The crisis of 1935

A small group of low-value notes bears testimony to a period in Mexico’s history when it was confronted by a shortage of coins and the consequent effect on daily business. The United States passed its American Silver Purchase Act on 19 June 1934: this caused the price of silver to increase and as a result, in Mexico, silver coins began to be hoarded to be remelted at a profit.

On 25 April 1935 the Mexican government reacted with a series of reforms, changing the fineness of its coinage, and withdrawing silver coins from circulation. It had ordered 50c coins (tostones) and $1 Banco de México notes from the United States but until these arrived the sudden shortage of small change led many commercial organisations, particularly Chambers of Commerce, to agree with the local banks to issue scrip in the form of bearer cheques (cheques al portador).

On 3 May it was reported that the Lotería Nacional was proposing to issue $200,000 in letras de cambio for $1 and $2, payable in the $1 Banco de México notes when they arrivedEl Informador, Año XVIII, Tomo LXVII, Núm. 6357, 4 May 1935 but it seem that this idea was overtaken by the one for cheques.

On 4 May, the Secretaría de Hacienda issued a notice that vales or cheques issued to overcome a shortage of change would only be valid when issued ‘to the bearer’ by firms that had current accounts with the banks. In addition, their acceptance was entirely voluntaryEl Dictamen, 5 May 1935.

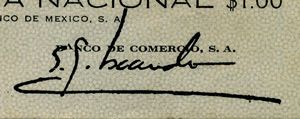

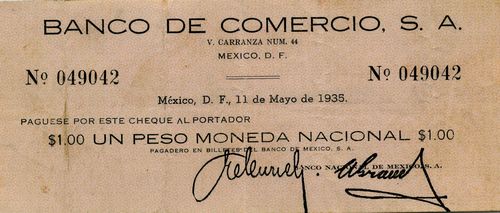

In Mexico City on 6 May a group of bankers agreed with the Secretaría de Hacienda to issue $500,000 in one and two pesos chequesLa Opinión, Puebla, Año XI, Tomo XVII, Núm. 4005, 7 May 1935; El Informador, Año XVIII, Tomo LXVII, Núm. 6360, 7 May 1935. Three banks, the Banco Capitalizador de Ahorros, the Banco de Comercio and the Banco Nacional de México issued cheques to a common design. The first tranche of $500,000 in $1 cheques of the Banco Nacional de México and Banco de Comercio were ready by 8 MayEl Siglo de Torreón, 8 May 1935.

On 7 May the Dirección General de Crédito of the Secretaría de Hacienda y Crédito Público issued its circular núm. 35-9-81, which contained the Secretaría’s instructions for the acceptance of the $1 notes issued by private institutions.

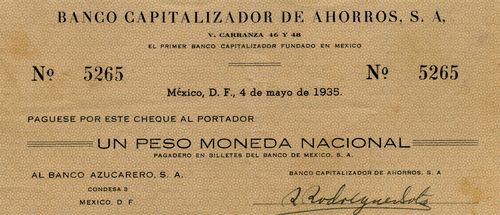

El Banco Capitalizador de Ahorros

These are two different type of $1 cheques drawn by the bankthe Banco Capitalizador de Ahorros was founded in 1933 on the Banco Azucarero, S. A.El Banco Azucarero (later called el Banco de Comercio e Industria) was founded by Aarón Sáenz Garza on 25 January 1932 with the object of specialising in investments in the sugar industry. Sáenz was a classic example of how the Mexican government of this era appeased and controlled military men by providing them with financial dispensations and channelling their political ambitions into business activities. At 26 he had been the head of General Álvaro Obregón’s presidential guard, the Estado Mayor Presidencial, and he maintained a close friendship with the President; in 1924, Obregón appointed him Minister for Foreign Relations; from 1927 to 1930, he was governor of his home state, Nuevo León, and he was Minister for Industry and Trade from 1930 to 1931. Sáenz then went from his role in the military and in the government to being a businessman. He established a construction firm (in association with President Calles) which benefited from government contracts. He and Calles were also associated in the construction of a major sugar refinery at El Mante, in the state of Tamaulipas. Sáenz, Calles and other government officials obtained the lands after a dam and irrigation system had been constructed at government expense, and a modern sugar refinery was built with the assistance of a substantial loan from the Banco de México. So Sáenz became a sugar magnate, on the strength of the political connections he had acquired during the Revolution and then in the public offices he held.

Sáenz was one of the main founding partners of Banco Internacional, together with Montes de Oca..

