El Banco Mercantil Mexicano

The first Consejo de Administración of the Banco Mercantil Mexicano

Faced with the prerogatives granted to the Banco Nacional Mexicano a group of Spanish-born businessman who controlled much of the wholesale textiles, tobacco and grocery business in Mexico City, led by Manuel Ibañez, convened a meeting on 29 August 1881, to consider establishing a national bank that would compete with the Banco Nacional MexicanoThe founders also included several Barcelonnette merchants, such as Ebrard and Co. and Gassier, Reynaud and Co.. The ensuing bank was authorised[text needed] by federal charter on 3 December 1881 and began operations on 27 March 1882The Two Republics, 30 March 1882. In the first few days various people had changed sizeable sums of hard cash for banknotesLa Voz de México, 2 April 1882.

The members of the first board of directors were M. Ibañez, Manuel Romano, José V. Collado, José Gargollo, Pedro Martín, R. Ortiz de la Huerta, Antonio Escandón Estrada, Benito Arena, Juan J. Martínez Zorrilla, Genaro de la Fuente and Francisco M. Prida and the senior employees Ramon Usandiraga, Patricio Cárdenas and J. D. BousquetEl Foro, 28 March 1882.

The bank's notes, according to a newspaper report, were "regardless of the beauty and true art with which they are engraved, impossible to counterfeitEL Foro, 28 March 1882. The bank's notes were accepted in payment of federal taxes, in federal offices, and in payment of local taxes, in the states of Puebla, Oaxaca, Querétaro, San Luis Potosí, Veracruz, Guanajuato, México, Zacatecas and Durango, according to decrees of their legislatures.

It merged with the Banco Nacional Mexicano to become the Banco Nacional de México in 1884.

American Bank Note Company print runs

The American Bank Note Company produced the following notes.

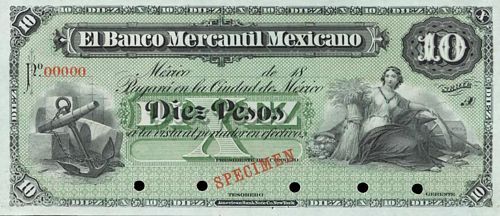

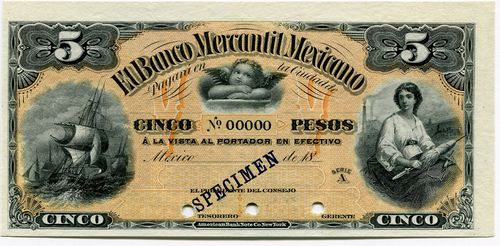

For the faces the ABNC used stock images, either of their own of from the National Bank Note Company. The $1 note had ‘Commerce’ (NBNC #1114) on the left and ABNC portrait #441 on the right. The $5 note had ABNC #868 on the left, a putto taken from Rafael's Madonna (ABNC #814) in the centre and NBNC ‘Industry’ on the right. The $10 note had (Old Firm #2371) on the left and ABNC #323 on the right. The $20 note had a vignette of a shepherdess (C-17), previously used by the National Bank Note Company for the 25c note of the Chihuahuan Banco Mejicano, on the left and 'Navigation' (ABNC #349), also used on the $50 Banco Yucateco, on the right. The $50 note had ABNC #226 on the left, ABNC #759 in the centre and ABNC #86 on the right. The $100 note had NBNC ‘L’Orient’ on the left and NBNC ‘Trade’, also used on the 25c Banco Minero note, on the right. The $500 note had NBNC ‘La Hija de las Incas’ on the left (for the history of this vignette, see here) and NBNC ‘Manufactures’ on the right. Finally, the $1,000 note had CBNC #250 (218) on the left, NBNC ‘Virgin del Sol’ in the centre and CBNC #269 (266) on the right.

