Signatures on Banco Nacional de México notes

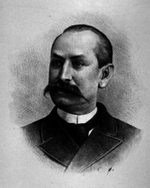

Consejero

The Banco Nacional de México notes carried two symbols, where it states SERIE, which were really controls.

On the left the letter corresponded to the initial of the branch from which the notes were issued, thus: M - Mérida, V - Veracruz, P - Puebla, G - Guadalajara, G2 - Guanajuato, CH - Chihuahua, M2 - México, M3 - Central en México, L - San Luis Potosí, O - Oaxaca and M4 - Monterrey.

On the right a capital letter, either alone or with a number, indicated which consejero (board member) signed the notes.

So combinations of codes fall into the hundred or even thousands: there are around 400 combinations for the $5 note alone.

This system seems to have broken down during the revolution.

| Letter | Consejero | date range | |

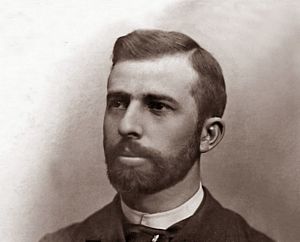

| A |

Benito Arena Bermejillo was a Spaniard, born in 1841. He had been a vocal propietario in the first consejo of the Banco Mercantil Mexicano. He owned the Hacienda de San Juan de Dios, near to Tlalpán, just south of Mexico City, with a herd of more than 600 Swiss and Dutch dairy cattle. |

1885 - 1890 |  |

| A | Carlos Arellano | 1911 - 1913 |  |

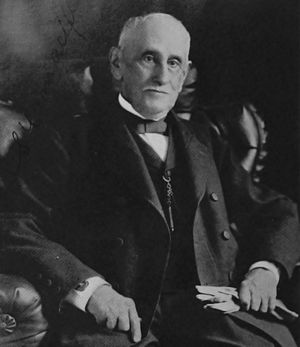

| B |

His father, José María Bermejillo, established a company that during the days of the French intervention was recognized as one of the most prosperous trading houses in Mexico City. Originally, at the beginning of the War of Reform, José María’s son, Pío, supported the conservative side, to which he provided various loans that were guaranteed with ecclesiastical properties, and therefore received lands in the state of Morelos. Later, at the end of the War of Reform Bermejillo was part of the group that ‘denounced’ the clerical properties offered for sale after the law of nationalization. It was then that Bermejillo became one of the most important buyers of the properties of the clergy. From 1884 to 1904 José María took over the management of the Bermejillo business from his brother Pío. His work was characterized by his marked interest in Mexican mining.: Casa Bermejillo granted various loans to different mining companies and Bermejillo’s participation in this sector made him one of its representatives in the Comisión Monertaria of 1903, which aimed to study the possible consequences of the adoption of the gold standard on the Mexican economy. José María Bermejillo can be considered an innovative entrepreneur, because he accessed a new market, that of the electrical industry of Guadalajara, though the Compañía de Luz Eléctrica de Guadalajara (later part of the Compañía Hidroeléctrica de Chapala), thanks to the good use he made of the natural resources of his hacienda which he owned with his wife, Dolores Martínez Negrete Alba, who inherited 12,319 hectares of estates in El Salto, Jalisco. He was a member of different Spanish associations in Mexico, such as El Casino Español and the Spanish Chamber of Commerce. These were ideal spaces where one could access market information, establish new economic relationships and design new investment projects. In the Casino Español not only the most distinguished members of the Spanish colony congregated, but also the members of the economic elite of Mexico City. José María was a shareholder and board member of the Banco Nacional Mexicano, Banco Mercantil Mexicano and Banco Nacional de México. He died in Mexico City on 1 September 1904, leaving a large fortune of more than three million pesos to his wife, who survived him 25 years until 1929. |

1885 - 1902 |  |

| B |

José María Roa Bárcena was born in Xalapa, Veracruz, on 3 September 1827 and moved to Mexico City in 1853. During these tumultuous times, he joined the Conservative Party, of which he was a distinguished champion and defender in the press, a supporter of the Empire and a member of the Junta de Notables who went to offer the crown to Maximilian. However, unhappy with his actions and inspired by the ideas of liberalism, he refused to cooperate in Maximilian’s administration. At the fall of the short-lived Empire, he suffered two years in prison, and then, on regaining his freedom, left politics and devoted himself to business and literature. He was a historian, novelist, literary critic, journalist and poet, leaving behind a vast opus. He died in Mexico City on 21 September 1908. |

