s $20 Banco de Durango specimen

| Date | Value | Number | Series | from | to |

| December 1890 | $1 | 20,000 | A | 1 | 20000 |

| $5 | 12,000 | A | 1 | 12000 | |

| $10 | 6,000 | A | 1 | 6000 | |

| $20 | 1,000 | A | 1 | 1000 | |

| $50 | 400 | A | 1 | 400 | |

| $100 | 200 | A | 1 | 200 |

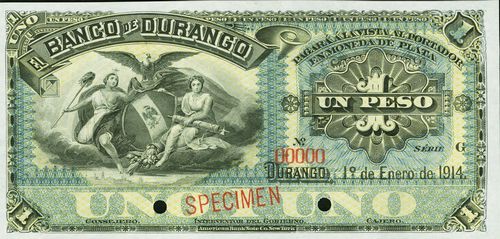

M333s $10 Banco de Durango specimen

M333s $10 Banco de Durango specimen

M338s $100 Banco de Durango specimen

M338s $100 Banco de Durango specimen

| Date | Value | Number | Series | from | to |

| September 1891 | $20 | 2,000 | B | 1 | 2000 |

| $50 | 400 | B | 1 | 400 | |

| $100 | 400 | B | 1 | 400 |

| Date | Value | Number | Series | from | to |

| April 1892 | $1 | 10,000 | B | 1 | 10000 |

| Date | Value | Number | Series | from | to |

| May 1892 | $1 | 20,000 | B | 10001 | 30000 |

| $5 | 20,000 | B | 1 | 20000 | |

| $10 | 7,000 | B | 1 | 7000 |

| Date | Value | Number | Series | from | to |

| January 1896 | $1 | 30,000 | C | 1 | 30000 |

| $10 | 5,000 | C | 1 | 5000 | |

| $20 | 5,000 | C | 1 | 5000 | |

| $50 | 1,400 | C | 1 | 1400 | |

| $100 | 500 | C | 1 | 500 |

Originally the series letter was engraved on all the plates but from 1899 it was typographed.

M332s $5 Banco de Durango specimen

M332s $5 Banco de Durango specimen

M335s $50 Banco de Durango specimen

M335s $50 Banco de Durango specimen

| Date | Value | Number | Series | from | to |

| June 1899 | $5 | 20,000 | D | 1 | 20000 |

| $10 | 10,000 | D | 1 | 10000 | |

| $20 | 5,000 | D | 1 | 5000 | |

| $50 | 2,000 | D | 1 | 6000 | |

| $100 | 1,000 | D | 1 | 1000 |

A new order (F 135) was placed in November 1902.

M335s $20 Banco de Durango specimen

M335s $20 Banco de Durango specimen

| Date | Value | Number | Series | from | to |

| November 1902 | $5 | 40,000 | E | 1 | 40000 |

| $10 | 20,000 | E | 1 | 20000 | |

| $20 | 10,000 | E | 1 | 10000 |

On 3 February 1906 the bank approved a new order (F 788) of notes, to be delivered to their agents in New York, Müller, Schall & Co.ABNC, folder 169, Banco de Durango (1906-1931). On 23 April the notes were ready and Müller, Schall & Co. instructed the ABNC to ship them to the Banco Mercantil de Veracruz, Veracruz, from where they would be forwardedibid..

| Date | Value | Number | Series | from | to |

| February 1906 | $5 | 20,000 | F | 1 | 20000 |

| $10 | 10,000 | F | 1 | 10000 | |

| $20 | 5,000 | F | 1 | 5000 | |

| $50 | 2,000 | F | 1 | 2000 | |

| $100 | 1,000 | F | 1 | 1000 |

In July 1907 the bank sent the ABNC a $10 note (Serie [ ] 00322, which had changed colour, with a different tint on the face, and said that there were other similar notes in circulation. The ABNC replied that this was a security measure. “If you will carefully examine one of these ten dollar notes, you will notice that the orange tint which is spread over all of the face, has a distinct pattern, although same is not very apparent. This orange tint is put on with the idea of security against counterfeiting by photography, and the note which you sent us proves its efficacy. Someone, evidently with the idea of obliterating this protective tint, so that they would be able to secure a clear photographic reproduction of the black work, has subjected the note to a bath of, say, sulpher, but has only succeeded in changing the color from orange to black, which brings out much more distinctly the [ ]oid pattern of the tint. The same chemical action has taken place with the orange back, changing the color to the brown as it now appears.”ibid..

In October 1910 the bank wrote that they wanted to make a new issue but, having found by experience that the $50 and $100 were too large, asked the cost of changing the $10, $50 and $100 plates to the size of the $20 note. On receiving the ABNC’s reply, they answered that as the $10 was so similar in size to the $20, they had decided to change just the $50 and $100 notes. The bank also noted that the paper previously used was thicker than necessary, and asked for it to the changed to that used in printing the $50 Banco Nacional de Mexico notes. The bank placed the new order (F 2732) on 24 November 1910ibid. and the next month the ABNC engraved new face plates for the $50 and $100 notes, slightly smaller than the previous ones.