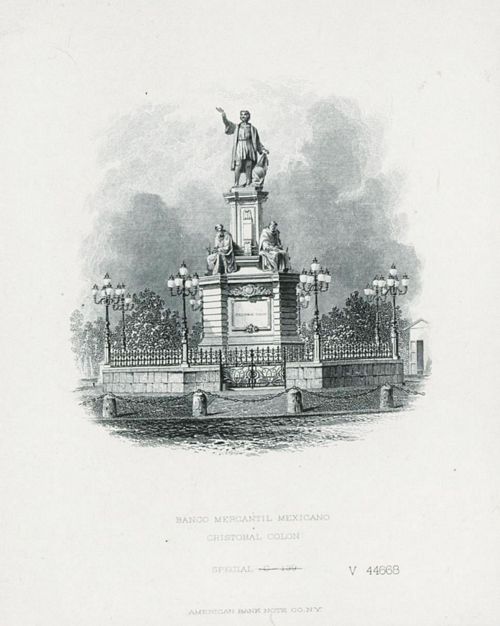

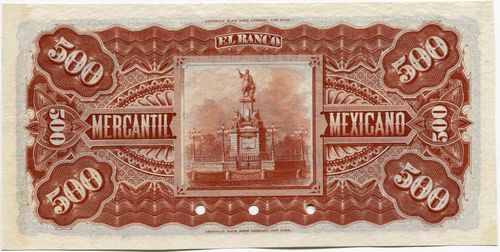

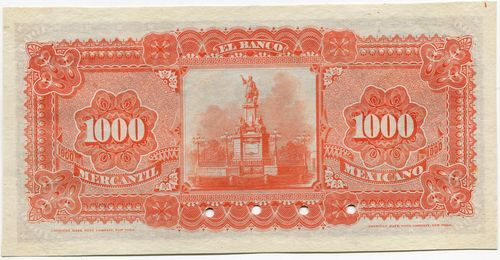

For the reverse, the $1 had a vignette of a peso, whilst for the other values the ABNC produced a special vignette of a 14 metre statue of Christopher Columbus (C 139) that stands in the Paseo de la Reforma.

This was modelled in Paris by the sculptor Charles Cordier, given to Mexico by the businessman Antonio Escandón and inaugurated on 21 August 1877. On its plinth are sculpted, in relief, the Convent of La Rabida, scenes of Columbus' landing in the first discovered lands, one of his letters to Queen Isabella and the Admiral's coat of arms. He is accompanied, at a lower height, by four statues, each of three metres, representing Fray Juan Pérez, Fray Bartolomé de las Casas, Fray Bernando Boil and Bishop Diego Deza.

The first issue was ordered on 17 November 1881.

M282s $1 Banco Mercantil Mexicano specimen

M282s $1 Banco Mercantil Mexicano specimen

M283s $5 Banco Mercantil Mexicano specimen

M283s $5 Banco Mercantil Mexicano specimen

M284s $10 Banco Mercantil Mexicano specimen

M284s $10 Banco Mercantil Mexicano specimen

M285s $20 Banco Mercantil Mexicano specimen

M285s $20 Banco Mercantil Mexicano specimen

M287s $100 Banco Mercantil Mexicano specimen

M287s $100 Banco Mercantil Mexicano specimen

M288s $500 Banco Mercantil Mexicano specimen

M288s $500 Banco Mercantil Mexicano specimen

M289s $1,000 Banco Mercantil Mexicano specimen

M289s $1,000 Banco Mercantil Mexicano specimen

| Date | Value | Number | Series | from | to | Comment |

| November 1881 | $1 | 10,000 | A | 1 | 10000 | with 'pagará en la Ciudad de México' |

| $5 | 100,000 | A | 1 | 100000 | ||

| $10 | 100,000 | A | 1 | 100000 | ||

| $20 | 75,000 | A | 1 | 75000 | ||

| $50 | 35,000 | A | 1 | 35000 | ||

| $100 | 30,000 | A | 1 | 30000 | ||

| $500 | 3,000 | A | 1 | 3000 | ||

| $1000 | 2,740 | A | 1 | 2740 |

The 1881 print states 'pagará en la Ciudad de México' but this was changed in an order dated 27 February 1882 to 'pagará en la Ciudad de _______' so that the notes could be issued by the branches.