1905 - 1906 |  |

| B | Eduardo N. Brown | 1911 - 1913 |  |

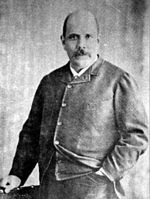

| C |

Félix de las Cuevas González , better known as Félix Cuevas, was born in Aniezo, Cantabria, Spain in 16 December 1830. In 1847, at the age of 17, he decided to seek his fortune in Mexico. Although the country was suffering from the effects of its war with the United States, the young Cuevas found a way to take advantage of the situation and make a good future. As someone with a good head for numbers, he generated trust among the members of Mexico's important families, who applied for his services as administrator, especially when, in the face of the country's instability, they chose to go abroad, leaving their assets in the country. After a few years he decided to explore the world of finance, investing in shares that over the years generated outstanding yields. In 1864 he invested in the Banco de Londres, México y Sud-América and in 1881 decided to invest much of his fortune in shares of Banco Nacional Mexicano, thus obtaining 20% of the capital of this new bank. He was a director of the Banco Nacional de México until 1910, when he resigned because of his ailing health. Cuevas also invested in other sectors such as transport, and participated in mining, electrical and railway companies. He was president of Ferrocarriles Nacionales de México and the Compañía Real del Monte y Pachuca, then the most important mining company in the country. Later, in 1890 he founded the Cámara Española de Comercio (Spanish Chamber of Commerce), which promoted and improved trade between Spain and Mexico. Although Félix Cuevas had a major impact on Mexico's financial and industrial sector, his main contribution was humanitarian. He sought to make life easier for Spanish migrants, combating health problems, unemployment, homelessness and resources and did so through the Sociedad Española de Beneficencia (Spanish Charity Society). While his main objective was the protection of the underdogs, he also supported the elderly and culture. He founded the Casino Español, a place in the Avenida Isabel la Católica, in the centre of Mexico city, where Spaniards could meet and relax. He died in Mexico City on 31 March 1918, leaving a considerable part of his fortune to acquire properties to be used to provide free board to the homeless. |

1885 - 1897 |  |

| D | Francisco Cortina é Icaza | 1886 - 1897 |  |

| D |

Maurice Armand Delille |

1911 - 1912 |  |

| E |

Antonio Escandón y Estrada was a promotor of the Anglo-Mexican company, Ferrocarril México-Veracruz He had been a vocal propietario in the first consejo of the Banco Mercantil Mexicano. |

1885 - 1890 |  |

| E | José G. Escandón | 1901 - 1902 |  |

| E |

He was a career soldier and became a brigadier general and Porfirio Díaz; Jefe de Estado Mayor. He was a deputy for Guanajuato from 1894 until 1912 and was governor of Morelos from 15 March 1909 until May 1911, but abandoned the governorship and went to the United States on Díaz’ resignation. He came back to support Huerta but on his defeat, returned to exile. He came back after 1920 and died in Mexico City on 31 March 1926. |

1906, 1909, 1910 |  |

| E | Luis Elguero was a “senator, capitalist, politician, lawyer of note”SD papers, 812.00, 11914. He was chair of the board of directors of the Ferrocarriles Nacionales (National Railways), president of the Caja de Préstamos para Obras de Irrigación y Fomento de la Agricultura and on the board of the Cía. Mexicana de Petróleo El Aguila. As a distinguished jurist he was part of Huerta’s peace delegation to the United States in 1914. | 1908, 1911 - 1913 |  |

| F |

Genaro de la Fuente was director of the Negociación Minera de Sauceda in Zacatecas La Iberia, 17 April 1874. He had been a vocal propietario in the first consejo of the Banco Mercantil Mexicano. |

