El Banco de Coahuila

For the last quarter of the nineteenth century the state of Coahuila showed great dynamism in its industry and cities like Saltillo and Torreón grew by leaps and bounds. The capital, Saltillo, supported by investment from Monterrey and southern Texas grew in various sectors to produce great fortunes whilst the city of Torreón, a strategic point because of its location, increased its population thanks to the industries that were established and the foreign investments coming in. The whole state became very attractive and cities such as Monclova and Piedras Negras (formerly Ciudad Porfirio Díaz) were connected to other cities through the technological advances of telegraph, electricity and rail.

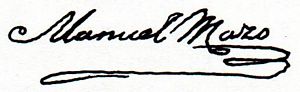

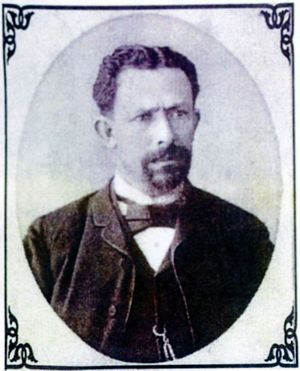

In the last decade of the nineteenth century several entrepreneurs, in view of the success of banks in the capital and other states such as Chihuahua, raised the possibility of establishing a bank of issue and savings in Coahuila further to strengthen the state economy. In March 1883 the executive was authorised to permit such a bankEl Foro, Tomo XX, Año XI, Núm. 57, 29 March 1883 and in March 1890 another attempt founded. Finally, in 1897 a group of businessmen and entrepreneurs founded El Banco de Coahuila. Among the major shareholders were William (Guillermo) Purcell, Pragedis de la Peña, Francisco Rodríguez García, Enrique Maas, Rómulo Larralde, Manuel Mazo, Marcelino Garza, Crescencio Rodríguez G. and Francisco Narro Acuña. All the shareholders were gentlemen of large fortunes, politicians or leaders of business.

A few months before the bank’s foundation, in March 1897, the Minister of Finance Jóse Limantour enacted the General Law of Credit Institutions (Ley General de Instituciones de Crédito) which aimed to stabilise the banking and banknote system by laying down the requirements necessary to establish a bank. The Banco de Coahuila complied with these requirements in order to be established. The concession was granted on 9 June 1897 to Francisco Arizpe Ramos, Gulliermo Purcell, Enrique Maas, Manuel Mazo, Francisco Rodríguez García and Crescencio Rodríguez G. and the bank began operations on 1 October 1897La Patria, Año XXI, Núm. 6,289, 16 October 1897. On 10 February 1898 the Ministry of Finance authorized an increase in the share capital from $500,000 to $1,600,000, divided into 16,000 shares of 100 pesos each.

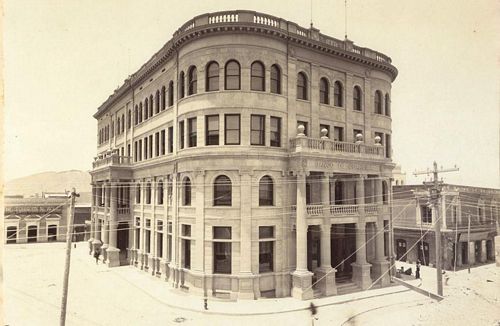

In 1902 the bank inaugurated in Saltillo the building that would house it for the whole of its life. The building, on the corner of Allende and Juárez, was designed by the American architect Alfred Guindo, and had two functions – the bank on the ground floor and the finest hotel in the city, the Hotel Coahuila, on its upper floors.

Main offices

Employees of the Banco de Coahuila in 1900

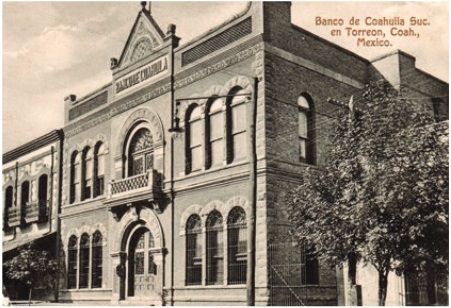

In addition, the bank opened branches in Torreón, Monclova, Parras, Matamoros, Cuatro Cienegas, Viesca, Sierra Mojada and Ciudad Porfirio Díaz (now Piedras Negras).