M282s $1 Banco Mercantil Mexicano specimen

M282s $1 Banco Mercantil Mexicano specimen

M283s $5 Banco Mercantil Mexicano specimen

M283s $5 Banco Mercantil Mexicano specimen

M284s $10 Banco Mercantil Mexicano specimen

M284s $10 Banco Mercantil Mexicano specimen

M285s $20 Banco Mercantil Mexicano specimen

M285s $20 Banco Mercantil Mexicano specimen

M286s $50 Banco Mercantil Mexicano specimen

M286s $50 Banco Mercantil Mexicano specimen

M287s $100 Banco Mercantil Mexicano specimen

M287s $100 Banco Mercantil Mexicano specimen

| Date | Value | Number | Series | from | to | Comment |

| February 1882 | $5 | 30,000 | A | 100001 | 130000 | with 'pagará en la Ciudad de ______' |

| $10 | 30,000 | A | 100001 | 130000 | ||

| $20 | 25,000 | A | 75001 | 100000 | ||

| $50 | 11,000 | A | 35001 | 46000 | ||

| $100 | 10,000 | A | 30001 | 40000 | ||

| $500 | 1,000 | A | 3001 | 4000 |

On 5 June 1882 the bank made a further order of $1 notes.

| Date | Value | Number | Series | from | to | Comment |

| June 1882 | $1 | 25,000 | A | 10001 | 35000 | with 'pagará en la Ciudad de México' |

| $1 | 75,000 | A | 35001 | 110000 | with 'pagará en la Ciudad de ______' |

The ABNC reprinted one $1,000 note (A 1501) in April 1882 to replace a missing banknote at the bank's request. The original was then presented, untrimmed and with forged signatures, to the bank and the person arrested. It was thought to have been stolen in the Veracruz Customs HouseABNC letter F. G. Mead, agent, Mexico City to ABNC, 12 May 1884.

The ABNC records state that 12,500 $1 notes were printed in June 1882 for the branches, which implies numbers 35001 to 47500, as stated in Ricardo M. Magan's Latin American Bank Note Records. However, the next page in the ABNC file recording actual numbers on notes lists 35001 to 110,000, hence 75,000 notes. The existence of notes numbered above 47500 suggests the latter is correct.

The platesThe plates were: “For Parent Bank” (i.e. engraved “en la Ciudad de México”)

1-6 on $1 face plate

1-6 on $1 tint plate

1-6 on $1 back plate

2-6 on $5 face plates Nos. 1 & 2

1-6 on $5 tint plate

1-6 on $5 back plate

1-4 on $10 face plate

1-4 on $10 tint plate

1-4 on $10 back plate

1-4 on $20 face plate

1-4 on $20 tint plate

1-4 on $20 back plate

1-4 on $50 face plate

1-4 on $50 tint plate

1-4 on $50 back plate

1-4 on $100 face plate

1-4 on $100 tint plate

1-4 on $100 back plate

1-1 on $500 face plate

1-1 on $500 tint plate

1-1 on $500 back plate

1-1 on $1,000 face plate

1-1 on $1,000 tint plate

1-1 on $1,000 back plate

all made on order of 17 November 1881.

and “For branches” (i.e. engraved “en la Ciudad de _____”)

1-6 on $5 face plate

1-4 on $10 face plate

1-4 on $20 face plate

1-4 on $50 face plate

1-4 on $100 face plate

1-1 on $500 face plate

all made on order of 27 February 1882, and

1-6 on $1 face plate made on order 5 June 1882 used in printing these notes were kept in the ABNC plate vault until 1932, when with the approval of its successor, the Banco Nacional de México, they were destroyed on 9 May 1932ABNC. folder 158, Banco Nacional de México (1920-1933).

Signatures

Presidente de Consejo

| José Gargollo was a Spaniard, a director of Diligencias Generales and member of the Convención Española. |  |

| Juan José Martínez Zorrilla was vicepresident of the Compañía Transatlántica MexicanaEl Siglo Diez y Nueve, Año XLIII, Tomo 85, Núm. 13817. |  |

| Bénito Arena Bermejillo was a Spaniard, born in 1841. He owned the Hacienda de San Juan de Dios, near to Tlalpán, just south of Mexico City, with a herd of more than 600 Swiss and Dutch dairy cattle. |  |

| Manuel Romano | |

|

Genaro de la Fuente was director of the Negociación Minera de Sauceda in Zacatecas La Iberia, 17 April 1874. |

Tesorero

| Ramón Usandizaga |  |

Gerente

José V. del Collado was born in Santander, Spain on 14 February 1831. As a young man he went to Mexico with his wife and two sons. He was a shareholder and manager of the Casa de Diligencias, then Director of the Banco Mercantil Mexicano, and finally director of the Banco Nacional de México for eleven years. He then was involved in various businesses, principally in agriculture. As well as a consejero of the Banco Nacional de México, he was a consejero of Buen Tono, the Compañía de Seguros “La Mexicana”, of the Banco Hipotecario and of various mining companies. As a philanthropist Collado was a founder of the Asilo de Mendigos in 1879, was an active member of the Conferencia de San Vicente de Paul and various Catholic societies and was president of the Casino Española and the Beneficencia Española. Apparently he was probably the only landlord in Mexico City who never raised his rents. He became ill in January 1901 and died of pneumonia on 21 November 1901Semanario Literario Ilustrado de “El Tiempo”, Tomo I, Núm. 49, 2 December 1901. |

|

Branches

The bank opened branches in various states, having made agreements that gave it favourable tax treatment and regulated the use of its notes within the state. These notes had the name of the branch handwritten in and also had a more visible overprint.

