El Banco Mercantil de Veracruz

The interest of the Veracruz elite in the banking system was manifested by several of them acquiring shares in the Banco Nacional Mexicano in 1882. After the merger of the Banco Nacional de México in 1884 it maintained a branch and various agencies in the state, competing at this time with just the Banco de Londres y México.

After the passing of the Ley General de Instituciones de Crédito on 19 March 1897 Zaldo Hermanos y CompañíaZaldo Hermanos y Compañía was founded in 1857 by the Spaniard Bruno Zaldo. a brilliant merchant with a creative entrepreneurial mentality. It grew to invest in several areas of commerce and expanded to other cities in Puebla, and to Oaxaca and Tabasco. In the port of Veracruz it was an importer and exporter, and owned a store famous for its English and French finos casimires and telas for women, imported from Europe and the United States.

In the the national banking sector it was a founder of the Banco Mercantil de Veracruz (directly controlling 81.2% of the initial stock), and shareholder in the Banco Nacional de México and the Banco de Londres y México. It also had shares of the Banco Mercantil Mexicano, Banco Oriental de México, S.A., in the Almacenes Generales de Depósito de Veracruz y México, as well as in the Banco de Tabasco.

In the textile sector it owned Fábrica de Hilados y Tejidos de Algodón San Bruno in Xalapa and La Purísima in Coatepec.

It owned the sugar hacienda de San José de Abajo in Córdoba. It also owned a coffee mill with which it processed the coffee beans that he acquired from individual producers and then marketed the coffee on the international market.

Among their other interests, the Zaldos financed La Tabacelera Mexicana, Mexico's second largest cigarette manufacturer. The Tabacelera was a partnership formed in 1899 by the Zaldos, Antonio Basagoiti, the firms of Solana Barreneche y Compañía and Martínez y Compañía. The Tabacelera controlled approximately twelve per cent of Mexico's cigarette market.

The company ran steamships and was a shareholder of the shipping company Pinillos Izquierdo y Compañía with branches in Cádiz and Barcelona.

At the beginning of 20th century the company was run by Román Zaldo, founding member of Cámara Nacional de Comercio. , Palomo y Compañía and José Breier, all members of the Veracruz elite, asked for authorisation to establish a bank of issue in Veracruz, and this was granted on 18 October. In fact the first subscription for shares was so successful that the bank asked to double its share capital to two million pesosThe first board was composed of Anselmo Román Zaldo as president; Antonio Palomo as vicepresident with Primer Vocal Secretario Jacinto Villacieros Benito; Segundo Vocal Propietario Esteban J. Pous; Primer Vocal Suplente Antonio G. Presno; Segundo Vocal Suplente E. Speckter; Tercer Vocal Suplente C. Pardo y Sáinz; Cuarto Vocal Suplente Laureano Alvarez; Comisionario Propietario Saturnino Ulibarri and Comisionario Suplente Manuel Gómez O..

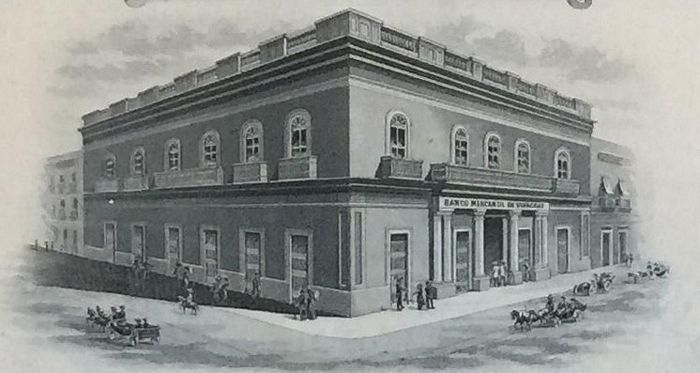

The bank opened on 1 March 1898La Patria, México, 3 March 1898. It opened to the public on 15 March according to report of interventor Mirón y Mosquera, 9 July 1898 in Memorias de las Instituciones de Crédito correspondientes a los años 1897-1898-1899, tomo I in a purpose-built building on calle Cinco de Mayo and calle ZamoraSemana Mercantil, 10 January 1898.

The first meeting of shareholders of the bank was held on 15 December 1897, and they asked that a special note (billete) be made for the bank’s promoter, Anselmo R, Zaldo, and that his portrait be hung in the bankLa Época, Veracruz, Tomo II, Núm. 314, 19 December 1897.