1885 | |

| F | Carlos Friederichs | 1909 - 1913 |  |

| G | José Gargollo was a Spaniard who had been a vocal propietario in the first consejo of the Banco Mercantil Mexicano. He was a director of Diligencias Generales and member of the Convención Española. | 1885 - 1897 |  |

| G | Agustín Garcin was a Barcelonnette. | 1902 - 1912 |  |

| H | Manuel Romano Gavito had been a vocal propietario in the first consejo of the Banco Mercantil Mexicano. | 1905 - 1908 |  |

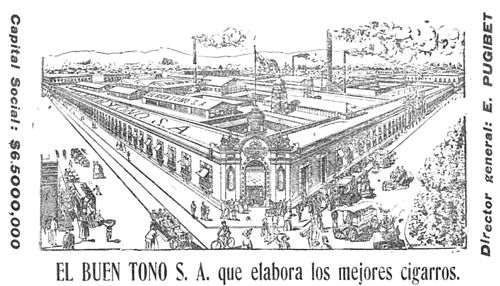

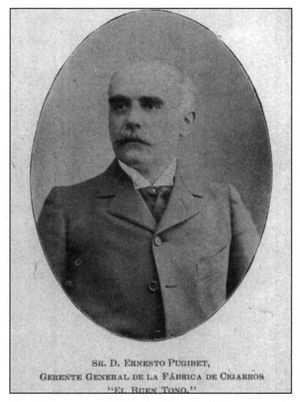

| H | The older Hugo Scherer probably came to Mexico in 1869 as part of a wave of German industrialists from Hamburg and Bremen and worked at first in the mining industry. With Hugo Scherer Pino (Hugo Scherer Jr.) (his cousin and brother-in-law) he founded Hugo Scherer y Compañía (finance) and then moved on to manufacturing with shares in the Compañía Industrial Manufacturera (cotton), the Compañía Compresora de Algodón in Torreón, El Buen Tono (cigars), the Compañía Nacional Mexicana de Dinamita y Explosivos and the Fundidora Monterrey.

Hugo Scherer, Jr. (cousin of Hugo Sr. and younger brother of his wife) was the director of Hugo Scherer y Compañía and on the board of the Compañía Maderera de la Sierra de Durango (land and timber), the Compañía Minera Dos Estrellas,the Agujita (coal), the Transportes de Guadalajara (trams), Ferrocarriles Nacionales de México and the Banco Internacional Hipotecario. Thanks to his international banking contacts he was director of the Société Financière pour l’industrie au Mexique and in charge of the Caja de Préstamos para Obras de Irrigación y Fomento de la Agricultura, which made a fifty million pesos bond issue in 1908In 1907, almost 90% of all bank loans were legally short-term; however, most were loans granted to long-term landowners, which were registered as commercial credits. That is, the provincial banks of issue were working with a high liquidity risk, given by the difference in terms between their liabilities (notes plus deposits) and loans. The idea was then to create an organization that would buy the banks' loan portfolio and, in return, they would receive cash (liquid assets. Hence, by a decree of 17 June 1908, the Caja de Préstamos, was founded through a concession to four of the most important banks in the country: the Banco Nacional de México, Banco de Londres y México, Banco Central and Banco de Comercio. Its initial capital was ten million, but its loanable resources soon amounted to fifty million pesos, as the federal government issued bonds in the amount of twenty-five million dollars in different international markets. The bonds were amortizable over 35 years and had denominations of $1,000, $500 and $100 and were offered simultaneously in New York, Frankfurt, Berlin, Amsterdam and London. Much of the resources of the Loan Fund were transferred to the banks of issue to meet their short-term commitments. Through this mechanism, the promissory notes of landowners were in turn transformed into long-term documents in favor of the Caja de Préstamos, in exchange for liquid foreign capital that was placed in the hands of the issuing banks. H. Scherer y Compañía became the fourth largest shareholder of the Banco de Tamaulipas. Hugo Sherer participated actively in regional banking. In 1897, he invested 50,000 pesos in the Banco de San Luis Potosí and another 50,000 pesos in the Banco del Estado de México. In 1896, on behalf of Scherer and Company, Hugo was a shareholder of the Banco Minero de Chihuahua and between 1907 and 1908, in the Banco Refaccionario de La Laguna. In 1906, he founded the Banco de Comercio e Industria with a share capital of ten million pesos The board of directors would include Scherer together with Óscar Braniff, Pablo Macedo, Guillermo de Landa y Escandón, Franz Boker and others. |