The Torreón branch opened on 1 April 1898. Its two-storey brick building was built on the southwest corner of avenida Hidalgo and calle Zaragoza, next to the Hotel París. The first manager in 1898 was Sigfrido (Siegfried) BuchenauBuchenau arrived in Torreón at the age of 20 and worked in commercial activities until he founded, in 1897, the Casa Buchenau y Cía., in partnership with Rodolfo Wilmanns of Bremen and Ernesto Hintz, becoming a business promoting the new city. who was succeeded by Hugo Francke in February 1899Fondo Fondo Praxedis Francke Ramírez caja 16 folio 48 exp. 06 . Later the manager was Rodolfo J. García, contador Agustín de Aldama, and cajero Pedro López NegreteThe Consejero Consultor was Coronel Carlos González Montes de Oca. Montes de Oca was a native of Viesca, who had fought the French and owned the hacienda La Concha, a valuable cotton plantation, and two hotels, the San Carlos and the Salvador.

The branch in Monterrey opened in 1899, under Adolfo Larralde.

The bank's notes circulated freely throughout the state of Coahuila, though if a person wanted to use their notes in another state they suffered a discount, as a little was deducted from their nominal value. Some notes have branch overprints, showing where they were issued: known examples are from Ciudad Porfirio Díaz, Monclova, Torreón and Monterrey, Nuevo León.

$50 note overprinted 'TORREON'

$50 note overprinted 'MONTEREY'

$50 note overprinted 'C.P.D.' (Ciudad Porfirio Díaz)

$50 note overprinted 'M' (Monclova)

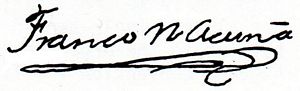

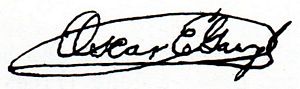

Each note had three signatures, of a Director (originally Consejero, then Presidente del Consejo on notes printed after 1910), the Manager (Gerente) and the government Interventor.

Interventor

|

He signed notes dated from 1898 to March 1900. |

|

|

Manuel Lara Missotten had been interventor for the Banco de San Luis Potosí until October 1900. He signed notes dated 15 November 1900. In September 1906 he took over as interventor of the Banco del Estado de México and then in June 1909 was appointed interventor for the Banco Internacional é Hipotecario in Mexico CityEl Contemporáneo, San Luis Potosí, tomo XIX, no. 3,183, 17 June 1909. |

|

|

Leopoldo Naranjo He signed notes dated 15 September 1909 and 7 June 1910. |

|

|

José Elizondo He signed $50 notes dated 7 June 1910. |

|

|

He was interventor at the beginning of the 1910s and his signature appears on $20 notes dated 7 June 1910 and $10 notes dated 5 May 1912. He was the Maderista Presidente Municipal of Saltillo and then an early adherent to the Constitutionalist cause. On 25 June 1913 he was appointed Tesorero General when Carranza was in Sonora and his signature appears on the Monclova issue and the Ejército Constitucionalista issue but he was removed from office in July 1914. He was later director of the Oficinba Reselladora in Veracruz. He died on 13 April 1949, in Mexico City, at the age of 80. |

|

|

Inocencio Francisco Sánchez Mestas He signed notes dated from 7 June 1910 to 15 February 1914. |

|

Gerente

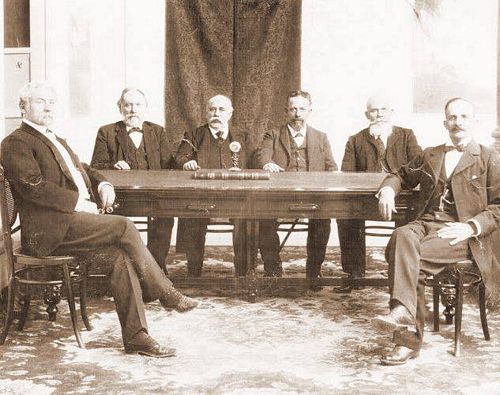

The first board of the Banco de Coahuila in 1900. Standing: Francisco Narro Acuña, Lic. José López Moctezuma, Rómulo Larralde Seated: Henry (Enrique) Mass, Marcelino Garza, Manuel Mazo, Crescencio Rodríguez G.