On 25 March 1898 the bank wrote to Secretario de Hacienda, Jose Y. Limantour, complaining about the actions of the Banco Nacional de México. All of commerce, the Banco de Londres y México, and federal and state offices were willing to take Banco Mercantil de Veracruz notes, but the Banco Nacional de México was refusing to accept them, even though it could immediately exchange any notes for hard cash in the Banco Mercantil’s office. This was bound to cause problems: businesses needed to pay customs dues or taxes, and having taken Banco Mercantil notes they would not be able to use them to pay their own dues. The Customs and federal offices paid their receipts into the Banco Nacional de México, so if the latter refused to accept them, this would cause a chain reactionCEHM, Fondo CDLIV Colección José Y. Limantour, 1a. 1883, carpeta 27, legajo 7148. The competition between the two national banks (the Banco de Londres y México and Banco Nacional de México) and the Banco Mercantil de Veracruz was open and reciprocal so that in 1899 the first two ordered their branches and agencies not to accept the Banco Mercantil de Veracruz’s notes because “they would not be accepted in the offices of the Aduana Marítima or Administración Principal del Timbre’. After an agreement the notes were accepted but the competition to serve Veracruz’ financial needs continued.

The bank originally suffered from the fact that use of its notes, unlike those of the Banco Nacional de México, were limited to within the state but in 1904 the bank signed an agreement with the government of Veracruz by which it provided banking functions to the government which in turn gave it privileges and accepted its note in all its offices.

The bank’s growth was slow and it was seven years before the bank opened branches in the central region. The branch in Xalapa was opened on 15 April 1904 on the groundfloor of calle de Enríquez 3 with Manuel López NegreteEl Correo Español, 4 April 1904: El Orden, núm. 37, 11 September 1904. Manuel López Negrete, from Burgos, Spain, arrived in Xalapa in 1900 and served as manager of the branch, apoderado of the Compañía Bancaria de Obras y Bienes Raíces and vice-consul of Spain. For a history of this branch see César Augusto Ordóñez López, La sucursal del Banco Mercantil de Veracruz en Xalapa, 1904-1910, Instituto Veracruzano de Cultura, 2005 as manager and Celestino Chamarrocame from Soria, Spain and set up in business in Xalapa in 1891 as consultor. The branch had a capital of $100,000, represented by $200,000 in notes (250 of $100, 1,250 of $20, 10,000 of $10 and 10,000 of $5source? But there were only 1,000 of $20 and also 400 of $50).

Other branches were opened in Orizaba on 1 July 1904Pedro Armada was appointed manager (gerente} and Rafael Tirado contador (ABNC, folder 196, Banco Mercantil de Veracruz (1904-1932), San Andrés Tuxtla on 1 September 1905 Pedro Ramos y Elias was appointed manager and Antonio Solana consultor (ABNC, folder 196, Banco Mercantil de Veracruz (1904-1932): report of interventor, 16 January 1906 in Memoria de las Instituciones de Crédito correspondiente a los años de 1904-1906, vol. I, tomo 2.) Braulio Chamarro, from Velilla de Medina, Spain, came to Xalapa in 1901, and ran the La Castellana business, owned by Celestino Chamarro. In 1909 he became the manager of the branch in San Andrés Tuxtla and Córdoba on 20 May 1908In 1908 the bank agreed that Castro J. Oropesa should prepare the necessary documentation and other details for the opening of a branch in Córdoba. It appointed the Spaniard Leonardo Penagos as consultor propietario (Penagos owned a grocery warehouse, dealt in fruits and vegetables, served as an exporter as the main shareholder of the Emporio del Café S. A. and owned the hacienda Venta Parada in Amatlán), Manuel Unanue as consultor suplente, Antonio Carlín as manager, Castro Oropesa as accountant and Alejandro Frasser as subcajero. and agencies in Puerto México (now Coatzacoalcos) in April 1906the firm of José Peña Sucs. was manager and Pedro Ruiz the consultor (ABNC, folder 196, Banco Mercantil de Veracruz (1904-1932)) and Túxpan at the beginning of June 1910 Luis Montoto Carai was consultor propietario, Manuel Pérez Morales consultator suplente, and Santiago Mota, gerente (ABNC, folder 196, Banco Mercantil de Veracruz (1904-1932)).

In the face of the 1907 banking crisis the Banco Mercantil was cautious and reduced its issue of banknotes and credit. During the period 1908-1915 the bank survived but not without difficulty and the expansion was slowed and several branches and agencies even closed. Despite this it maintained profitability until the revolution. On 31 January 1916 the Comisión Reguladora y Inspectora de Instituciones de Crédito found that the bank conformed with the law and reasserted its concession.

In 1918 the bank closed its branch in San Andrés Tuxtla and its agencies in Túxpan and Puerto México and in 1921 closed its branches in Xalapa and Córdoba.

