El Banco Central Mexicano

These are not strictly paper money but are included in the major catalogues.

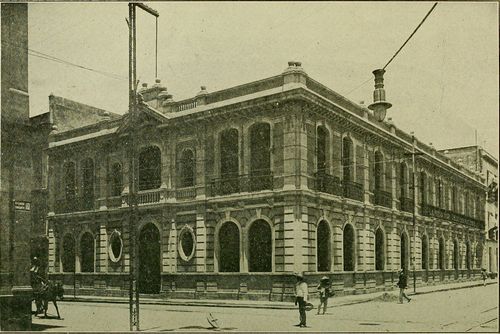

One problem of the 1897 Ley general de Instituciones de Crédito was that the two banks of issue in Mexico City, the Banco Nacional de México and the Banco de Londres y México, were allowed to open branch offices throughout the country whilst the state banks could not operate outside specific areas and could not exchange their banknotes in the Federal District. Against this background, on 12 October 1898, President Díaz granted a concession to Enrique C. Creel, Ramón Alcázar, Antonio V. Hernández, Carlos Bracho and Guillermo Vermehren to create a development bank in Mexico City called the Banco Refaccionario Mexicano. A development bank (banco refaccionario) had to adhere to different rules than did the banks of issue, but the crucial distinction was that it could not issue notes. On 28 January 1899 the name of the bank was changed to Banco Central Mexicano. The bank’s statutes stipulated that it would enter into correspondent arrangements with state banks. Although the Banco Central Mexicano was expected to raise some of its capital from its members, it could also issue shares to outside investors. With the federal government’s help, more than half of the bank’s capital was raised from a private placement and after raising one half of the authorized capital, the bank began operating on 15 February 1899.

The first consejo de administración was made up of Enrique C. Creel (presidente), Ramiro de Trueba (vicepresidente), with Joaquín D. Casasús, Ramón Alcázar, Olegario Molina, Antonio V. Hernández, Fernando Pimentel y Fagoaga (who was also the gerente), José Castellot as consejeros propietarios, and Donato de Chapeaurouge, Carlos Casasús, Manuel Rivero Collada, Emilio Meyrán, Pablo Guma, Viviano L. Villarreal, Rómulo Larralde , Carlos Bracho, Eduardo Meade, and Manuel Araoz as consejeros propietarios. Other officers were Francisco Cortina é Icaza as interventor del gobierno and Juan F. Brittingham as comisario.

The bank acted as a clearing house and redeemed member bank notes for specie (gold or silver coin) at par. Its operations greatly enhanced the acceptability of notes issued by state banks.

American Bank Note Company print runs

The bank ordered its first batch of bonos de caja from the American Bank Note Company on 4 October 1899.