Board of Directors in 1905. From left to right: Rómulo Larralde, Henry (Enrique) Mass, Damascus Rodríguez García, Pragedis de la Peña, Crescencio Rodríguez G., Francisco Narro Acuña

|

In 1892 he was a subscriber to and part of the committee set up to arrange the statutes and regulations for the new Banco de Nuevo LeónThe Two Republics, Vol. 34, No. 54, 3 March 1892. He was the first manager from 1897. He also served as a director of the Fundición de Torreón, one of the most prosperous business in Mexico El Tiempo, 14 February 1905. In February 1905 the board was comprised of Ernesto Madero as president; Coronel Carlos González as vicepresident; Pragedis de la Peña as secretario; Pedro Torres Saldaña as tesorero and Tomás Mendirichaga , Evaristo Madero, Rómulo Larralde, Frumencio Fuentes and Joaquín Serrano as directors.. In May 1907 Larralde was granted a leave of absence for six to eight months to allow him to dedicate himself to his personal business, with Melesio Garza, the contador, appointed interim managerPeriódico Oficial, Coahuila, Epoca 3a, Tomo XV, Núm. 10, 4 May 1907. In September he left for New York and Europe with his family, with the intention of living in Paris for some yearsThe Mexican Herald, vol. XXIV, No. 11, 11 September 1907. He returned to Saltillo briefly in December 1907The Mexican Herald, vol. XXV, No. 121, 30 December 1907 but resigned in January 1908El Tiempo, Año XXV, Núm. 8177, 26 January 1908. By 1913 Larralde was back in Mexico and living in Mexico City but was planning to return to France in the middle of AugustEl Imparcial, Tomo XXXV, Núm. 7,037, 30 July 1913. He signed notes dated 1898 to 1900. |

|

|

Melesio Garza was contador for several years. In May 1907 he was appointed interim manager, while Larralde went to FrancePeriódico Oficial, Coahuila, Epoca 3a, Tomo XV, Núm. 10, 4 May 1907 and was appointed as manager in DecemberThe Mexican Herald, vol. XXV, No. 121, 30 December 1907. He died in office at the beginning of 1913. He signed notes dated 1909 to 1912. |

|

|

Tomás Olivares was appointed cajero of the bank in October 1904The Mexican Herald, vol. XIX, no. 53, 23 October 1904. He was promoted to manager in February 1913 on the death of GarzaSemana Mercantil, 2a Epoca, Año XXIX, Núm. 5, 3 February 1913. He remained manager up to the 1920s. He signed notes dated 1914. |

|

Presidente del Consejo

Consejero

|

Pra From 1885 he lived in La Laguna and was instrumental in developing Torreón into a city. He a cousin of Ernesto Madero and uncle of Francis I. Madero, and the Madero family favoured him over Venustiano Carranza for the governorship of Coahuila. He was provisional governor from August to November 1884 and from August to December 1909 and interim governor from 21 November 1913 until 2 February 1914. De la Peña signed some $20 notes dated 15 November 1900 but still in the Interventor's strongbox in 1908, and then notes dated from 1909 to 1914. |

|

When in November 1913 President Huerta amended the Ley General and authorized banks to issue banknotes of denominations less than five pesos the Banco de Coahuila began issuing $1 and $2 notes, printed in Mexico City by Bouligny & Schmidt. It also issued a $10 note printed by the American Book & Printing Company. The Bouligny & Schmidt and American Book & Printing Company notes have Inocencio Francisco Sánchez Mestas as Interventor, Tomás Olivares as Gerente and Pragedis de la Peña as Consejero.