Following Obregón’s decree of 31 January 1921 and an examination of the bank’s books and records, on 28 March 1921 the Secretaría de Hacienda authorized the reopening for businessEl Paso Herald, 11 April 1921. The bank finally went into liquidation in 1930.

American Bank Note Company print runs

The American Bank Note Company produced the following notes. The company engraved a view of Veracruz (C 651) for all the backs and a vignette of a group of Mexican cavalry (C 662).

M528s $5 Banco Mercantil de Veracruz specimen

M528s $5 Banco Mercantil de Veracruz specimen

M529s $10 Banco Mercantil de Veracruz specimen

M529s $10 Banco Mercantil de Veracruz specimen

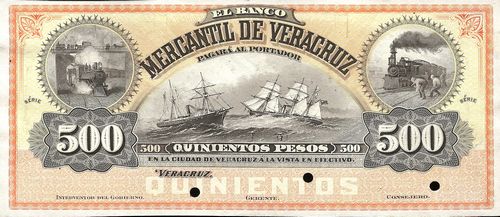

M534s $500 Banco Mercantil de Veracruz specimen

M534s $500 Banco Mercantil de Veracruz specimen

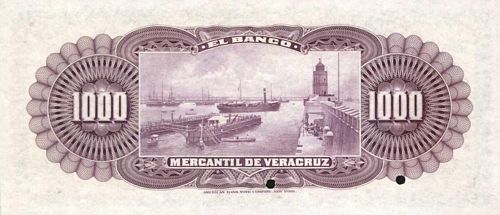

M535s $1,000 Banco Mercantil de Veracruz specimen

M535s $1,000 Banco Mercantil de Veracruz specimen

| Date | Value | Number | Series | from | to |

| November 1897 | $5 | 80,000 | 1 | 80000 | |

| $10 | 40,000 | 1 | 40000 | ||

| $20 | 20,000 | 1 | 20000 | ||

| $50 |

12,000 | 1 | 12000 | ||

| $100 |

6,000 | 1 | 6000 | ||

| $500 | 800 | 1 | 800 | ||

| $1000 | 200 | 1 | 200 |

| Date | Value | Number | Series | from | to |

| November 1898 | $5 | 54,000 | 80001 | 134000 | |

| $10 | 27,000 | 40001 | 67000 | ||

| $20 | 13,000 | 20001 | 33000 | ||

| $50 |

8,000 | 12001 | 20000 | ||

| $100 |

4,000 | 6001 | 10000 | ||

| $500 | 500 | 801 | 1300 | ||

| $1000 | 150 | 201 | 350 |

On 19 September 1910 the bank sent one of these $20 notes (32238) which seemed different from the others and made them question its genuineness. One factor was “the colour of the Government seal on the back of the note, which is violet (morado), while on the others issued with the same date, 8 February 1905, it is red (rojo); another … is the colour and design of the background on the face of the note. As for the rest of the note, it has every appearance of genuineness – not only with respect to the engraving, but also in its countersigns and signatures”. The ABNC replied that the note was undoubtedly genuine, with the change of colour in the tint being caused by perspiration or some other exterior action with which the note has come into contact.

By August 1901 counterfeits $10 notes had begun to appear and so in February 1903 the ABNC produced a new $10 note, engraving a portrait of Miguel Lerdo de Tejada (C 261).

M530s $10 Banco Mercantil de Veracruz specimen

M530s $10 Banco Mercantil de Veracruz specimen

| Date | Value | Number | Series | from | to |

| February 1903 | $10 | 80,000 | 1 | 80000 |

On 13 February 1904 the bank asked for price and delivery for 60,000 $5 notes, and on 23 February placed the orderABNC, folder 196, Banco Mercantil de Veracruz (1904-1932).

| Date | Value | Number | Series | from | to |

| February 1904 | $5 | 60,000 | 134001 | 194000 |

On 13 July 1905 the bank placed an order for 76,000 $5 and 50,000 $10”in accordance with model approved in our letter of 9 April 1903” (ABNC, folder 196, Banco Mercantil de Veracruz (1904-1932).

| Date | Value | Number | Series | from | to |

| July 1905 | $5 | 76,000 | 194000 | 270000 | |

| $10 | 50,000 | 80001 | 130000 |

On 1 September 1905 the ABNC forwarded, by Adams Express (via Laredo) to the Banco Central Mexicano, Mexico City, one box containing 1,000 sheets of 6 $5 notes (194001-200000) and 1,500 sheets of 4 $10 (80001-86000). On 16 September it completed the order by shipping three boxes containing 11,666⅔ sheets of 6 $5 (200001-270000) and 11,000 sheets of 4 $10 (86001-130000).