Chihuahua

On 31 July 1882 José María SánchezBorn in Coahuila in 1850, Sánchez moved to Monterrey and became an employee of the business house of González Treviño y Compañía. When the brothers set up in Chihuahua in 1873 Sánchez moved with them though later he established his own business, selling clothes, groceries, glassware, crockery and spirits. When Terrazas took over the governorship in 1903, Sánchez became Treasurer General (Tesorero General) and later was substitute governor for Enrique Creel on various occasions. When the Maderista revolt broke out in 1910, President Díaz felt that it would be better if the governorship was in the hands of a Terrazas and Sánchez renounced in favour of Alberto Terrazas. He died in 1940. (representing the shareholders José and Jesús González Treviño) and Félix Francisco Maceyra, representing the Banco Mercantil Mexicano, were given permission to establish one or more branches and agencies of the bank within the state of Chihuahua. The branches' notes would be voluntarily accepted in all the state's offices, and by the public, for their face value in hard cash or with an 8% discount on the legal tender in use in the state (en pesos fuertes á la par ó con el 8 p% de cambio sobre la moneda legal que circule en el Estado)Periódico Oficial, 5 August 1882. The bank was given six months in which to establish at least one branch: otherwise the concession would lapse, which seems to have happened.

Durango

The state executive agreed a contract with Toribio Bracho, representing the bank, on 31 March 1882 La Voz de Mexico, 27 October 1882 and it was expected to open at the end of the yearEl Siglo Diez y Nueve, 30 October 1882.

Guanajuato

M285b $20 Banco Mercantil Mexicano overprinted 'GUANAJUATO'

M285b $20 Banco Mercantil Mexicano overprinted 'GUANAJUATO'

The state government agreed a contract with the bank on 10 February 1882El Siglo Diez y Nueve, 13 May 1882 and the branch opened on 1 November 1882. The Director was Esteban Quintanilla, and the consejo composed of Gregorio Jiménez, Eusebio González, Felipe Osante, Francisco de P. Castañeda and Pablo Orozco as vocales propietarios and Luis Goerne, Carlos Chico and Juan Caire as vocales suplentes.

León

In November 1881 it was reported that the bank would open a branch in LeónEl Siglo Diez y Nueve, 28 November 1881; El Diario del Hogar, 1 December 1881.

Mérida

On 2 August 1882, Francisco Ogarrio, representing the state of Yucatán, and José V. Collado, for the bank, agreed a contract to open a branch in Yucatán. The contract allowed the bank to issue banknotes which would be accepted as legal tender in all payments to the state and municipalities with the bank obliged to redeem them in cash at the bank’s branch. The contract was approved by the state’s Congress on 30 SeptemberEl Siglo Diez y Nueve, 25 October 1882; La Oposicion Radical, Año I, Tomo I, Núm. 98, 30 September 1882 but lapsed without a branch being established.

Puebla

The branch opened on 1 August 1882. The director was Mariano F. Pasquel, a member of an ancient and moneyed family with links to Veracruz and Mexico City, and the cajero J. M. Pérez DîazEl Foro, 3 August 1882. Tthe consejo wa composed of Vicente de la Hidalga, Manuel M. Conde, Leopoldo Gavito, Vicente Gutiérrez, Manuel Rueda, Joaquín G. Pacheco and Cristobal Couttolenc.

Querétaro

M283b $5 Banco Mercantil Mexicano overprinted 'QUERETARO'

M283b $5 Banco Mercantil Mexicano overprinted 'QUERETARO'

The branch opened on 15 August 1882 with Luis Rivera MacGregor in chargeEl Foro, 15 August 1882; La Sombra de Arteaga, Año XV, Núm. 22, 27 August 1882. The consejo was composed of Francisco de G. Cosío, Manuel María Rubio and Antonio Cayón as vocales propietarios and Ignacio G. Rebollo and Agustín Arnaud as vocales suplentes.