1910 |  |

| J |

José A. Signoret was the fifth Presidente of the Consejo de Administración from June 1915 until 1934. |

1909 - 1913 |  |

| K |

He was alternate senator from Jalisco (1888-1894, 1896-1898), deputy from Guanajuato (1894 – 1898) and senator from the Federal District (1900-1914). Camacho was the fourth Presidente of the Consejo de Administración from May 1904 until 1914. |

1890 - 1913 |  |

| L |

He died on 21 June 1908. |

1890 - 1908 |  |

| M |

On 29 October 1894 he was appointed Mexico’s envoy to France, a post he held until his death in Paris, France on 13 December 1899. His widow, Isabel Pesado, donated her husband’s library of 7,526 books to the Biblioteca Nacional de México. |

1885 |  |

| M |

He was on the board of the Caja de Préstamos para Obras de Irrigación y Fomento de la Agricultura, Cía. Manufacturera El Buen Tono, and the Cía Fundidora de Fierro y Acero de Monterrey (1907), among othersCía. de Luz y Fuerza de Pachuca, S. A., Cía. Mexicano de Express, S. A., Mexican Light and Power, Pan American Company, Pan American Railway; cofounder of El Boleo Copper Company, Baja California; president of the Banco Mexicano de Comercio y Industria, president of the National Surety Co., vice-president of the Compañía Bancaria de Fomento y Bienes Raíces de México; vice-president and lawyer of the Banco de Londres y México, lawyer for the Banco Nacional de México. He owned 3,620,532 hectares of land in Baja California. He was a federal deputy from the Federal District from 1880 through to 1882 and from 1900 to 1912. He was president of Congress in 1907 and 1910. He died in exile in Madrid, Spain, on 25 December 1918. |

1902 - 1913 |  |

| N | Pedro Martín was an investor in the Banco Mercantil Mexicano. | 1885 - 1889 |  |

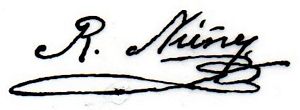

| N | Roberto Núñez Castañares was born on 1 December 1859 in Mexico City. He married Josefina Prida y Arteaga, the daughter of industrialist and banker Francisco Macario de Prida Palacios.

He was a member of the Mexico City council from 1886 to 1888, a federal deputy from the Federal District 1886 to 1896, from Puebla 1896 to 1902 and from the Federal District 1902 to 1911. A bureaucrat, he served as a judge, ambassador, Oficial Mayor of the Treasury 1893 to 1900 and Subsecretario from 1900 to 1904 and from 1905 to 1911. He was vicepresident of the San Rafael y Anexas paper company, a member of the boards of the Cía. Manufacturera El Buen Tono, the Cía. de Luz y Fuerza de Pachuca and the Caja de Préstamos para Obras de Irrigación y Fomento de la Agricultura and a shareholder in the Santa Gertrudis mine in Hidalgo. He accompanied Porfirio Díaz to exile in Paris in 1911, and died on 27 December 1912. |

1905 - 1911 |  |

| O |

He died on 5 January 1903. |

1885 - 1902 |  |

| O | Ernesto Otto | 1908 - 1913 |  |

| P | Francisco M. de Prieta, founder of Circulo Mercantil de Veracruz, had been a vocal propietario in the first consejo of the Banco Mercantil Mexicano. | 1885 - 1897 |  |

| P |

He was Commercial Counselor of France and received the medal of the Legion d'Honneur. He died in 1915. |

1908 - 1913 |  |

| Q | Pedro Peláez | 1887 - 1905 |  |

| R |

Strück died in February 1906. |

1885 - 1905 |  |

| R | Pablo Escandón (see E above) | 1908 | |

| R | Hugo Scherer, Jr. (see H above) |

1910 |  |

| S | León Stein was originally involved in finance for mining, exports of silver and imports of fine jewelry. | 1885 |  |