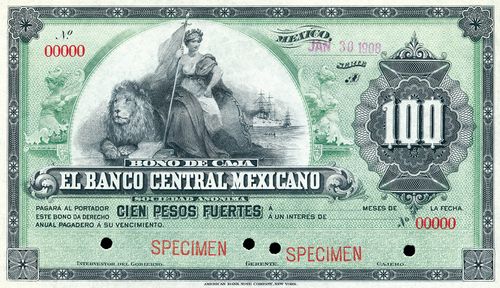

M203 $100 Banco Central Mexicano specimen

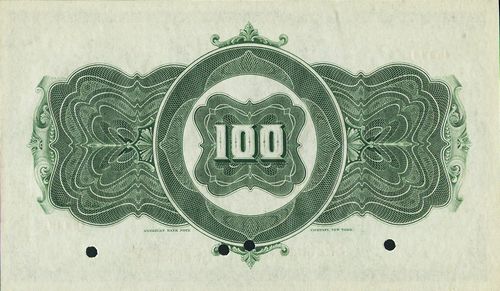

M203 $100 Banco Central Mexicano specimen

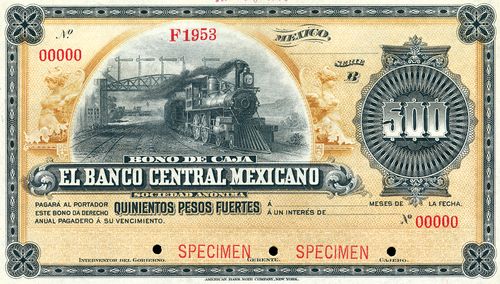

M204 $500 Banco Central Mexicano specimen

M204 $500 Banco Central Mexicano specimen

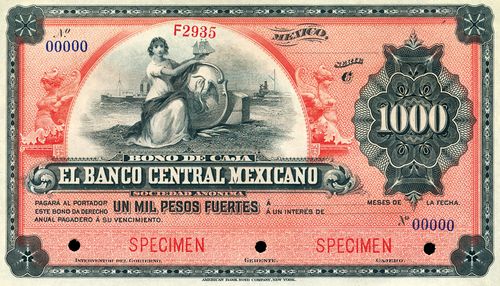

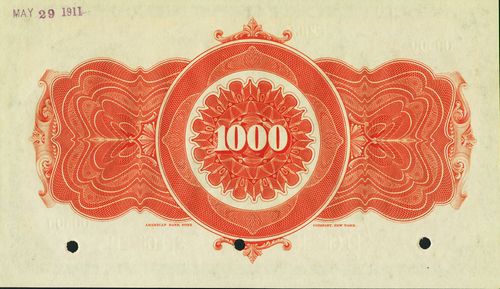

M205 $1,000 Banco Central Mexicano specimen

M205 $1,000 Banco Central Mexicano specimen

| Date | Value | Number | Series | from | to |

| October 1899 | $100 | 10,000 | A | 00001 | 10000 |

| $500 | 12,000 | B | 00001 | 12000 | |

| $1,000 | 1,500 | C | 0001 | 1500 |

The $1,000 bonds had four coupons for $25.

On 21 January 1908 the bank ordered 5,000 $100 and 2,000 $500 bonos, both without coupons.

| Date | Value | Number | Series | from | to |

| January 1908 | $100 | 5,000 | A | 10001 | 15000 |

| $500 | 2,000 | B | 12001 | 14000 |

These were shipped on 23 March.

On 5 October 1908 the bank telegraphed “Send us as quickly as possible 2000 Cash Bonds Serie C. without coupon Nos. 21251 to 23250, 8000 Cash Bonds Serie C. with coupons of $25. Nos, 501 to 8500.” as it urgently needed such bonds, but the next day cancelled the order as it had received a telegram from Paris saying that the bonds could not be placed at the moment. However, the Resident Agent expected an order very soon, and on 13 October the bank reinstated its order. The ABNC then said that their last record of series C was 1500, so suggested the numbering continued at 1501.

| Date | Value | Number | Series | from | to |

| October 1908 | $1,000 | 8,000 | C | 1501 | 9500 |

| 2,000 | 21251 | 23250 |

On 14 November the ABNC sent one box containing the 10,000 bonds.

On 2 April 1909 the bank ordered 4,000 $500, without coupons and numbered from 14001 to 18000.

| Date | Value | Number | Series | from | to |

| April 1909 | $500 | 4,000 | B | 14001 | 18000 |

These were dispatched on 19 May 1909.

Then on 6 June 1909 the bank ordered 5,000 $1,000 bonds.

| Date | Value | Number | Series | from | to |

| June 1909 | $1,000 | 5,000 | C | 23251 | 28250 |

These were dispatched on 12 July and received by 23 July.

On 23 May 1911 the bank ordered another 10,000 $1,000 bonds.

| Date | Value | Number | Series | from | to |

| May 1911 | $1,000 | 10,000 | C | 28251 | 38250 |

These were dispatched by Wells Fargo Express (via Laredo) on 24 June.

On 4 February 1913 the bank asked for another 10,000 $1,000 bonds, as they were in urgent need of the bonds.

| Date | Value | Number | Series | from | to |

| February 1913 | $1,000 | 10,000 | C | 38251 | 48250 |

On 10 February the ABNC reported that because of the poor condition of the plates they would have to prepare new ones. The bonds were dispatched by Wells Fargo Express (via Laredo) on 16 April. However, the case was held up at the border and on 28 April Wells Fargo reported that it had been recovered at Eagle Pass and left that point the day before back to New York. They were then shipped direct to Veracruz by steamer on 8 May. By 10 June they had been received by the Banco Central Mexicano.