M336s $50 Banco de Durango specimen

M336s $50 Banco de Durango specimen

M337s $100 Banco de Durango specimen

M337s $100 Banco de Durango specimen

| Date | Value | Number | Series | from | to |

| December 1910 | $5 | 20,000 | G | 1 | 20000 |

| $10 | 10,000 | G | 1 | 10000 | |

| $50 | 2,000 | G | 1 | 2000 | |

| $100 | 1,000 | G | 1 | 1000 |

On 31 March 1911 ABNC advised that the notes were ready and asked for shipping instructions, but the bank replied that as communications were uncertain and it would be dangerous to ship documents of value, it asked for the ABNC to hold on to themibid.. It was not until 27 January 1913, nearly two year later, that the bank thought it was time to receive the notes. They were sent to Veracruz by the steamer "Mexico" on 6 February 1913, but because of the lack of documentation the customs refused them and on 1 April the bank asked for them to be sent to the Banco Central Mexicanoibid..

On 26 July 1913 the Jefe del Estado Mayor of the Tercera Brigada, Mayor Felíx Puron, asked for permission to appoint José Martínez R., who had been employed by the Banco Nacional de México when it set up in Durango, as Interventor since the former Interventor had left the city, but was told that was a matter for the Gobierno

GeneralADUR, Fondo Secretaria General de Gobierno (Siglo XX), Sección 6 Gobierno, Serie 6.7 Correspondencia, caja 6, nombre 8. However, following Carranza’s ultimatum to the banks in his area, on 24 February 1914 Pastor Rouaix took possession of the Banco de Durango and Banco Nacional de MéxicoEl Demócrata, 25 February 1914 and ordered Leonardo Pescador and Carlos G. Saravia to carry out a detailed inventoryADUR, Libro Copiador 267, Hacienda 11 July 1913 - 25 April 1914, pp.811-815. The branch of the Banco de Durango in Gómez Palacio was taken over by Coronel Mateo Almanza, Jefe de Confiscaciones, in April 1914ADUR, Libro Copiador 314, Telegramas 7 December 1915 - 15 January 1918, p119.On 24 November 1913, just after Huerta’s relaxed the restrictions of the Ley General de Insitituciones de Crédito, the bank asked for a quote of 50,000 and 100,000 $1 notes, similar to their pre-1897 issue. On 12 January 1914 the bank ordered 50,000 $1 notes, Series G, and on 17 January ordered 20,000 $20, 6,000 $50 and 3,000 $100 notes, Series Hibid.. On 23 January the bank asked that the $5 note have two sets of serial number, so the text “PAGARÁ Á LA VISTA AL PORTADOR EN MONEDA DE PLATA” was moved.

M331s $1 Banco de Durango specimen

M331s $1 Banco de Durango specimen

| Date | Value | Number | Series | from | to |

| January 1914 | $1 | 50,000 | G | 1 | 50000 |

| $20 | 20,000 | H | 1 | 20000 | |

| $50 | 6,000 | H | 1 | 6000 | |

| $100 | 3,000 | H | 1 | 3000 |

On 11 February 1914 the ABNC shipped via the steamer “Mexico” a box containing 8,000 $20 (H 00001-08000) and 3,500 $50 (H 0001-3500) and on 19 February shipped via S.S. “Monterey” 12,000 $20 (H 08001-20000) and 2,500 $50 (H 3501-6000. On 26 February it shipped via S.S. “Morrow Castle” 2,000 $1 (C 1-12000) and 3,000 $100 (H 0001-3000). On 3 March it shipped via the steamer “Esperanza” 38,000 $1 (C 12001-50000), completing the order.

On 31 October 1913 the bank had asked the ABNC to prepare models for a $500 note, leaving the design to the ABNC’s discretion but making use of a photograph of the bank’s building which was enclosed. However, this first request was lost in the post. The ABNC started work on models in February 1914, with a special vignette of the bank building (C 1376) and sent complete face and back models on 16 February. These were approved on 6 March, with a slight change of “en efectivo” in place of “en moneda de plata”. The bank ordered 3,000 notesABNC, ibid. Also AGN, SC226 Comisión Monetaria, caja 104 statement from ABNC, 6 February 1931.

On 27 March 1914 the bank made its final order (F 4111) of ABNC notes, in six denominations, including adding an extra 1,000 $500 notes (A 3001-4000)ABNC, ibid. Also AGN, SC226 Comisión Monetaria, caja 104 statement from ABNC, 6 February 1931.