With the Revolution the bank suffered various attempts on its finances. One was in Torreón in 1913, when Francisco Villa captured the city. He demanded a forced loan of 80,000 pesos from all the banks in Torreón, including the Banco de Coahuila. In the absence of enough money in the city the banks decided to issues cheques for $1, $2, $5, $10 and $20, drawn on one another, which circulated among the public as money, and were payable in cash once the railway line to Mexico City re-opened. The Banco de Coahuila issued $1, $5, $10 and $20 cheques drawn on the Banco de la Laguna in two series (Series A of 7 October 1913 and Series B of 5 February 1914) and $5, $10 and $20 cheques drawn on the Banco Nacional de México (Series A of 7 October 1913).

In August 1915 Venustiano Carranza instructed his Undersecretary of Finance, Rafael Nieto, to devise a plan for inspecting and regulating the banking situation in order to establish a single state-controlled bank of issue. On 26 October 1915 he established the Comisión Reguladora e Inspectora de Instituciones de Crédito. Among other duties the Comisión would be responsible for ending the concessions of banks that did not comply with current laws. For a bank to continue operating it needed to have cash in its vaults equivalent to 50% of its note issues and deposits, that is for every ten pesos in notes and deposits it needed to have at least five pesos in hard currency (silver or gold). Unfortunately the revolution was a very strong blow to the banks, and the Banco de Coahuila was also damaged by Huerta’s request to several banks, including the Banco de Coahuila, for mandatory loans. When Huerta’s government requested a forced loan it handed out certificates from the Treasury of the Federation who said that the money would be paid later. The Banco de Coahuila included these certificates on their balance sheets as if they were worth money, but the Comisión considered any Huerta administration document invalid so the Carranza government did not recognize these certificates as valid.

When the bank was audited it argued that it had in its vaults $1,090.533.72 but after removing receipts and other documents this was reduced to $806,477.81. This would allow a circulation of twice this amount, namely $1,612,895.62. However, notes in circulation and bank deposits amounted to $4,596, 871.15, an excess of $2,983,975.53. There were also Federal Treasury bonds from 1914 for an amount of $1,419,298.00 and $38,425.00 in notes of other banks that the Commission failed to consider in the balance sheet as cash. So on 6 December 1915 the Banco de Coahuila was declared in default and its concession withdrawn.

Under Obregón's decree of 31 January 1921 the bank was placed into Class A (for banks whose assets were greater than their liabilities) and allowed to resume all customary operations except the issue of bank notes. The bank changed its name to Banco Refaccionario y Fideicomiso de Coahuila S.A. and operated as a refactional bank, that could not issue notes but was dedicated to facilitating mining, agricultural and industrial operations through the issuing of loans. In 1953 it moved its home to the Banco Internacional S.A. Finally, the bank was acquired by the Banco Internacional, later BITAL, and was then bought by HSBC.

During the 1950s, the original bank building and Hotel de Coahuila remained abandoned. Finally, developers who acquired the property decided to tear it down in 1965.

(based on “El Banco de Coahuila” by Pablo Luna Hererra in USMexNA journal September 2017)

José López Moctezuma had been a Juez in the district of San Luis Potosí, and then Tampico, which he resigned when he was appointed Interventor on 6 October 1897

José López Moctezuma had been a Juez in the district of San Luis Potosí, and then Tampico, which he resigned when he was appointed Interventor on 6 October 1897 José Serapio Aguirre Farías was born on 14 November 1868 in Ramos Arizpe, Coahuila.

José Serapio Aguirre Farías was born on 14 November 1868 in Ramos Arizpe, Coahuila.

gedis de la Peña y Flores was born in Saltillo on 18 November 1847. He was a practising lawyer and businessman. Amongst his many business interests, besides being Director General of the Banco de Coahuila, he founded the Compañía Luz y Fuerza Eléctrica de Saltillo, was a stockholder and vice-president of the

gedis de la Peña y Flores was born in Saltillo on 18 November 1847. He was a practising lawyer and businessman. Amongst his many business interests, besides being Director General of the Banco de Coahuila, he founded the Compañía Luz y Fuerza Eléctrica de Saltillo, was a stockholder and vice-president of the