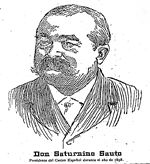

| S |  Saturnino A. Sauto Saturnino A. Sauto |

1890 - 1906, 1910 |  |

| S | Hugo Scherer, Jr (see H above) | 1910 |  |

| T | Nicolás de Teresa came from Llanes, Asturias, Spain, and, together with Manuel Ibañez , was one of the principal drivers behind the Banco Mercantil Mexicano. He had his own successful banking house and subscribed for 2,000 shares in the Banco Mercantil Mexicano,. He married Dolores Miranda, the daughter of the Spanish vice-consul, and his son, José de Teresa Miranda married the daughter of Manuel Romero Rubio (above). | 1885 - 1890 |  |

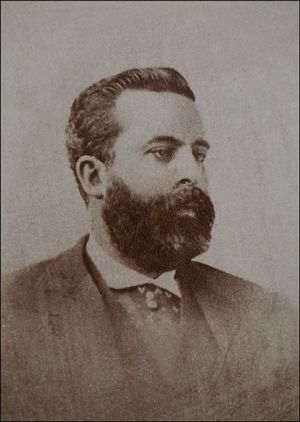

| V |

José V. del Collado was born in Santander, Spain on 14 February 1831. As a young man he went to Mexico with his wife and two sons. He was a shareholder and manager of the Casa de Diligencias, then Director of the Banco Mercantil Mexicano, and finally director of the Banco Nacional de México from 1885 to 1891. He then was involved in various businesses, principally in agriculture. As well as a consejero of the Banco Nacional de México, he was a consejero of Buen Tono, the Compañía de Seguros “La Mexicana”, of the Banco Hipotecario and of various mining companies. As a philanthropist Collado was a founder of the Asilo de Mendigos in 1879, was an active member of the Conferencia de San Vicente de Paul and various Catholic societies and was president of the Casino Española and the Sociedad Española de Beneficencia. Apparently he was probably the only landlord in Mexico City who never raised his rents. He became ill in January 1901 and died of pneumonia on 21 November 1901Semanario Literario Ilustrado de “El Tiempo”, Tomo I, Núm. 49, 2 December 1901. |

1885 - | |

| W |

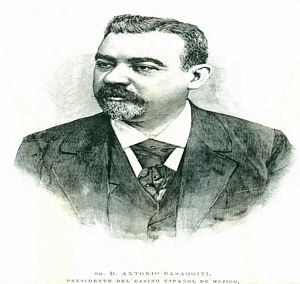

He began his career as an employee in the firm of Antonio Escandón but soon established firm links to the Zaldo family, which operated out of Veracruz and specialised in both textiles and tobacco production and imports. Basagoiti early on set up a textile factory in the provincial capital of Xalapa. Years later he moved to Mexico City where he set up the merchant banking firm of Basagoiti/Zaldo. His prestige in the Spanish merchant colony in Mexico, helped his business as he generated much confidence in clients. By moving from merchant and importer to financier, Basagoiti was able to consolidate his networks of contacts and correspondents and clients. But Basagoiti also began to diversify his investments, particularly in the new banking institutions in the capital and provinces (Banco Nacional de México, Banco de Londres y México, Banco Oriental in Puebla and Banco Mercantil de Veracruz, among others.) In the first place he discounted bills or letters of exchange issued by a multitude of merchants. This allowed him to build up a very broad network of clients and correspondents and facilitated a great variety of local and trade operations. In the second place he became a specialist in the discount of bills of exchange on other cities and ports abroad, particularly those in Cuba and Spain. In the third place he began directly to lend money in short, medium and long term credits to merchants, industrialists and landowners. In the fourth place, he helped manage the fortunes and business of other Spanish entrepreneurs, some of whom had returned to Spain. He married the daughter of one of the wealthiest Spanish merchant bankers, Manuel Ibañez, who had developed the business of remittances to Spain. Basagoiti not only developed his merchant and financial business, but also became a prime leader in the early industrialization of Mexico. He set up tobacco and textile firmsFor example, in 1892 Iñigo Noriega and Antonio Basagoiti formed the Compañía de Hilados, Tejidos y Estampados San Antonio Abad, owner of the largest factory at the time of the revolution, with 350 looms. In 1895 Basagoiti undertook the construction of another plant, attached to the company El Salvador, S. A.. Other investments were the Tajimaroa linen factory in Michoacán, the La Victoria wool factory (the second largest in the country); and in the textile firms: La Virgen, Velocitán S.A. and the Progreso Industrial S.A. The financial company Basagoiti Zaldo was formed to raise a capital of two million pesos among the business elite to invest in the La Tabacalera la Mexicana factory in Veracruz. In addition, together with other firms such as Barroso Arias, Basagoiti founded the Compañía Industrial Atlixco S.A. which in 1899 brought together several companies., but most important was his participation as 25% owner of the first steel firm in Mexico and Latin America, Fundidora de MonterreyThe Compañía Fundidora y Afinadora Monterrey, S.A, known as La Maestranza or simply La Fundidora, was founded in 1900 with a capital of $10,000,000, some raised from the wealth accumulated by the region’s capitalists, including the Madero family. Two foreign investors, Antonio Basagoiti and León Signoret, owned approximately 40% of the company’s stock., which began operations in 1900 and was run by Asturian managers for over eighty years. Basagoiti´s experience in business in Mexico was key in facilitating his reinvestment of profits in Spain in a field he knew well, that of banking, and allowed him to create the Banco Hispano Americano in Madrid in 1901 with capital from Mexico and Cuba. |