On 17 January 1914 Charles Blackmore, the Resident Agent in Mexico City, asked New York for a price and delivery on 310,500 notes. On 21 January New York apologised for a delay in replying “but as these plates are very old and we did not have impressions of them at hand, we had to stay and get them out to pull impressions before we could give you any sort of promise. Finding they were not in as good shape as we had hoped, again delayed us, for we had to figure on making new plates, and this is the main reason for our not being able to give you better promises on the $5, $10 and $100 notes. The only plate we are able to use is that of the $1000.” Assuming that Blackmore would get the order, they had “taken upon ourselves to start work, knowing that we will hear in a day or so at the latest. We have made a considerable reduction in our price for this order, due to the fact that one or two of the denominations are being ordered in such larger quantities. This should help materially in securing this order, even though our promise of delivery may not be as good as they think we should make.” On 22 January the bank gave a formal order, accepting Blackmore’s conditions for delivery, F.O.B. New York, as 2½ weeks from receipt of order for the $1,000, 4½ weeks for the $100 and six weeks for the $5 and $10.

| Date | Value | Number | Series | from | to |

| January 1914 |

$5 | 200,000 | 270000 | 470000 | |

| $10 | 100,000 | 130001 | 230000 | ||

| $100 | 10,000 | 10001 | 20000 | ||

| $1000 | 500 | 351 | 850 |

On 11 February the ABNC sent by registered mail, per the S S. “Mexico”, a package containing the 500 $1,000 notes (351-850). On 28 February it sent five packages containing 5,000 $100 (10001-15000), received by 26 March, and on 5 March, per the steamer “Esperanza”, the remaining 5,000 $100 (15001-20000). The next week, on 12 March it sent, per the S. S. “Mexico”, 32,000 $10 (130001-162000), received by 7 April, and then, on 19 March, per the steamer “Monterey”, 96,000 $5 (270001-366000) and 48,000 $10 (162001-210000). Finally, it completed the order by shipping on 26 March, on the steamer “Morro Castle”, 20,000 $10 (210001-231000) and 104,000 $5 (366001-470000).

The plates used in printing the notes were cancelled on 14 and 15 October 1931 (order F 9472)The plates were:

4 – 6 on $5 face plates Nos. 1 to 4 made on order 11/8/97

2 – 8 on $5 face plates Nos. A5 & A6 made on order F 4052

4 – 6 on $5 back plates Nos. 1 to 4 made on order 11/8/97

2 – 8 on $5 back plates Nos. A5 & A6 made on order F 4052

2 – 1 on $5 tints Nos. 1 & 2 for litho transfer made on order 11/8/97

4 – 4 on $10 face plates Nos. 1 to 4 made on order 11/8/97

2 – 4 on $10 face plates Nos. 1 & 2 made on order F 173

2 – 8 on $10 face plates Nos. A5 & A6 made on order F 4052

4 – 4 on $10 back plates Nos. 1 to 4 made on order 11/8/97

2 – 4 on $10 back plates Nos. 1 & 2 made on order F 173

2 – 8 on $10 back plates Nos. A3 & A4 made on order F 4052

2 – 1 on $10 tints Nos. 1 & 2 for litho transfer made on order 11/8/97

1 – 1 on $10 tint No. 2 for litho transfer made on order F 173

1 – 4 on $20 face plate made on order 11/8/97

1 – 4 on $20 back plate made on order 11/8/97

1 – 1 on $20 tint for litho transfer made on 11/8/97 (No.1)

1 – 4 on $20 steel tint plate made on order 11/8/97 (No.2)

1 – 2 on $50 face plate made on order 11/8/97

1 – 2 on $50 back plate made on order 11/8/97

1 – 1 on $50 tint No. 1 for litho transfer made on 11/8/97

1 – 2 on $50 steel tint No. 2, plate made on order 11/8/97

1 – 4 on $100 face plate made on order F 4052

1 – 4 on $100 back plate made on order F 4052

1 – 1 on $100 tint No. 1, for litho transfer, made on 11/8/97

1 – 4 on $100 tint No. 2, steel plate made on order F 4052

1 – 1 on $500 face plate made on order 11/8/97

1 – 1 on $500 back plate made on order 11/8/97

1 – 1 on $500 tint No. 1, for litho, made on 11/8/97

1 – 1 on $500 tint No. 2 for steel, made on order 11/8/97

1 – 1 on $1,000 face plate made on order 11/8/97

1 – 1 on $1,000 back plate made on order 11/8/97

2 – 1 on $1,000 tints No. 1 & 2 for litho transfer made on 11/8/97.