On 11 April 1913 the bank ordered another 10,000 $500 bonds.

| Date | Value | Number | Series | from | to |

| April 1913 | $500 | 10,000 | B | 18001 | 28000 |

On 3 July the ABNC forwarded, by Wells Fargo & Co. Express, per the steamer “Mexico” one box containing these 10,000 $500 bonds (B 18001-28000).

The plates were cancelled on 11 December 1932The plates were:

1 – 4/on $100 Face plate without coupons.

1 – 4/on $100 Back plate without coupons

1 – 2/on $100 Face plate. @ $2.

1 – 2/on $100 Back plate with coupons. @ $2.

1 – 2/on $100 Face plate with coupons @ $2.50

1 – 2/on $100 Back plate with coupons. @ $2.50

1 – 4/on $500 Face plate without coupons.

1 – 4/on $500 Back plate without coupons.

1 – 2/on $500 Face plate with coupons @ $10.

1 – 2/on $500 Back plate with coupons @ $10.

1 – 2/on $500 Face plate with coupons @ $12.50

1 – 2/on $500 Back plate with coupons @ $12.50

1 – 2/on $1000 Face plate with coupons @ $20.

1 – 2/on $1000 Back plate with coupons @ $20.

1 – 2/on $1000 Face plate with coupons @ $25.

1 – 2/on $1000 Back plate with coupons. @ $25.

1 – 2/on Tint plate, with coupons.

all made on the order of 4 October 1899

1 – 2/on $1000 Face plate without coupons, made on order F 637

1 – 2/on $1000 Back plate without coupons, made on order F 637

1 – 2/on $1000 Face plate with coupons @ $25 made on order F 637

1 – 2/on $1000 Back plate with coupons. @ $25 made on order F 637

1 – 1/on Tint plate, with coupons, made on order F 637

1 – 4/on $1000 Face plate without coupons, made on order F 3693

1 – 4/on $1000 Back plate without coupons, made on order F 3693

1 – 4/on Tint plate, without coupons, made on order F 3693 (ABNC, folder 204, Banco Central Mexicano (1907-1932).

Issues

$100

| date of issue | date on note | series | from | to | Interventor | Gerente | Cajero | |

| A | 10001 | Cortina | includes number 2700 | |||||

| 10001 | 15000 |

$500

| date of issue | date on note | series | from | to | Interventor | Gerente | Cajero | |

| B | 12000 | Cortina | includes number 6448 | |||||

| 12001 | 14000 | |||||||

| 14001 | 18000 | without coupons | ||||||

| 18001 | 28000 |

$1,000

| date of issue | date on note | series | from | to | Interventor | Gerente | Cajero | |

| 1903 to 1904number 0030 has a 5c revenue stamp of the 1903/1904 type | C | Cortina | includes number 0030 | |||||

| 1501 | 9500 | with four coupons | ||||||

| 21251 | 23250 | without coupons | ||||||

| 23251 | 28250 | |||||||

| 28250 | 38250 |

Signatories

Interventor

|

Francisco Cortina é Icaza was born in Mexico City on 25 June 1841 and was a member of the city’s economic and political elite. His daughter, Guadalupe Cortina Cuevas married Andrés Bermejillo, the son of José María Bermejillo. Cortina Icaza was Interventor of the Banco Central Mexicano but transferred to the Banco de Londres y México in May 1906 when the previous holder resignedThe Mexican Herald, Vol. XXII, No. 83, 22 May 1906. He died in Mexico City on 1 January 1915. |