1890 - 1902 |  |

| W | Luis Elguero (see E above) | 1909 - 1910, 1912 |  |

| Y | Manuel Ibáñez had been a vocal propietario in the first consejo of the Banco Mercantil Mexicano. | 1885 |  |

| Z | Juan José Martínez Zorrilla had been a vocal propietario in the first consejo of the Banco Mercantil Mexicano. | 1885 - 1889 |  |

| Z |

Limantour was a member of the Mexico City Ayuntamiento and later a member of the National Congress. He was assigned to the Mexican Legation in Paris and held the position of attaché for several years. In 1899 while residing in Paris, he was named a chevalier of the Légion d'Honeur by the French President for his participation in the establishment of the Liceo Francés in Mexico. He was also a member of several cultural and charitable societies, including the Junta de Beneficencia Privada and the Comisión Nacional del Centenario de la Independencia. Julio Limantour was an investment partner in the banking firm of Hugo Scherer Jr. and Company for many years. He was well-known in Mexico City’s business circles and abroad. Along with engineer Juan Navarro and Carlos Moricard, Limantour joined in a society to build a railroad line in Veracruz. In 1900 Navarro had acquired the rights to a railroad concession granted in 1898 to build a railroad line to run from Córdoba to Huatusco. The railroad was known as the Ferrocarril de Córdoba a Huatusco. The construction of the railroad as well as the transportation of passengers, products and supplies were affected by the weather, topography, and infectious diseases, which were more prevalent near the coast. Construction was also delayed by the need for specialized equipment, some of which had to be acquired from firms in the United States and overseas. In 1907 Mr. Limantour acquired a private rail car in the United States which he had renovated and which bore the name “Lolita”. Besides his work with the Ferrocarril de Córdoba a Huatusco, Limantour was a member of the Junta Directiva Encargada de la Conservación y Reparación de Carreteras, and was appointed by President Díaz as Comisario Inspector de Ferrocarriles, assigned to the Ferrocarril de Chihuahua al Pacífico. Among the many companies in which he was a stock holder were the Banco Nacional de Mexico, the Compañía Manufacturera El Buen Tono, S.A., the Compañía Mexicana de Dinamita y Explosivos, the Compañía Mexicana de Construcciones y Obras de Ingeniería, S.A., Ferrocarriles Nacionales de México, Cervecería MoctezumaThe Cervecería Moctezuma, in Orizaba, Veracruz, founded in 1894 by the Germans Guillermo Haase, Cuno Von Alten and Emilia S. de Mantey. Two years later the company was transformed into a joint stock company and opened to French participation. It had ice factories and refrigeration facilities in Mexico City, Veracruz, Salina Cruz, Santa Lucrecia and Coatzacoalcos. It had a network of agencies and warehouses in the main cities of the country. Its board was chaired by, successively, Julio Limantour, Henri Tron, Ernest Pugibet and Adrián Carranza (who was presidente in 1922)., and the Société Financière pour l’Industrie au Mexique. He also invested in other railroad companies, including the Ferrocarril del Noroeste de México, in several tramways and automobile companies, and a number of mining companies. He was a member of the board of directors of several companies besides being president of the Ferrocarril de Córdoba a Huatusco and the Cía. Cristalera Mexicana de Puebla, S.A., including the Banco Nacional é Hipotecario de México. Due to multiple occupations and delicate health Limantour eventually resigned from several companies. He died in Mexico City on 11 October 1909. |