Saltillo

On 7 March 1882 the bank entered into a contract with the state of Coahuila to establish a branch in Saltillo and agencies in other towns. The government would accept the bank’s notes to the exclusion of any other bank which did not have branches and cashed its notes for hard currencyEl Siglo Diez y Nueve, 22 May 1882.

The branch opened on 8 October 1882.

San Luis Potosí

The project to establish a branch of Banco Mercantil Mexicano in San Luis Potosí had the support of the state governor, Pedro Díez Gutiérrez, who suggested it to the bank’s board of directors, through one of its members, on 22 May 1882AHBanamex, Banco Mercantil Mexicano, actas del Consejo de administración, 22 May 1882. The agreement was authorized by the local congress on 17 October 1882 and the contract for the concession celebrated between governor Pedro Díez Gutiérrez and Ramón C. Othón and Ignacio MurielASLP, Secretaría General de Gobierno, Colección Leyes y Decretos., 17 October 1882: La Unión Democrática, Periódico Oficial, Tomo VII, Núm. 524, 24 October 1882. Among the specifications it stipulated that if the state government decided to grant privileges to another bank they would be considered as granted as well to the Banco Mercantil Mexicano, its branches and agencies, "with the exception of the one granted to the Banco Nacional Mexicano in relation to the banknotes of its branches being the only ones which are forcibly admitted to the offices of the State according to the decree of 5 January 1882". The branches or agencies that the Banco Mercantil Mexicano established in the state could put into circulation the banknotes that the head office sent them with the obligation to pay them on presentation in the office of the agencies or branches from where they came. The bank had to establish a branch or agency in the state within six months or the contract would be null and void. ASLP, Secretaría General de Gobierno, Colección Leyes y Decretos., 4 October 1882.

The branch was established at 1a calle de la Catedral 4El Estandarte, 2 August 1885. Eduardo C. Pitman was appointed director of the branch on a salary of $6,000 per yearAHBanamex, Banco Mercantil Mexicano, actas del Consejo de administración, 6 October 1882 and the branch opened at the end of November 1882AHBanamex, Banco Mercantil Mexicano, actas del Consejo de administración, 4 December 1882. The first consejo de administración consisted of Eduardo C. Pitman, Matías Hernández Soberón, Felipe Muriedas, José Encarnación Ipiña and Santiago WastallPeriódico Oficial, San Luis Potosí, 27 November 1882. An alternative source has Matias Hernández Soto (sic), Ramón C. Othon and Ignacio Muriel as vocales propietarios and Atanasio Hernández and Enrique Ocharen as vocales suplentes.. Pitman continued managing the branch after the fusion to form the Banco Nacional de México.

Tampico

In July 1882 the state government authorised the bank to set up a branches in Tampico and elsewhereLa Patria, 26 July 1882.

Veracruz

M282c $1 Banco Mercantil Mexicano overprinted 'PAGADERO EN LA SUCURSAL DE VERACRUZ'

M282c $1 Banco Mercantil Mexicano overprinted 'PAGADERO EN LA SUCURSAL DE VERACRUZ'

The branch opened on 20 May 1882 with Angel F. Grinda as director and Ramón Herrera as cajeroEl Foro, 24 May 1882. The consejo was composed of Francisco J. Muñoz, Claudio A. Martínez, Adolfo Hollscher, Demetrio Fagoaga, Francisco L. Negrete, Francisco Ituarte and Gaspar Sainz Calleja as vocales propietarios and Enrique Lombard, Juan Ritter and Pedro J. Méndez as vocales suplentes.

Zacatecas

In August 1882 the firm of Kimball y Albordi y sócios applied to establish a branch of the bank in ZacatecasLa Voz de Mexico, 3 August 1882. The following month the state Congress authorised a branch for a period of 25 years. In turn the bank would facilitate business transactions and grant a credit line to the state government[text needed]Periódico Oficial del Estado de Zacatecas, 16 September 1882.

The representatives nominated for the branch were Julián Ibargüengoitia, Ramón C. Ortiz and Antonio Gómez Castellanos, all shareholders. The branch had not opened by February 1883 as on 3 February governor Jesús Aréchiga extended the time-limit within which the branch should open by another six months.