M332s $5 Banco de Durango specimen

M332s $5 Banco de Durango specimen

M336s $50 Banco de Durango specimen

M336s $50 Banco de Durango specimen

M339s $500 Banco de Durango specimen

M339s $500 Banco de Durango specimen

| Date | Value | Number | Series | from | to |

| March 1914 | $5 | 50,000 | J | 1 | 50000 |

| $10 | 25,000 | J | 1 | 25000 | |

| $20 | 12,500 | J | 1 | 12,500 | |

| $50 | 4,000 | J | 1 | 4000 | |

| $100 | 3,500 | J | 1 | 3500 | |

| $500 | 4,000 | A | 1 | 4000 |

There was a brief hiccough when on 21 April the company stopped work on the $5 notes (order F 4142) but continued with the $10, $20, $50 and $100 notes (orders F 4143 and F 4144). The factory was ordered to finish engraving the face and back dies for the $500 (orders F4111 and F4144) but not to print until further notice. This was done because the ABNC did not think conditions in Mexico supported going ahead. The go-ahead on the $5 and $500 notes was then given on 4 May.

On 21 May ABNC shipped via S.S. “Guantanamo” 25,000 $10 (J. 00001-250000, 12,500 $20 (J 00001-12500), 4,000 $50 (J. 0001-40000 and 5,500 $100 (J. 0001-5500) this time consigned to the Wells Fargo agent at Veracruz, as Wells Fargo & Co. Express would not take any freight for points beyond the port of entry. On 9 July ABNC shipped via S.S. “Guantanamo” 50,000 $5 (J. 00001-500000).

The $500 notes took longer to produce but the 4,000 notes (A. 0001-4000) were shipped via the S. S. “Morro Castle” on 13 August.

The bank owed $1,117.80 to the ABNC and on 19 September 1914 the Resident Agent reported “The Manager of this bank informs me that as we did not fulfil our promise as to delivery the notes are are at present no use to them, and that although the bank acknowledges the account he wished me to give them a little longer time in which to pay, more especially as the rate of exchange is so bad and they have no funds in New York. He further explained that they had received no news about the receipt of the notes in Veracruz. After a long talk with him I got a promise that they would make payment in full as soon as they received the notes or had more definite information that the notes had reached Veracruz. I therefore wrote at once to the Agent of the Wells Fargo Express Company at Veracruz asking if he had the notes in his possession. As soon as I receive his answer I will be in a position to settle this account”ABNC, folder 169, Banco de Durango (1906-1931). This amount was still outstanding in November 1929, when the bank wrote they had never received the notes covered by this invoice. The resident Agent therefore wrote to the Wells Fargo agency in Mexico City, in the hope of proving that all the notes had been received by the bank but was told that Wells Fargo could not give him any information relating to the receipt of the notes for their files only covered ten years backibid.. In February 1931 the Comité Liquidador de los Bancos Antiguos de Emisión, in acknowledging the ABNC’s claim, decided that the evidence showed that the notes had been received by the bank but, any way, the invoices were for delivery F.O.B. New York, with shipping at the bank’s risk.

The plates used in printing the notesOrder F 9467, The plates were:

1 plate – 1 Peso – face

1 “ – 1 “ – back

2 plates – 1 “ – tint

1 plate – 5 Pesos – face

1 “ – 5 “ – back

2 plates – 5 “ – tint

2 “ – 10 Pesos – face

2 “ – 10 “ – back

2 “ – 10 “ – tint

2 “ – 20 Pesos – face

2 “ – 20 “ – back

2 “ – 20 “ – tint

2 “ – 50 Pesos – face

2 “ – 50 “ – back

4 “ – 50 “ – tint

2 “ – 100 Pesos – face

2 “ – 100 “ – back

4 “ – 100 “ – tint

1 plate – 500 Pesos – face

1 “ – 500 “ – back

2 plates – 500 “ – tint were cancelled on 19 October 1931.

At the beginning of April 1913 Gustavo Sáens de Sicilia was named Interventor by Huerta in substitution for Emiliano G. Saravia. He was to have taken up his appointment as soon as communications were restored with the city, but they never were, so he operated from Mexico CityFigaro, Tomo I, Núm. 29, 3 April 1913.

Bouligny & Schmidt issues

In May 1914 Bouligny and Schmidt produced $5 and $10 notes. The bank had only just received 25,000 $10 notes from the ABNC, which demonstrates how quickly the number of banknotes in circulation grew.

M341a $5 Banco de Durango

M341a $5 Banco de Durango

M342a $10 Banco de Durango

M342a $10 Banco de Durango

Insolvency

Due to the revolution the bank closed its doors in October 1914. Following the establishment of the Comisión Reguladora e Inspectora de Instituciones de Crédito its Inspector, Rafael Herrera y Lasso, interviewed the bank’s manager, Manuel de Urquidi, at their lawyer’s offices in Mexico City on 3 December 1915. As the bank could not produce the required documentation about its financial status, the Comisión declared its concession invalid.

Under Obregón's decree of 31 January 1921 the bank was placed into Class A (for banks whose assets were greater than their liabilities) and allowed to resume all customary operations except the issue of bank notes.The bank was finally liquidated in 1930.