1896 - 1909 |  |

| Z | Eusebio González[identification needed] | 1912 - 1913 |  |

|

He trained as a lawyer and so later served as the abogado of the bank. He was subsecretario de Gobernación from 1906 until 1911 and, for want of a Secretario de Gobernación, in charge of the department at the start of the revolution. Macedo went on to be a successful financier. He founded the Banco del País, S.A., the Banco Hipotecario Reforma, S.A., La Continental, Seguros, S.A., Almacenes del País, S.A., and from 1943 to 1951 was president of the Latinoamericana life insurance company and responsible for the building of the Torre Latinoamericana. He died in Los Angeles on 26 September 1959. |

1913 |  |

|

| V [ ][identification needed] | 1913 |  |

Interventor

| Interventor | date range | |

Manuel Romero Rubio was born on 7 March 1828 in Atzcapotzalco, Mexico City. He was a lawyer and politician holding various offices including deputy from Puebla (1856-1857, 1867-1868), governor of Mexico City (1857). He joined Juárez’ Liberals during the revolution of Ayutla (1855-1856), was captured by the French and exiled to Europe in 1863, as a supporter of Lerdo and his secretary of foreign relations he opposed Díaz’ Plan of Tuxtepec in 1876 and was exiled to New York from 1877 until 1880. He returned to establish an opposition newspaper and became a senator from the state of Tabasco from 1880 to 1895. He eventually collaborated with his former political opponent by serving as Díaz’ Secretario de Gobernación for eleven years until his death (1 December 1884-3 October 1895). He was the father of Carmen Romero Rubio, the second wife of Porfirio Díaz, as well as the father-in-law of the prominent banker José de Teresa. He died on 3 October 1895. Manuel Romero Rubio was born on 7 March 1828 in Atzcapotzalco, Mexico City. He was a lawyer and politician holding various offices including deputy from Puebla (1856-1857, 1867-1868), governor of Mexico City (1857). He joined Juárez’ Liberals during the revolution of Ayutla (1855-1856), was captured by the French and exiled to Europe in 1863, as a supporter of Lerdo and his secretary of foreign relations he opposed Díaz’ Plan of Tuxtepec in 1876 and was exiled to New York from 1877 until 1880. He returned to establish an opposition newspaper and became a senator from the state of Tabasco from 1880 to 1895. He eventually collaborated with his former political opponent by serving as Díaz’ Secretario de Gobernación for eleven years until his death (1 December 1884-3 October 1895). He was the father of Carmen Romero Rubio, the second wife of Porfirio Díaz, as well as the father-in-law of the prominent banker José de Teresa. He died on 3 October 1895. |

1885 - 1890 |  |

Cástulo Zenteno was born in Matamoros, Tamaulipas on 22 May 1837. He owned the El Cristo coal mine in Tempoal, Veracruz, served as a special messenger for Porfirio Díaz in 1876 and attained the rank of colonel in 1878. As well as political offices (deputy for Yucatan (1876-1878), senator for Yucatan (1884-1888) and deputy from Yucatan (1896-1900)), he represented the Mexican government on the Oriental, Internation and Interoceanic Railroads (1881), and was chief tax collector for the Federal District (1884). Cástulo Zenteno was born in Matamoros, Tamaulipas on 22 May 1837. He owned the El Cristo coal mine in Tempoal, Veracruz, served as a special messenger for Porfirio Díaz in 1876 and attained the rank of colonel in 1878. As well as political offices (deputy for Yucatan (1876-1878), senator for Yucatan (1884-1888) and deputy from Yucatan (1896-1900)), he represented the Mexican government on the Oriental, Internation and Interoceanic Railroads (1881), and was chief tax collector for the Federal District (1884). |