Type 1

| from | to | total number |

total value |

||

| $1 | includes number 74069 |

This is presumably the first issue, as the second bears a common format with the cheques of the Banco de Comercio and Banco Nacional de México. This has the signatures of [ ][identification needed] and [ ][identification needed].

Type 2

| from | to | total number |

total value |

||

| $1 | includes number 5265CNBanxico #10823 |

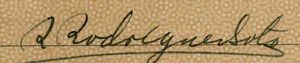

This has the signature of [ ] Rodríguez Soto whilst the second has the signatures of [ ][identification needed] and [ ][identification needed].

| [ ] Rodríguez Soto |  |

In Puebla the Banco Mercantil de Puebla, Banco Nacional de México, and Azúcar, S.A. as well as the local branch of the Banco Capitalizador put out a notice that they would accept these chequesLa Opinión, Puebla, Año XI, Tomo XVII, Núm. 4032, 3 June 1935.

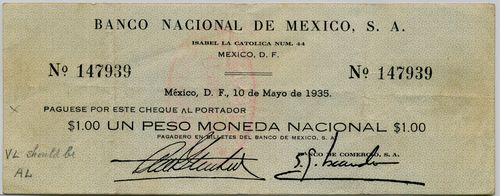

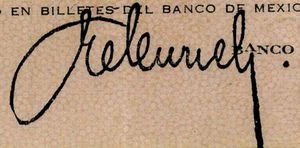

El Banco de Comercio

| from | to | total number |

total value |

||

| $1 | includes number 147939CNBanxico #10825 |

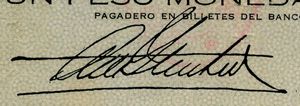

This is a cheque drawn by the Banco de Comercio, S. A.The origins of the Banco de Comercio date from 1932, when Salvador Ugarte, a banking executive from a middle-class provincial family, recruited several wealthy partners to found a bank in Mexico City. In a feat unrivalled in the post-revolutionary banking sector, Ugarte built up its business so that it quickly overtook the Banco de Londres y México, to become second only to the Banco Nacional de México.

Among the bank’s chief backers and board members were three powerful and prestigious financiers who would join with Ugarte in forming what became known as the BUDA Group, an informal alliance rather than a conglomerate, the label being an acronym of their surnames. These were the silver magnate Raúl Bailleres, one of Mexico’s richest men, Ugarte himself, the bank’s chairman, Mario Domínguez, who with his brother Augusto separately owned another bank, the Banco General de Capitalización, and Ernesto Amescua, who headed insurance company Seguros La Nacional. on the Banco Nacional de México, dated 10 May and signed by [ ][identification needed] and [ ][identification needed].

|

|

|

This cheque, like the following cheque of the Banco Nacional de México, has a typo, with an inverted 'V' instead of 'A' in 'AL PORTADOR'.

El Banco Nacional de México

| from | to | total number |

total value |

||

| $1 | includes number 049042CNBanxico #10824 |

This is, conversely, a cheque drawn by the Banco Nacional de México on the Banco de Comercio, dated 11 May and signed by [ ][identification needed] and [ ][identification needed].

|

|

|

On 16 May Secretario de Hacienda Narciso Bassols instructed the federal Oficinas de Hacienda and the Correos y Telegrafos to accept the $1 and $2 cheques that various institutions had issued, without limitation. A similar instruction was sent to the Ferrocarriles NacionalesEl Dictamen, 17 May 1935.

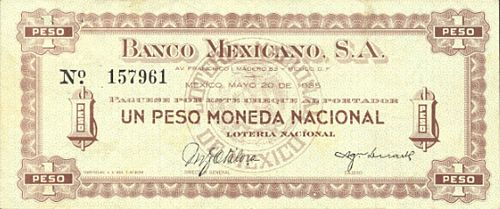

Lotería Nacional

On 3 May it was reported that the Lotería Nacional was proposing to issue approximately $200,00 in letras de cambio, payable in banknotes of the Banco de México on 20 MayEl Dictamen, Veracruz, 4 May 1935: El Informador, Año XVIII, Tomo LXVII, Núm. 6357, 4 May 1935. However, the Lotería Nacional issued $1 cheques, dated 20 May, drawn on the Banco Mexicano, S. A.

| from | to | total number |

total value |

||

| $1 | includes number 157961CNBanxico #10826 |

These were signed by Manuel E. Otálora Ruiz de la Peña as Director General and [ ][identification needed] as Cajero.

| Manuel E. Otálora Ruiz de la Peña was Director General from 1932 to 1936. |  |

|

When the crisis passed most of these cheques were redeemed and so survivors are extremely rare, seemly limited to single examples in the Banco de México collection.