|

Cajero

Gerente

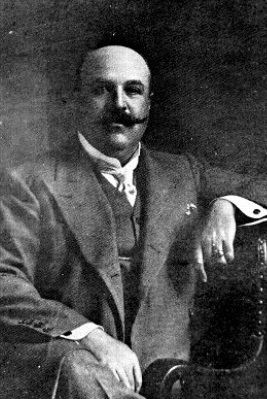

|

Fernando was a member of Limantour’s Comisión Monetaria that developed the Ley General de Instituciones de Crédito of 1897. He was the first vice-president of the Banco Central Mexicano, later becoming president, and held positions on the boards of the Banco del Estado de México, Banco Peninsular Mexicano, Banco de Guanajuato, Banco de Michoacán and Banco de Morelos. He was also president of the Compañía Bancaria de Obras y Bienes Raícesorganised in 1905 as Compañía Bancaria de Obras y Bienes Raíces, with change of name to Compañía Bancaria de Fomento y Bienes Raíces in 1909, president of the Mortgage and Credit Foncier Bank of Mexico, vicepresident of the Almacenes Generales de Depósito de México y Veracruz and director of the Caja de Préstamos as well as on the board of insurance companies, industries (the Compañía Fundidora de Fierro y Acero of Monterrey, the Compañía Industrial de Atlixco, the Compañía de las Fábricas de Papel de San Rafael y Anexas, the Compañía Mexicana de Cigarros), and mining, power (the Compañía Hidroeléctrica de Chapala and the Compañía Mexicana de Petróleo El Aguila) and streetcar companies, among others., He was Presidente Municipal of Mexico City from January 1904 until 21 November 1911, a city council that by then was losing government capacity and that, was "politically innocuous, and 'colonized' by the financiers of the regime", headed of course by Pimentel himself. |

Bonos de caja in circulation

| 1900 | 1901 | 1902 | 1903 | 1904 | 1905 | 1906 | 1907 | 1908 | 1909 | |

| January | 622,500 | 1,720,100 | 1,774,900 | 659,300 | 2,527,000 | |||||

| February | 488,400 | 1,786,900 | 652,700 | 2,879,200 | ||||||

| March | 545.800 | 1,645,800 | 604,900 | |||||||

| April | 1,248,600 | 589,100 | 3,460,800 | |||||||

| May | 2,462,300 | 559,300 | 3,481,100 | |||||||

| June | 1,590,500 | 5,555,900 | ||||||||

| July | 652,200 | 590.600 | 3,296,300 | 1,594,700 | 544,700 | |||||

| August | 853,800 | 3,332,700 | 1,577,900 | |||||||

| September | 741.100 | 3,354,200 | 4,527,300 | |||||||

| October | 837,600 | 3,776,500 | 828,500 | 486,000 | 4,527,600 | |||||

| November | 751.500 | 1,797,500 | 3,729,600 | 801,300 | ||||||

| December | 766,600 | 1.769.600 | 3.182.100 | 2,392,400 | 2,496,900 | 4,517,100 |

| 1910 | 1911 | 1912 | 1913 | 1914 | 1915 | 1916 | 1917 | 1918 | 1919 | |

| January | 4,494,700 | 5,037,800 | 3.064,900 | 6,892,300 | ||||||

| February | 6,473,600 | 4,344,000 | ||||||||

| March | 5,412,200 | 6,827,000 | ||||||||

| April | 4,982,000 | 9,413,700 | 6,816,000 | |||||||

| May | 4,890,800 | 6,363,700 | 6,546,200 | |||||||

| June | 8,977,700 | |||||||||

| July | 4,868.900 | 6,827,900 | 4,356,400 | 8,940,900 | ||||||

| August | 4.915,200 | 8,926,300 | 6,573,200 | |||||||

| September | 4,861,100 | 6,573,200 | ||||||||

| October | 5,101,200 | 4,854,300 | 8,914,100 | 6,555,500 | ||||||

| November | 2,873,600 | 8,918,700 | ||||||||

| December | 5,000,500 | 6,467,200 |

It is surprising, given the number of bonos issued, how few, even cancelled, have survived. This must be a consequence of the high values of the bonds and the diligence and efficiency of the Banco Central Mexicano's accounts department.

Fernando Pimentel y Fagoaga was a businessman, banker and politician, a member of the Científicos and closely aligned to French interests.

Fernando Pimentel y Fagoaga was a businessman, banker and politician, a member of the Científicos and closely aligned to French interests.