1885 - 1890 |  |

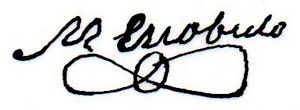

| M. Escobedo | 1896 - 1897 |  |

| Roberto Nuñez | 1896 - 1902 |  |

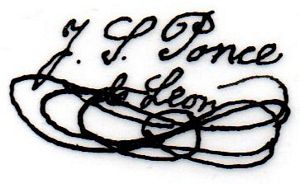

| Y. S. Ponce de León | 1901 |  |

| G. Baranda | 1901 - 1902 |  |

|

Alfredo Chavero was Interventor of the Banco de Londres y México in 1902, before serving here. |

1905 - 1906 |  |

| Francisco Rincón Gallardo y Doblado, from a wealthy Aguascalientes family, married Luz Díaz Ortega, and so was the son-in-law of President Porfirio Díaz. He was a minor shareholder in the Compañía Bancaria de Fomento y Bienes Raíces. | 1905 - 1911 |  |

|

Gabriel Mancera Mancera was President of Congress in 1904 and 1906. He was vice chairman of the Ferrocarriles Nacionales de México. |

1908 - 1911 |  |

|

In June 1898 he was appointed Director General of the Casa de Moneda (Mint).

He died in Mexico City in 1924. |

1912 - 1914 |  |

|

Bernabé L. de la Barra De la Barra lost his job in August 1912El Diario, 31 August 1912 because President Madero wanted to give it to Federico González Garza, who was complaining that he needed to complement his salary as governor of the Federal DistrictCEHM, Fondo CDLIV Colección José Y. Limantour, 2a 1910, carpeta 27 legajo 135 letter Hugo Scherer Jr. to Limantour, 30 August 1912. |

1911 -1912 |  |

|

Federico González Garza was born in Saltillo, Coahuila, on 7 March 1876, graduated with a law degree on 28 March 1906 and worked as an attorney. He met Francisco Madero while head of the San Pedro de Colonia telegraph office and was a cofounder of the Anti-Reelectionist party, editor of its newspaper, and president of the executive committee for Madero’s presidential campaign in 1910. He was provisional secretary general of the government of Coahuila in 1911, subsecretary of justice in 1911, subsecretary of government in 1911-1912, and governor of the Federal District in 1912-1913. His brother was Roque González Garza, the Convention president. He died in 1951. |

1912 |  |

| Fernando de Teresa was appointed interventor on 28 February 1913 to replace González GarzaEl País, 1 March 1913 but only lasted until April 1913. | 1913 |  |

|

Manuel Mondragón, hijo Mondragón signed the reports for May and June 1913. |

1913 |  |

|

Arturo de la Cueva De la Cueva signed the reports from July 1913. |

1913 - 1914 |  |

Cajero

| Cajero | date range | |

| Ramón Usandizaga | 1885 - 1896 |  |

|

Manuel Pereda Pereda was then a director of the bank, from 1901 until 1908. |

1897 - 1901 |  |

| Joaquin Salas A. | 1902 - 1910 |  |

|

Luis Uhink In June 1910 Luis Uhink was elected to the board of the Mexican Stock Exchange (Bolsa Mercantil de México)El Tiempo, Año XXVII, Núm. 8886, 17 June 1910. Uhink resigned as Cajero Principal at the beginning of 1916, with his resignation accepted at the board meeting of 25 January 1916AHBanamex, Libro de Actas no. 8. |

1911 - 1915 |  |

Miguel Salvador Macedo y Boubée was born in Mexico City on 17 May 1884 and was the nephew of Pablo Macedo.

Miguel Salvador Macedo y Boubée was born in Mexico City on 17 May 1884 and was the nephew of Pablo Macedo. Alfredo Chavero

Alfredo Chavero Leandro Fernández Imas was born in Nombre de Dios, Durango on 27 February 1851. He studied at the Escuela Nacional de Ingenieros, the Escuela Nacional De Comercio and the Conservatorio Nacional and had a distinguished career as an academic, engineer and architect.

Leandro Fernández Imas was born in Nombre de Dios, Durango on 27 February 1851. He studied at the Escuela Nacional de Ingenieros, the Escuela Nacional De Comercio and the Conservatorio Nacional and had a distinguished career as an academic, engineer and architect.